Download Pintu App

Bitcoin (BTC) shows hidden strength, what are its prospects at the beginning of 2026?

Jakarta, Pintu News – Bitcoin (BTC) remains steady above $90,000 ahead of the Federal Open Market Committee (FOMC) meeting, while on-chain indicators are displaying much stronger fundamental signals than what is seen in the price action on the spot market.

Declining Reserves on the Exchange: A Signal of Structural Strength

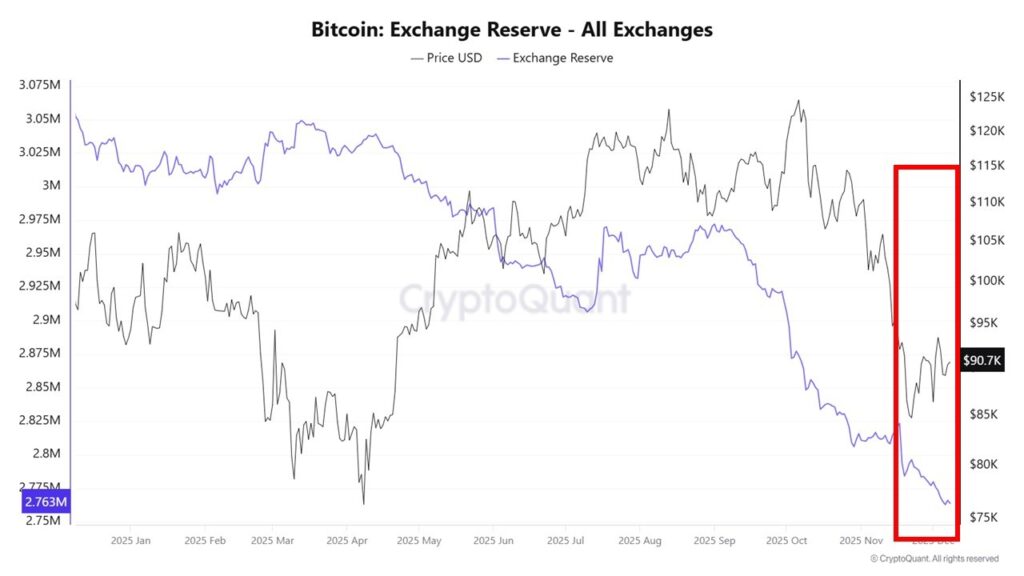

The latest report from CryptoQuant by Japan’s XWIN Research shows that Bitcoin (BTC) reserves on exchanges continue to decline significantly throughout 2025. Even as the price corrected towards the $90,000 area, the amount of Bitcoin stored on centralized exchanges dropped to just 2.76 million BTC, close to the lowest level in history.

This phenomenon is all the more interesting because it comes on the heels of heavy selling in November-December, which usually leads to a rise in stock exchange balances-but this time it declined faster.

The red zone in the analyzed chart highlights the acceleration of outflows as the price falls. This indicates the absence of major selling pressure from investors, reflecting a change in market behavior that is not typical of strong correction phases.

Also Read: Will Dogecoin (DOGE) be back in the hands of the bulls by early 2026?

Long-term Accumulation Behavior

The data shows that investors are not taking Bitcoin to exchanges to sell when the price drops. Instead, they are withdrawing BTC to long-term storage, either to personal wallets or cold storage. This pattern shows a high level of confidence from long-term holders despite the increased volatility ahead of the FOMC decision.

The contrast between the fear of short-term traders and the accumulation by long-term investors is one of the most significant dynamics in the current Bitcoin market structure.

Market Implications of the Reserve Decline

The rapid decline in exchange reserves has direct implications for market liquidity. With an increasingly limited availability of Bitcoin for sale, the market has become more sensitive to new demand. According to the report, the downward trend is not driven by short-term speculators, but rather by institutional entities and long-term holders securing BTC in self-storage.

This sets the stage for a potential “supply shock”-when demand increases but liquid supply is too low to balance it.

Conclusion

Although Bitcoin’s spot price appears weaker, on-chain metrics point to a more bullish structural shift. The decline in exchange reserves towards historical levels opens up the possibility of a supply shock in the future, which could trigger another bullish trend once market sentiment recovers.

Also Read:Michael Saylor Signaled New Bitcoin Purchases, BTC Price Ready to Skyrocket?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Bitcoin (BTC)?

Bitcoin (BTC) is a decentralized digital asset introduced in 2009, allowing peer-to-peer transactions without intermediaries through blockchain technology.

Why is a decrease in Bitcoin reserves on exchanges important?

A decrease in reserves indicates that less BTC is available for sale, increasing potential supply pressure and opening up opportunities for price increases if demand increases.

How does the FOMC meeting affect Bitcoin?

The FOMC’s decisions on interest rates and monetary policy can alter the risk appetite of global investors, which often has a direct impact on the price of crypto assets like Bitcoin.

How have investors responded to the recent Bitcoin price correction?

Instead of selling, many investors are withdrawing BTC from exchanges and storing it long-term, signaling confidence in Bitcoin’s fundamental value.

What does “supply shock” mean in the context of Bitcoin?

A supply shock occurs when the supply of BTC available on exchanges shrinks drastically, causing an imbalance between demand and supply that can push prices up sharply.

Reference

- NewsBTC. Bitcoin Exchange Reserves Fall to Lowest Levels on Record, The Bullish Signal Most Traders Are Missing. Accessed on December 10, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.