Download Pintu App

Antam Gold price chart today December 4, 2025: Up or Down?

Jakarta, Pintu News – The gold market is getting attention again after the daily price chart showed significant dynamics ahead of the beginning of December 2025.

Data from HargaEmas.com displays spot gold and Antam gold price movements that reflect global market sentiment, including USD/IDR exchange rate factors as well as physical demand in Indonesia. The following summary provides a complete reading based on the latest available data.

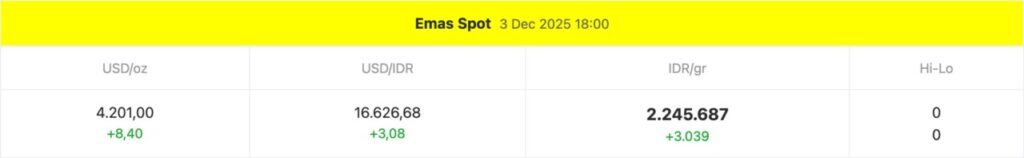

1. Spot Gold Price Touches USD 4,201 per Ounce According to PriceEmas.com Data

Based on the December 3, 2025 update at 18:00 on HargaEmas.com, the spot gold price is at USD 4,201.00 per ounce. This data shows an increase of USD 8.40 which indicates a moderate strengthening in the global market. This movement is supported by macro conditions that tend to stabilize ahead of major economic data releases.

In its denomination against the rupiah, the spot gold price was recorded at USD/IDR 16,626.68, also an increase of 3.08 points. The data shows how the strengthening of the US dollar has a direct impact on the adjustment of domestic gold prices. The exchange rate is one of the important variables affecting gold prices in Indonesia.

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

2. Gold Price in Indonesia Recorded at IDR 2,245,687 per Gram According to Daily Data

Data from HargaEmas.com recorded the spot price of gold in Indonesia at IDR 2,245,687 per gram. This figure shows an increase of IDR 3,039 compared to the previous period. The daily chart shows a gradual increase reflecting stable domestic purchasing power.

Despite the moderate increase, the daily trend shows relatively low volatility. The data indicates that the domestic gold market is moving with global dynamics without extreme pressure. This stability is an important indicator for market participants monitoring physical prices.

3. Intraday Chart Shows Significant Rise in the Morning Based on Spot Chart

The intraday chart shows that the price of gold in rupiah had strengthened to close to IDR 2,260,000 in the morning session of December 3, 2025. The chart data displays a pattern of rapid rise which was then followed by a correction back to the IDR 2,245,000 area towards the afternoon. Movements like this often occur when the market responds briefly to changes in global sentiment.

According to PriceEmas.com chart observations, the price moved up from around IDR 2,236,000 in the early hours of the morning to its peak around IDR 2,259,000. The pattern reflects Asian market activity which usually contributes initially to intraday volatility. After reaching its peak, the chart shows an adjustment to return to the daily average level.

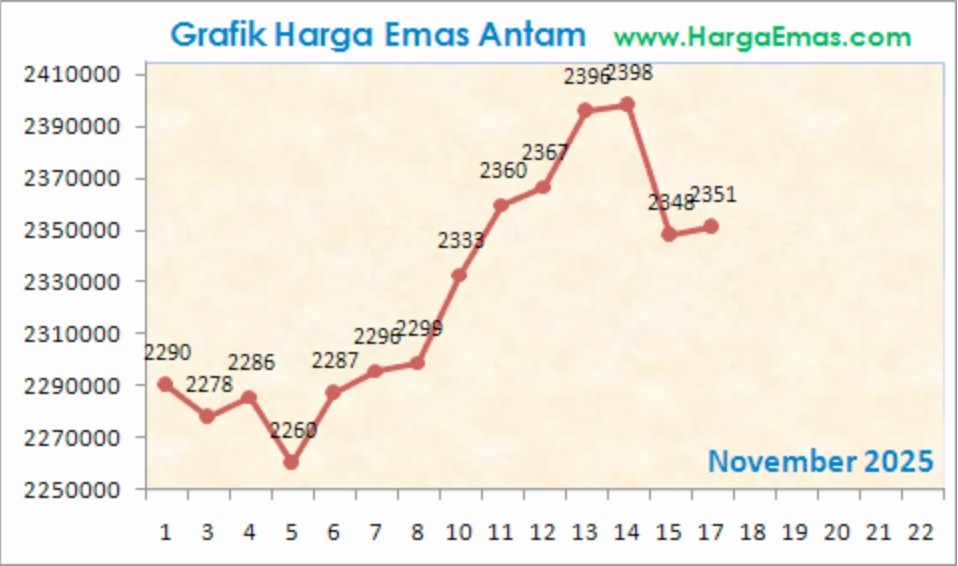

4. Antam Gold Chart Shows an Uptrend from November 17 to December 4, 2025

Antam gold price chart data from November 17 to December 4, 2025 shows a consistent upward trend. Prices were recorded moving from a range of IDR 2,322,000 to a peak of IDR 2,425,000 on December 2, 2025. This trend reflects an increase in retail gold demand towards the end of the year.

The period also saw some minor corrections, but the overall trend remained upward according to the price chart. After reaching its peak, the price slightly corrected towards IDR 2,406,000 on December 4, 2025. This pattern is in line with the dynamics of the physical market which usually experiences a spike ahead of the holiday season.

5. Global Spot Gold and Antam Gold Comparison Shows Similar Trend Direction

The charts of global gold prices and Antam gold show relatively similar trend patterns in the period from late November to early December. HargaEmas.com data shows that when global prices rise, Antam prices follow suit with a short time lag. This confirms that the domestic gold market is very sensitive to changes in international prices.

Price differences are also influenced by factors such as production costs, distribution, and retail demand. Overall, however, the data shows that investors monitoring global gold can use the spot chart as an initial indicator before looking at Antam’s price movements. This consistency makes gold’s daily chart one of the most important metrics to continue monitoring.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused the gold price to rise on December 3, 2025?

According to HargaEmas.com data, the increase occurred due to strengthening global spot prices and movements in the USD/IDR exchange rate that affected domestic prices.

What is the highest Antam gold price in the period November 17-December 4, 2025?

Chart data shows the highest price was at IDR 2,425,000 on December 2, 2025.

Why do intraday charts show sharp fluctuations in the morning?

According to the pattern on the chart of PriceGold.com, Asian market activity in the early session often triggers a quick rise before the movement adjusts in the afternoon and evening.

Is the global spot gold price always in line with the Antam price?

Data shows that both have similar trend directions, although Antam’s prices are also influenced by manufacturing costs and domestic retail demand.

How does the USD/IDR exchange rate affect the daily gold price?

According to daily data, an increase in the USD/IDR exchange rate will push the price of gold in rupiah up as global gold transactions are denominated in US dollars.

Reference

- HargaEmas.com. Spot Gold Price Data & Antam Gold Chart. Accessed on December 4, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.