Download Pintu App

The Burning of 1 Billion HYPE Tokens: Impact on the Crypto Market by the End of 2025

Jakarta, Pintu News – The crypto market is abuzz again with a token burning proposal by the Hyper Foundation. A total of 1 billion Hyperliquid (HYPE) tokens are proposed to be burned in a bid to reduce supply and increase the token’s value. However, the big question that arises is whether this move is enough to keep the price above $20 amid selling pressure that may arise from the token’s December unlock.

Burning Proposal by Hyper Foundation

The Hyper Foundation has proposed to burn the 1 billion HYPE tokens currently held by the Relief Fund. This proposal is expected to be decided through a vote to be conducted by validators on December 21st, with the results of the vote announced on December 24th.

If this proposal is approved, there will be a significant reduction in the total and circulating supply which could have a positive impact on the token price. Burning this many tokens is expected to create a supply shock in the market.

In theory, when supply decreases while demand remains constant or increases, prices tend to rise. However, the current situation shows that demand for HYPE has yet to show a significant increase, along with falling prices and trading activity.

Also Read: How Crypto is Remaking the Financial System, AI, and Privacy Until 2026 According to a16z Crypto

Defense in the $20 Zone

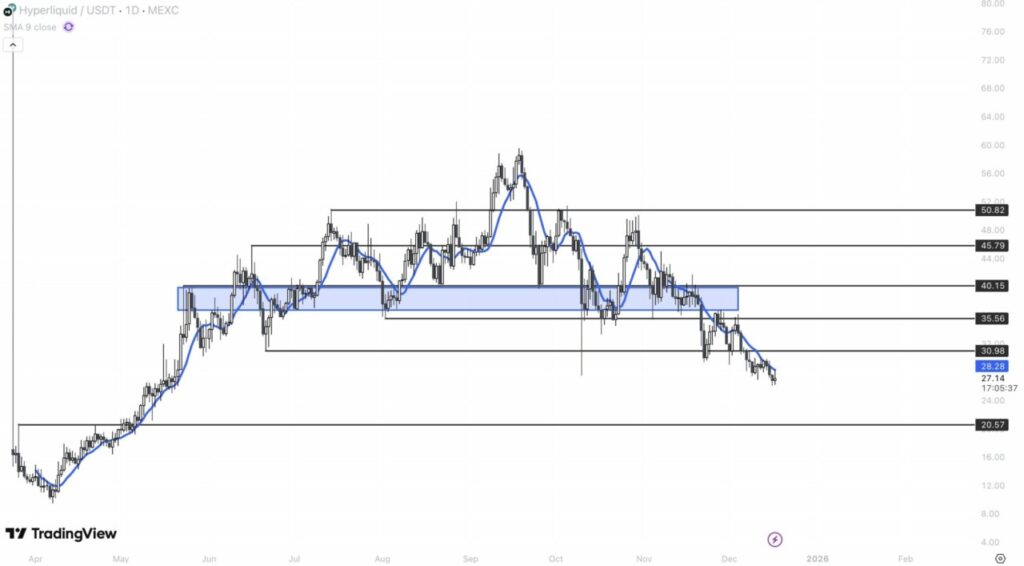

In the market, the price of HYPE has broken lower, following the broader negative trend in the crypto market. The token has fallen from the $35 zone and is currently trying hard not to fall deeper below $20. This $20 level is not only psychologically important but is also the previous higher peak recorded in April, which makes it a potential turning point.

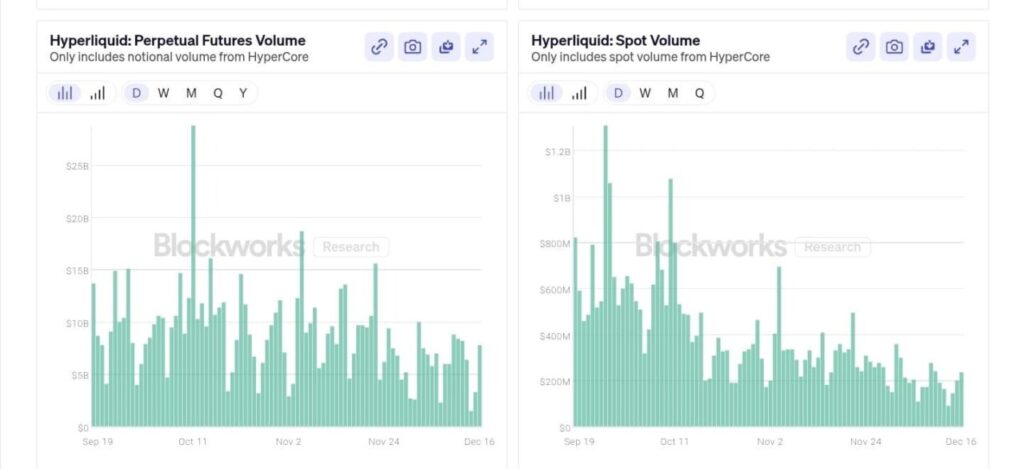

The defense of this zone will largely depend on the bulls’ ability to keep prices above it. However, with Perpetual Futures trading volumes falling dramatically and Spot volumes also declining, selling pressure seems to be intensifying. This adds to the complexity of trying to defend HYPE prices.

Selling Pressure Theory of Unlocking

While the token burn could provide a positive boost to the price, there are other concerns that arise from the upcoming HYPE token unlock in December. According to information from Ali Charts, there will be an additional 10 million tokens coming onto the market, which brings the total tokens that have been unlocked since November to 20 million.

This increase in supply could create short-term selling pressure, although it does not fully offset the impact of the 1 billion token burn. This suggests that market dynamics may still experience significant fluctuations in the near future.

HYPE’s Post-Fire Outlook

With a significant burn proposal and an upcoming token unlock, the HYPE market is faced with two opposing forces. The decisions of investors and traders in the coming weeks will largely determine the direction of the HYPE price. As an investor, it is important to keep a close eye on these developments and make decisions based on in-depth analysis and careful consideration of risk.

Also Read: 7 XRP Facts on Institutional Finance via VivoPower’s $900 Million Exposure Structure

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the burning of 1 billion Hyperliquid (HYPE) tokens?

The burning of 1 billion Hyperliquid (HYPE) tokens is a proposal from the Hyper Foundation to permanently remove tokens from supply with the aim of reducing the number of tokens in circulation and affecting market dynamics.

When will the HYPE token burn proposal be decided?

HYPE’s token burning proposal is scheduled to be decided through a validator vote on December 21, with the final results announced on December 24.

How can token burn affect HYPE’s price?

In theory, token burning reduces supply and therefore has the potential to support prices if demand remains constant or increases, but the impact is highly dependent on current market conditions and trading interest.

Why is the $20 price level considered important for HYPE?

The $20 level is an important psychological and technical area as it previously served as the price peak in April, making it a key defense point in the current price trend.

What are the risks of unlocking the HYPE token in December?

Token unlocking has the potential to add supply to the market, which may create short-term selling pressure despite the smaller amount compared to the planned token burn.

Does token burning completely negate the impact of unlocking?

Not entirely, because even though the 1 billion token burn is much larger, the additional supply of unlocked tokens can still affect sentiment and price movements in the short term.

What are the prospects for HYPE after the token burn?

HYPE’s outlook will be determined by the balance between supply reduction from flaring and market pressure from unlocking and trading activity, so price direction is still dependent on the overall market response.

Reference

- AMB Crypto. 1 Billion HYPE burn could shock supply, can HyperLiquid hold 20%?. Accessed on December 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.