Download Pintu App

Can BNB Break $1,000 Again in December 2025? Here’s What Analysts Say!

Jakarta, Pintu News – With increasing price movements, Binance Coin (BNB) is once again attracting market attention. After testing the technical support level at $827, which was an important demand zone in August and September, BNB now faces the challenge of reaching a value above $1,000 again.

However, several factors such as a decrease in onchain activity and DEX volume have affected BNB prices recently.

Short-term Optimism Emerges

On the daily chart, the strong trend was bearish, but the internal structure turned bullish. This change occurred when BNB managed to break the lower high of $906.5 on Wednesday, December 3.

Nonetheless, the resistance zone at $950 is the next challenge that is not easy to overcome. DMI indicators confirm a strong bearish trend with ADX and -DI both above 20, while CMF continues to fluctuate around neutral values, indicating the absence of significant and sustained capital flows.

Also Read: 5 Shocking Facts About Strategy: 650,000 BTC worth ±$60 Billion!

Attention BNB Bulls

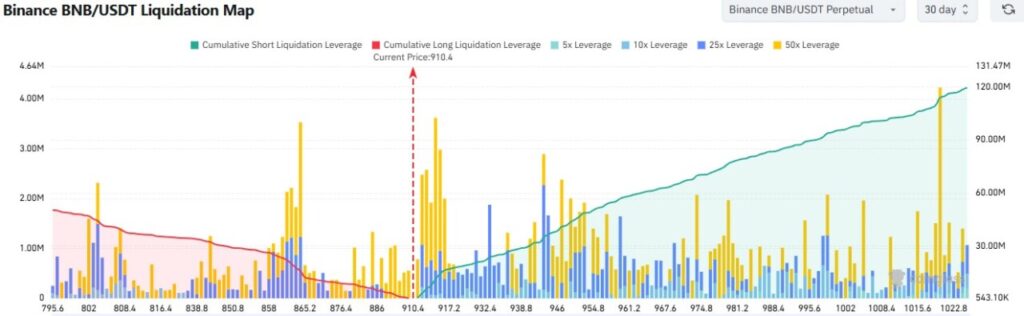

A breakthrough past $1,000 would be crucial, as this is a psychological level that if closed above in a single daily session, would signal market acceptance. In particular, BNB needs to pass $1,019, which was the swing peak in November, to re-establish an uptrend. However, the legal challenges that Binance is facing in North Dakota could also have a negative impact on BNB prices.

Conclusion

Although the bearish trend still looks strong, the current rally may only be a temporary bounce due to the lack of buying pressure and relatively low trading volume. The $950 to $1,000 area will be difficult to break and could be an opportunity for short-selling. Traders are advised to be prepared for a possible short squeeze that could push prices higher before resuming their downtrend.

Also Read: Decisive Week: XRP Braces for a Huge December 2025 Surge!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Binance Coin (BNB)?

A1: Binance Coin (BNB) is a cryptocurrency issued by the Binance exchange, one of the largest cryptocurrency exchanges in the world.

Q2: Why is BNB testing the $827 support level?

A2: BNB is testing the $827 support level as this area was previously a significant demand zone in August and September, which again proved important.

Q3: What is a short squeeze?

A3: A short squeeze is a market condition where a sudden increase in prices forces traders who are short selling to buy back assets at a higher price to minimize losses, which in turn pushes prices up further.

Q4: How will the North Dakota lawsuit affect Binance and BNB?

A4: The North Dakota lawsuits could have a negative impact on Binance and the BNB price, as legal issues often create uncertainty in the market.

Q5: What is the $950 resistance zone?

A5: The $950 resistance zone is a price level where BNB faces significant selling from the market, making it difficult to break and often acting as an upper limit for price increases.

Reference

- AMB Crypto. BNB Price Prediction: Will it Conquer $1000 Again in December? Accessed on December 5, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.