Download Pintu App

Countdown to the FOMC Meeting: What Could Be in Store for BTC, ETH, SOL, XRP & LINK?

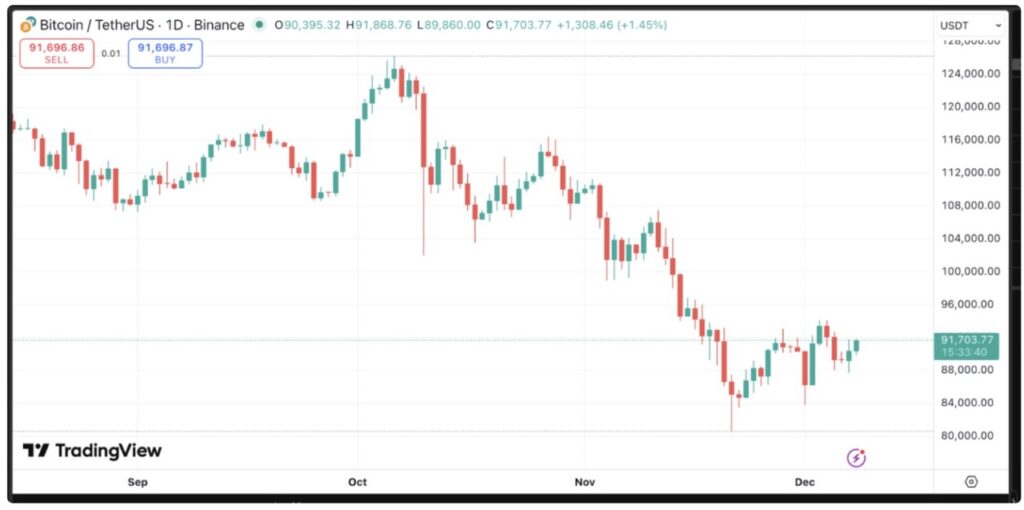

Jakarta, Pintu News – Bitcoin (BTC) price today traded above $91,000, showing a recovery trend with a pattern of higher highs and higher lows. The Federal Open Market Committee (FOMC) meeting that will take place in the next three days is expected to greatly affect the crypto market.

According to market forecasts, there is an 86% chance that interest rates will be cut by 25 basis points, while the chance of rates remaining unchanged stands at 14%. This comes amid a rising number of layoffs in the US that are approaching the levels of theGreat Recession, putting pressure on the Fed to provide additional monetary support.

The end ofquantitative tightening and the potential return of liquidity injections could have a major impact on Bitcoin and financial markets as a whole.

If the Fed does implement an interest rate cut as expected, this could be a trigger for crypto prices to rise, as lower borrowing costs generally encourage greater capital flows into the market.

Bitcoin Price Predictions This Week Ahead of the FOMC Meeting

Read also: Bitcoin Slips to $90,000, But Analysts See Path to $124,000 Ahead

Bitcoin (BTC) price is currently trading above $91,000, indicating a short-term recovery with higher lows pattern. BTC faces an area of resistance in the range of $92,000-$94,000, where accumulated liquidity above current price levels indicates potential upside pressure.

The short-term chart also shows underlying strength despite temporary selling pressure.

The possibility of a retest to the $81,000 level is still open before any further upside movement takes place. If BTC manages to break the $94,000 level, the next target is expected to be in the range of $99,000-$100,000. Meanwhile, the nearest support is at the $85,000 level.

Altcoins to Watch Out For: ETH, SOL, XRP, LINK

Ethereum

Ethereum (ETH) is currently testing an important support zone in the range of $3,000-$3,100. If the daily candle close is below $3,000, this could signal a further decline towards $2,800, with additional support around $2,600.

Resistance remains in the range of $3,250-$3,300, with higher upside targets in the $3,600-$3,700 area.

Solana

Solana (SOL) is still moving sideways between support $124-$128 and resistance $143-$147. Although the SOL market is still within the broader bearish trend, the short-term movement is expected to remain confined within the range in the next few days.

XRP

Read also: XRP Holds 2021 Highs as Technical Indicators Point Toward $20 Bullish Target

XRP (XRP) is currently testing key support near $2.00, with additional levels at $1.9495 and $1.82. There is a short-term bullish divergence still active, suggesting a potential sideways consolidation or slight recovery in the coming days.

Chainlink

Chainlink (LINK) recently hit the $15 target based on the W-pattern, and is now retesting the previous Fibonacci resistance area which now serves as support in the $13.4-$13.5 range. The still-active bullish divergence suggests the potential for sideways consolidation or a minor upside in the short term. The immediate resistance is around $15 and between $15.20-$15.70.

Overall, the crypto market is currently in a “calm before the storm” phase ahead of the Fed meeting.

Although trading activity over the weekend tended to be low with flat price movements, volatility is expected to increase at the start of next week. This opens up significant trading opportunities across a range of major crypto assets.

FAQ

What is the Federal Open Market Committee (FOMC) Meeting?

The Federal Open Market Committee (FOMC) meeting is a meeting held by the US Federal Reserve to determine monetary policy, including interest rates.

What are the market predictions for the FOMC decision on interest rates?

The prediction market shows that there is an 86% chance of a 25 basis point rate cut and a 14% chance that rates will remain fixed.

What impact will the rate cut have on the crypto market?

A rate cut could increase capital flow into the market, which could potentially be a bullish catalyst for the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. FOMC Meeting in 3 Days: Here’s What to Expect for Bitcoin and Altcoins. Accessed on December 9, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.