Download Pintu App

Pi Network Price Drops Today: Pi Coin Technicals Headed Down to $0.1919!

Jakarta, Pintu News – Pi Network (PI) has been consistently falling below its 50-day exponential moving average (EMA), and on Monday (8/12), the token was trading at around $0.2200.

The crypto asset, known for its mobile mining concept, is at risk of further decline, as the supply of tokens on the centralized exchange (CEX) increases due to a surge in token migration to themainnet.

Technically, the price outlook for the PI token shows that the path of least resistance is currently pointing downwards. In other words, selling pressure dominates the market, and in the absence of a significant demand push, PI prices could potentially fall deeper in the near term.

Pi Network price drops 1.4% within 24 hours

On December 9, 2025, the price of Pi Network was recorded at $0.2209, a decrease of 1.4% in 24 hours. If converted into the current rupiah ($1 = IDR 16,675), then 1 Pi Network is IDR 3,683. Throughout the day, the PI price moved within a range of $0.218 to $0.2241.

Read also: Pi Network Launches AI Tools to Accelerate Migration and KYC

PI’s market capitalization stood at around $1.84 billion, while its fully diluted valuation stood at $2.83 billion. Trading volume over the past 24 hours stood at around $15.68 million, signaling fairly steady transaction activity amid the price correction.

Supply Pressure Increases

The steady increase in the number of PI tokens deposited on exchanges indicates that selling pressure is getting stronger.

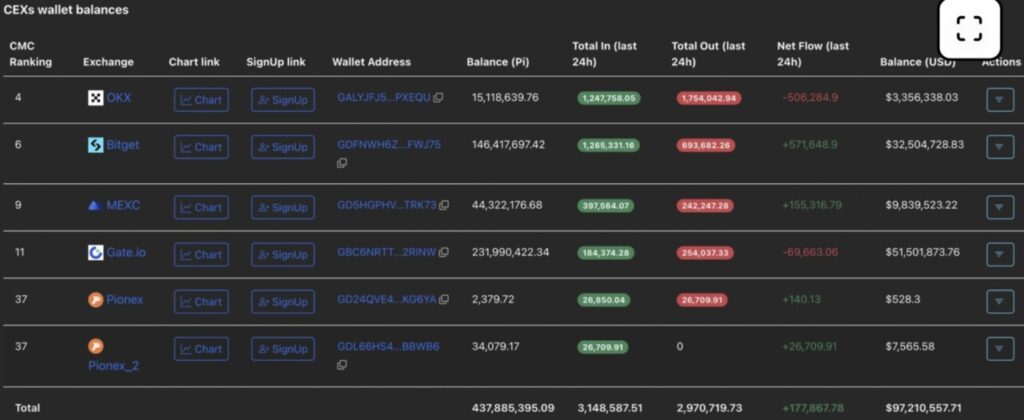

Data from PiScan reveals that in the past 24 hours, wallets belonging to the centralized exchange (CEX) received an inflow of 177,867 PI tokens, bringing the total stored balance to 437.88 million tokens.

One of the main factors driving this surge in deposits is the migration of tokens from the testnet to the Pi Network mainnet, along with 17.5 million users who have completed the identity verification(Know Your Customer / KYC) process.

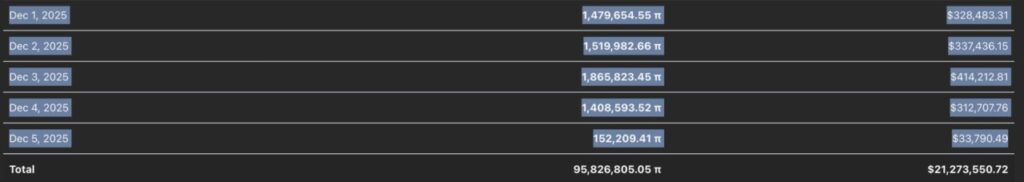

In addition, Pi Network reported that the integration of AI technology in the KYC process has cut the waiting time by 50%. According to PiScan, more than 6.42 million PI tokens have been successfully transferred to the mainnet during the month of December.

However, if the network fails to drive token demand through implementation in real-world use cases, investor confidence may decline, ultimately amplifying the ongoing selling pressure.

Technical Outlook: Headed to $0.1919

On Monday, the price of Pi Network (PI) was relatively stable after experiencing a decline of almost 2% on Sunday. However, technically, the path of least resistance is currently pointing towards the support level at $0.1919, which was the lows on October 11.

If the token drops below this level, potential losses could continue until it reaches the record low of $0.1533 recorded on October 10.

Read also: Dogecoin Holds Around $0.14 as Real‑World Adoption Gains Momentum

The daily chart shows an increase inoverhead pressure. The Relative Strength Index (RSI) indicator is at 43, below the centerline of 50 and pointing down, indicating a potential further bearish movement.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator is still giving a sell signal, as the MACD line and the signal line are both moving down below the zero line. To recover theuptrend, PI needs to break and hold above the 50-day exponential moving average (50-day EMA) at $0.2394.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Pi Network Price Forecast: Bearish outlook as supply pressure mounts on CEXs. Accessed on December 9, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.