Download Pintu App

Bitcoin VS Ethereum: ETH Tumbles More than BTC as Crypto Funds Out $952 Million!

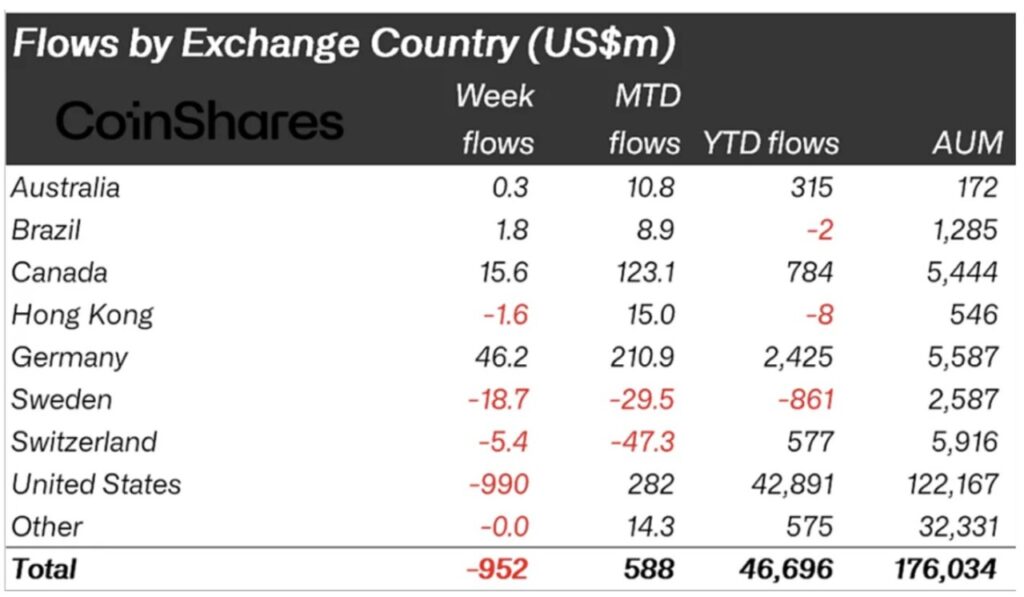

Jakarta, Pintu News – Digital asset investment products recorded their first weekly outflow in four weeks, with withdrawals totaling $952 million last week. The outflow of crypto funds came after the delay of the US Clarity Act reignited regulatory uncertainty and depressed institutional investor sentiment.

Crypto funds experience $952 million outflow

Based on weekly crypto fund flow data, the outflows were driven by a combination of stagnant legislation and growing concerns over selling pressure from large holders of crypto assets.

Read also: Is Ethereum Undervalued? These Two On-Chain Data Reveal the Fact!

“We think this reflects the market’s negative reaction to the delay in passing the US Clarity Act, which extends regulatory uncertainty for this asset class, along with concerns over continued selling bywhales,” wrote James Butterfill, Head of Research at CoinShares.

With the momentum fading, analysts are now saying that it is unlikely that inflows into digital asset exchange-traded products (ETPs) in 2025 will surpass the previous year’s achievements.

Total assetsunder management (AUM) currently stands at $46.7 billion, lower than the $48.7 billion by the end of 2024.

This negative sentiment was mainly concentrated in the United States, which accounted for $990 million of the total crypto fund outflow. In contrast, investors in other regions showed a more positive outlook.

- Canada recorded inflows of $46.2 million

- Germany attracted $15.6 million in funds, partially covering losses in the US, but not enough to reverse the overall trend.

This difference highlights how regulatory uncertainty has a greater impact on US-based institutional investment products compared to those listed in other regions.

Meanwhile, the Clarity Act was intended to establish a clearer federal framework for digital assets. However, delays in the process have prolonged ambiguity regarding oversight, registration requirements, and the division of authority between regulators in the US.

For financial institutions that operate with strict adherence to rules, this uncertainty has directly led to a decrease in exposure to digital assets.

Bitcoin Vs Ethereum: ETH Most Vulnerable to Regulatory Risk

Ethereum (ETH) led the weekly outflows with a total of $555 million, reflecting the high sensitivity of this asset to the outcome of crypto legislation in the United States.

Read also: Brazil Experiences Crypto Investment Boom, Up 43% Through 2025

Market participants widely view Ethereum as having the most upside – or downside – depending on how clearly defined digital commodity and security are in future regulations.

Despite recording sharp weekly outflows, Ethereum’s long-term inflows remain strong. So faryear-to-date, Ethereum has posted $12.7 billion in inflows, far surpassing the $5.3 billion recorded throughout 2024.

This contrast shows that institutional interest in Ethereum is still maintained, although the level of trust remains fragile due to the lack of regulatory clarity in the near future.

Bitcoin came in second place with an outflow of $460 million. Although Bitcoin (BTC) is still the main destination for institutional capital overall, inflows so far this year have only reached $27.2 billion, well below the $41.6 billion recorded in 2024.

This data suggests that Bitcoin’s role as a “safe harbor” against regulatory risk is now being tested amid broader US market uncertainty.

However, not all assets experienced a sell-off. Solana (SOL) recorded inflows of $48.5 million, while XRP (XRP) attracted funds of $62.9 million. This indicates selective investor support, rather than a complete withdrawal from the digital asset market.

These inflows indicate a clearer differentiation in the market, with capital shifting to assets that are perceived to have a clearer regulatory position or a stronger network narrative.

Until US lawmakers provide clarity through legislation such as the Clarity Act, fund flows are expected to remain highly volatile.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Hit Harder Than Bitcoin as $952 Million Exits Crypto Funds-Here’s Why. Accessed on December 24, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.