Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (12/03/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia today returned to the limelight after increased scrutiny of its economic foundations. Amidst massive liquidity that puts the market capitalization close to billions of dollars, the community’s discussion on Pi’s economic structure has picked up again.

This attention was sparked by a white paper analysis in a video highlighting the Pi Network’s supply mechanism, emission model, and phased development strategy. These dynamics have now opened a new discussion about the ecosystem’s level of trust and the direction of Pi’s development in the coming months.

How much is 1 PI in Indonesia today?

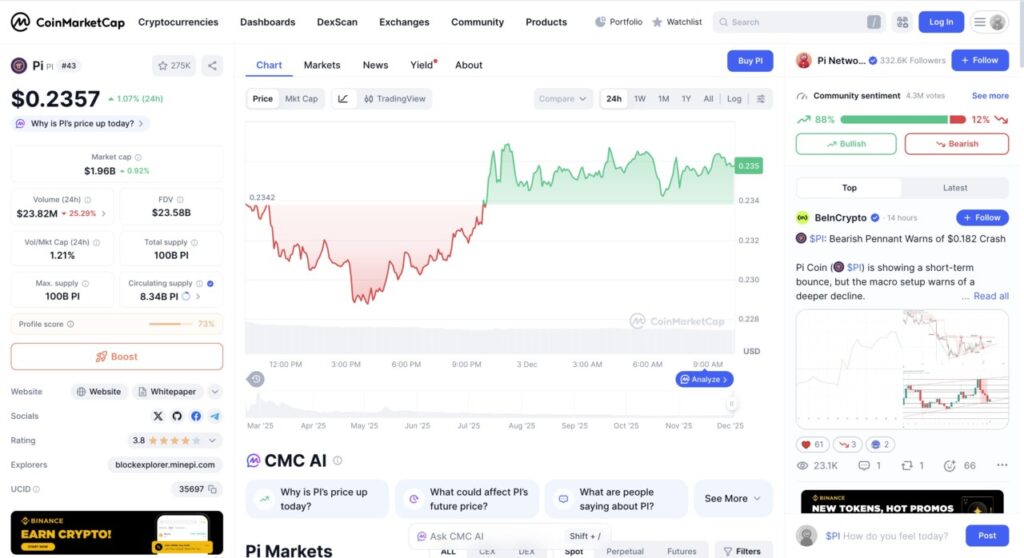

The Pi Network (PI) price chart in a 24-hour span on the CoinMarketCap display shows a fairly dynamic movement pattern, with a sharp downward phase at the beginning of the period which then reverses into a strong recovery trend during the night to morning.

At the start of the chart, the price of PI was around $0.2342 and experienced sustained selling pressure. This decline was steady until it bottomed out around $0.228, characterized by the red area dominating the chart. This phase illustrates the short-term bearish sentiment, with 24-hour trading volumes falling by more than 25%, indicating weakening market activity.

Entering the evening, the chart showed a fairly clear trend reversal. The PI price jumped sharply, breaking back into the green area and stabilizing around $0.2350. This recovery looks strong, characterized by a higher and consistent range of movement throughout the early morning hours. The increase reflects increased buying interest or improved sentiment after the previous selling pressure subsided.

Overall, the price pattern of PI in the past 24 hours shows a firm “drop and rebound” structure. While still in tight fluctuations, the strong rebound movement shows that the market remains responsive to changes in sentiment. With the community bullish sentiment dominating at 88%, this chart illustrates the dynamics of the market trying to recover after the sharp drop at the beginning of the period.

Read also: Tokenized Gold Could Be the Next King of Stablecoins? Here’s Why!

Large Liquidity Lifts Ecosystem Confidence

The Pi Network community highlighted the surge in liquidity which is now estimated to reflect a market capitalization equivalent of $2 billion. The trading volume of $77 million per day is seen as evidence that more market participants are entering the Pi ecosystem. The combination of liquidity and volume also reinforces the perception that Pi is starting to gain wider trust from cryptocurrency traders and observers.

This increase in liquidity is also described as a signal that users are increasingly convinced the Pi Network is on the path to an open-network economy. Although Pi is currently still operating in a closed-network model, the high external trading activity indicates great interest in the asset.

The community feels that this market behavior reflects a positive sentiment towards the Pi’s development direction ahead of a rumored major update coming in the near future.

Read also: Silver price surge triggers new trend in crypto market, metal tokenization in demand?

Economic Evidence in White Paper Analysis Video

A widely circulated video in the community shows a Chinese narrator discussing the Pi white paper and highlighting key sections related to the mining structure, supply emission model, and phased development strategy.

The explanation confirms that Pi has been preparing the economic framework for the transition from a closed network to an open economy from the beginning. The community considers that this piece of information is not a coincidence, but part of a roadmap that is now increasingly visible in its realization.

The narrator of the video also refers to a number of official Pi Network blog posts that are thought to provide indirect clues as to the technical infrastructure being finalized.

Many users have interpreted these updates as a signal that Pi’s internal ecosystem is about to enter a new period of growth. Although there has been no official confirmation, community discussions show that expectations for the development of Pi technology are getting stronger over time.

FAQ

What made Pi Network’s liquidity increase?

Liquidity increased due to an estimated market capitalization of $2 billion equivalent and daily trading volume of approximately $77 million, reflecting greater market activity and interest.

Why is the 2019 white paper being discussed by the community again?

The community considers the white paper to contain early clues about the structure of the Pi economy, which is now considered relevant to the development of liquidity and ecosystems.

What is the purpose of the testnet cleanup by the developers?

The testnet cleanup was done to prepare the ecosystem for the implementation of major features such as Protocol 23 and the launch of DEX.

Is there really a rumor of an open mainnet launch on December 10?

The rumor is widely circulated in the community, but there is no official confirmation of the open mainnet launch date.

How will the possible release of 190 million tokens impact the market?

The release of a large number of tokens may trigger high volatility and increased trading activity, although the direction of price movements is yet to be ascertained.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinfomania. Pi Network’s Hidden Liquidity Signals a Massive Shift Ahead. Accessed December 3, 2025

- Featured Image:

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.