Download Pintu App

XRP Price Prediction: ETF Adds $50.27 Million to Portfolio, XRP Skyrockets?

Jakarta, Pintu News – XRP (XRP) continues to attract strong interest with significant fund additions into XRP-related ETFs. This activity provides clearer direction and supports a stronger basis for market evaluation. The gradually changing macro environment with the involvement of large buyers adding allocations on a regular basis, promises a brighter outlook for the XRP price.

ETF fund flows boost XRP price outlook

On Wednesday, new additions into the ETF reached $50.27 million, an amount that boosted confidence among large buyers. The price of XRP reacted positively with institutions increasing their allocations at regular intervals. These additions indicate a more long-term intention rather than just temporary positioning by speculative participants.

This activity shows that there is growing confidence among institutional investors in XRP’s long-term potential. With fresh funds flowing into the ETF, this signals more stable support for XRP prices in the future.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

Inverse Pattern Structure Supports XRP Price Rise

The chart shows a strong inverse head and shoulders pattern that reinforces the existing XRP price prognosis. The left shoulder formed in early November when the price reacted significantly to the support at $2.15.

Buyers then step in and push the price towards the neckline. This pattern is a classic indicator in technical analysis that often signals a trend reversal from bearish to bullish. If the price of XRP manages to break the neckline with significant volume, it could trigger further price increases.

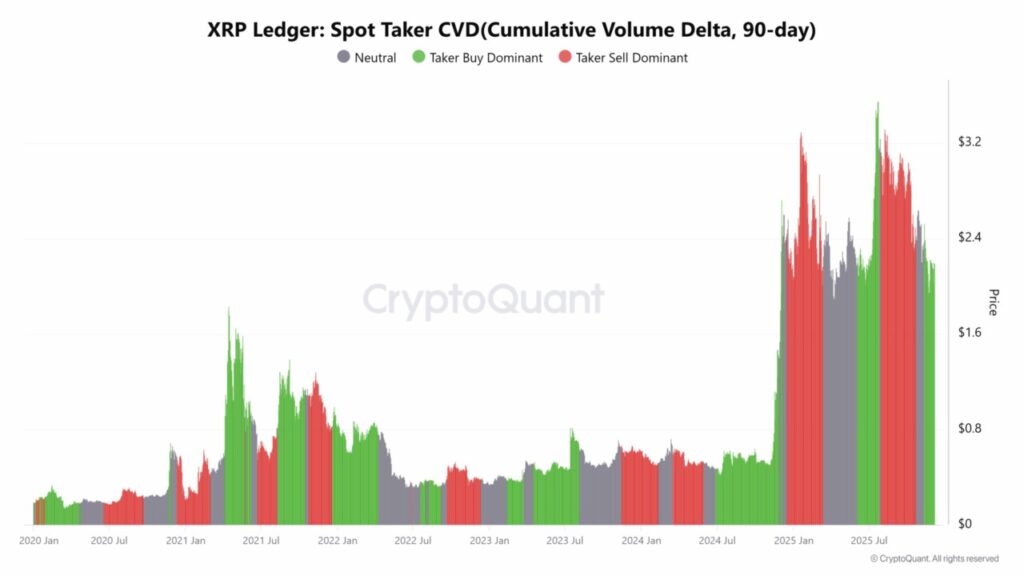

Spot Flows and CVD Strength Reinforce XRP Price Setup

Spot outflows show persistent activity, but the latest pattern shows a clearer moderation. This movement alleviates short-term selling pressure on XRP prices as supply exits with weaker intensity.

The latest reading shows that outflows amounted to $11.7 million on December 4, but the depth of the market remains under control. This moderation suggests that sellers are no longer dominating the market, leaving room for buyers to take the pressure off. This is a positive signal for those observing the supply and demand dynamics within the XRP market.

Conclusion: XRP Price Outlook Looks Favorable

Overall, XRP price has a favorable outlook along with increased exposure by ETF buyers with stronger conviction. The inverse head and shoulders pattern suggests structural improvement and better focus.

This change is supported by the moderation of flows and the strong aggression of buyers as they take over the pressure. These aligned signals form a positive roadmap towards increased valuations, provided that the buyers manage to break the neckline.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What are ETFs and how do they affect the price of XRP?

A1: An ETF (Exchange-Traded Fund) is a type of investment fund that is traded on a stock exchange like a stock. Adding funds to XRP-related ETFs shows investor confidence and may increase the price of XRP due to increased demand.

Q2: What is a reverse head and shoulders pattern?

A2: An inverted head and shoulders pattern is a chart formation that signals a potential trend reversal from bearish to bullish. It forms when the asset’s price creates three valleys, with the middle valley being deeper than the other two.

Q3: What was the value of XRP spot outflows on December 4?

A3: The value of XRP spot outflows on December 4 was $11.7 million. This indicates more moderate selling activity, which may ease selling pressure on XRP prices.

Q4: What impact do institutional buyers have on the price of XRP?

A4: Institutional buyers can provide stability and price support to XRP through large, planned investments. Their involvement often signals confidence in the asset’s long-term prospects, which can attract more buyers.

Q5: What is a neckline in the context of head and shoulder patterns?

A5: The neckline is the resistance level formed by the peak price between the head and shoulders in a head and shoulders pattern. A price breakout through this line is often taken as confirmation of a trend reversal.

Reference

- Coingape. XRP Price Prediction as ETF Buyers Add $50.27M to Holdings. Accessed on December 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.