Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (12/02/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia on December 02, 2025 is back in the spotlight as the network’s fundamentals strengthen and its ecosystem develops. The two main factors influencing market sentiment are Pi Network’s move to penetrate the Swedish exchange through the launch of Valour Pi ETP, as well as the cleanup of the testnet which marks the readiness of Protocol 23 and the launch of DEX.

This combination of institutional expansion and technical preparation suggests that the Pi Network is moving towards a real utility phase, which is helping to shape investor expectations in the local market.

How much is 1 PI in Indonesia today?

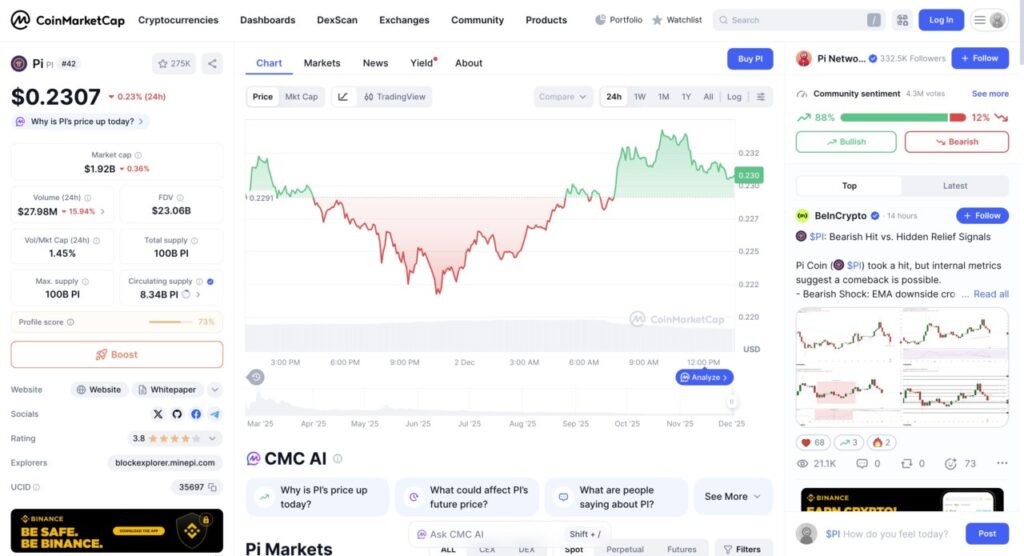

The Pi Network (PI) price chart in a 24-hour span on the CoinMarketCap display shows a fairly volatile movement pattern with two main phases: selling pressure at the beginning of the period and recovery in the latter half.

In the first part of the chart, the PI price opened in the $0.229-$0.230 range, then moved down gradually until it bottomed out around the $0.225 area. This phase is characterized by the dominance of red, reflecting the selling pressure that made the price move lower throughout the night and into the early morning hours. This downward pattern was consistent, reflecting the weak market sentiment during this period.

Entering the morning until noon, the chart showed a fairly clear change in direction. The price of PI began to recover and rise gradually towards the $0.232 area, which is visible through the green zone on the chart. This recovery indicated an increase in buying interest or an improvement in short-term sentiment which helped push the price back closer to its opening position. However, towards the end of the chart, the price slightly corrected back to the $0.230 range, which was the last position on the data.

Overall, the chart displayed a “V-shape recovery” pattern that did not fully recover to its daily high, but it was enough to show that the initial selling pressure was successfully offset by the intraday recovery momentum. The community sentiment which stood at 88% bullish was also in line with the price movement which tried to bounce back in the second half of the trading period.

Also read: Gold Jewelry Price Today, Tuesday, December 2, 2025

Pi Network Officially Breaches Swedish Exchange Through Valor ETP

The listing of the Valour Pi ETP marks a new chapter for Pi Network in expanding its legitimacy in the cryptocurrency sector. The product appears in the official regulatory archive alongside ETPs for assets such as Shiba Inu, VeChain, and Celestia, confirming that PI is now entering a segment that has so far only been occupied by established assets. The existence of ETPs allows retail and institutional investors to access Pi through regulated instruments, without having to be directly involved in its ecosystem.

Valor’s move provides additional credibility as the company operates under strict European capital market rules. With a strong compliance structure in place, Pi Network is gaining a new foothold in the previously hard-to-reach global financial space.

The project’s backers see this as a transition from the “community mining” phase to wider financial recognition. While Pi’s internal economy still dominates user activity, this ETP builds an important bridge to global institutional capital.

Testnet Cleanup Pushes Protocol 23 and DEX Readiness

On the technical side, Pi Network did a major cleanup of the testnet. Only eight remaining test tokens now appear as “N/A” in the wallet, which includes old contracts, expired domains, and experimental tokens from the initial phase of the testnet. The developers confirmed that this cleanup was the final part of preparation for the implementation of Protocol 23 as well as the launch of Pi DEX.

Clearing out old tokens helps create a cleaner and more stable environment for trading activities, liquidity pools, and other DeFi functions. The removal of irrelevant tokens is not a sign of reduced opportunity, but rather a sign that the ecosystem is approaching full readiness. A clean infrastructure supports more secure transactions, fewer errors, and more robust DeFi operations.

FAQ

What does the launch of Valor Pi ETP mean for Pi Network?

Valor Pi ETP provides Pi with access to regulated investment instruments, opening up opportunities for retail and institutional investors.

Why is the PI mining rate increase important?

The increase in mining rate reflects a stable network adjustment and supports the sustainability of token distribution.

What is the purpose of clearing testnet tokens?

The cleanup was done to prepare a clean mainnet environment before the launch of Protocol 23 and Pi DEX.

How do ETPs increase the credibility of Pi in the global market?

Regulated ETPs strengthen Pi’s position in the regulated financial sector as they follow European capital market compliance standards.

What is the main focus of Pi Network’s development at the moment?

Pi Network focuses on infrastructure: regulation, on-chain utilities, and DEX readiness, not on price speculation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinfomania. Pi Network Joins Valor ETP as December Mining Rate Rises and DEX Nears. Accessed December 2, 2025

- Fetaured Image: CoinTrust

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.