Download Pintu App

BlackRock offloads $135 million worth of Ethereum, this will affect the ETH price!

Jakarta, Pintu News – A resurgent crypto market hasn’t stopped BlackRock from selling Ethereum (ETH) in a big way. According to data from Lookonchain, an on-chain monitoring firm, BlackRock has again deposited a large amount of Ethereum into Coinbase Prime, allegedly as a selling attempt.

Large Shipments of Ethereum

BlackRock has sent 44,140 ETH, worth approximately $135.36 million, to Coinbase Prime in four batches consisting of 10,000 ETH and one transfer of 4,140 ETH. This marks one of a series of sales that this prominent asset manager has made over the past month.

Despite the crypto market showing a strong price recovery, BlackRock does not seem to be easing up on its selling pace. This activity has sparked widespread discussion in the crypto community regarding the motives behind the rapid selling by BlackRock. Speculations are rife, but there has been no official confirmation regarding the reason behind this major move.

Also Read: 5 Signals Ethereum (ETH) Has Reached the Bottom After Dropping 28 Percent?

Market Reaction to BlackRock Sale

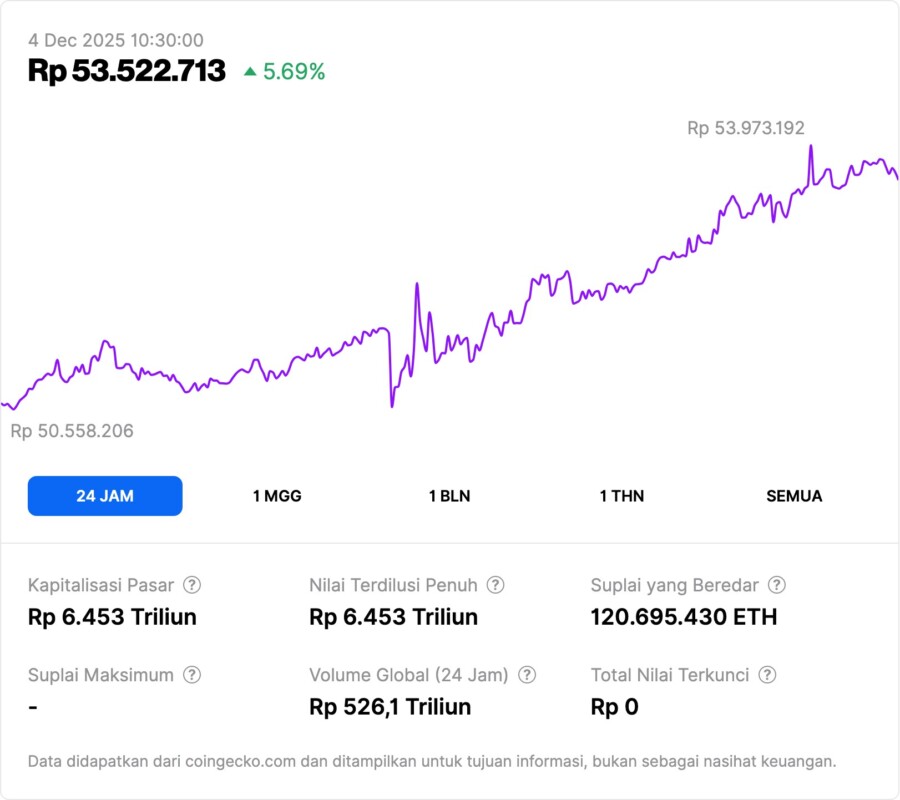

Although Ethereum (ETH) has seen a rise of over 7% in a day, reaching a multi-week peak of $3,100, the continued selling by BlackRock raises questions.

The crypto market as a whole has seen significant price increases in the last 24 hours, yet BlackRock continues to deposit Bitcoin (BTC) and Ethereum (ETH) into Coinbase. This suggests that BlackRock’s strategy may not just be in response to down market conditions, but may also be part of a broader strategy or rebalancing of the ETFs they manage.

Speculations and theories

Debate continues to rage about whether BlackRock’s move is part of profit-taking, ETF rebalancing, or a larger change in strategy. The volatile crypto market makes interpreting actions like this complex and often speculative.

With no confirmation from BlackRock as to the reasons behind these consistent transfers, the community and investors continue to find out what is really going on behind the scenes. This shows the importance of transparency and communication in crypto asset management.

Conclusion

This large sale of Ethereum by BlackRock shows the ever-changing dynamics of the crypto market and how big players can influence prices and market perception. Going forward, eyes will continue to be on BlackRock and their next steps in the crypto ecosystem.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much Ethereum was sold by BlackRock recently?

A1: BlackRock has sold 44,140 Ethereum (ETH), which is worth approximately $135.36 million.

Q2: Where was the Ethereum sent by BlackRock?

A2: The Ethereum was sent to Coinbase Prime in four batches of 10,000 ETH and one transfer of 4,140 ETH.

Q3: Does BlackRock’s sale of Ethereum have any effect on the market price?

A3: Although Ethereum (ETH) has seen a price increase, the continuous selling by BlackRock raised questions in the market, but was not directly confirmed to have an effect on the price.

Q4: What is the speculation surrounding BlackRock’s sale of Ethereum?

A4: Speculation includes theories that the sale may be part of profit-taking, ETF rebalancing, or a larger change in strategy.

Q5: Has BlackRock given an official reason for selling Ethereum?

A5: As of now, BlackRock has not provided any official confirmation regarding the reason behind this massive Ethereum sell-off.

Reference

- U.Today. $135 Million in Ethereum Sold by BlackRock Amid Crypto Market Resurgence. Accessed on December 4, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.