Download Pintu App

7 Crypto facts Solana (SOL) fell 39%: Q4 2025 was the worst quarter ever, what happened?

Jakarta, Pintu News – The performance of Solana (SOL), one of the largest cryptocurrencies by market capitalization, entered a phase of significant pressure in the 4th quarter of 2025 which was recorded as the deepest decline throughout the year based on Cryptorank data.

This decline contrasts with the crypto market sentiment that had recovered in the previous quarter and provides context for the SOL price situation in late 2025. This information was gathered from relevant market reports published by crypto news U.Today and market data aggregation sources.

1. Solana Down 39.1% in the Fourth Quarter of 2025

Market data indicates that Solana experienced a 39.1% decline during Q4 2025, making it the worst quarter of the year, worse than Q1’s 34.1% decline and contrasting with the gains in Q2 and Q3. This decline comes amid SOL’s inability to break the resistance level above $150 in the last 30 days.

Every month of the quarter closed with a negative performance, including October and November which recorded a decline each, indicating that downward momentum continued throughout the period despite some market participants initially anticipating a continued recovery.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

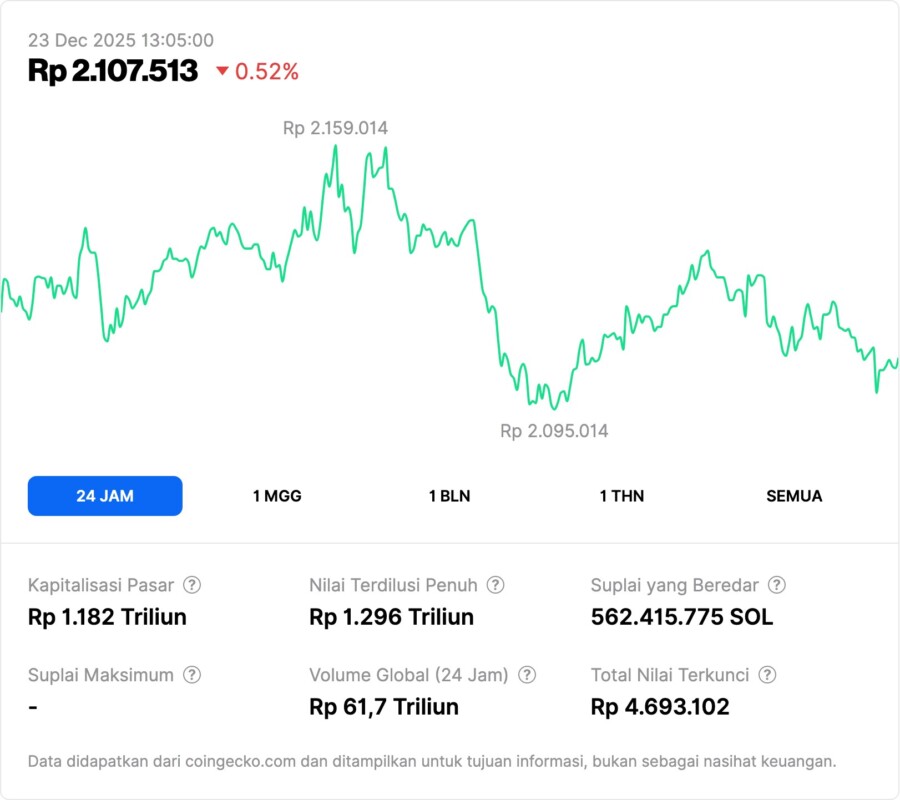

2. Actual Price Movement & Trading Volume

At the time of the report, SOL was trading at around $127.02, having bounced off its lowest intraday level of around $124.02. In the last 24 hours, the price showed a small increase while the trading volume surged 40.52% to around $2.87 billion.

This surge in volume gives an indication that market activity – despite the price drop – remains dynamic, with short-term capital re-entry or capital rotation between more liquid cryptocurrency assets.

3. Solana Previously Recovered in 2025

In contrast to the Q4 decline, Solana recorded a positive performance in Q2 2025 with a 24.2% increase and rallied to 34.9% in Q3. This positive trend reflects the high volatility experienced by SOL in some quarters, where bull and bear momentum alternated throughout 2025.

This shows that despite the worst quarter ever, the coin still has a history of recovery, which provides important context in understanding the dynamics of the year’s overall price movement.

4. Revenue Performance & Comparison with Ethereum

Other reports suggest that Solana is on the verge of surpassing Ethereum (ETH) in terms of annual revenue, with estimated revenue reaching $1.4 billion compared to $522 million for Ethereum, despite the sharp fall in SOL prices at the end of the year.

These strong annualized revenues provide context that network activity levels and technical adoption of SOL remain attractive to institutional players despite price volatility exerting downward pressure in the short term.

5. Decreased Tissue Activity

Other market data sources note that Solana’s network activity experienced a dramatic decline of 97% in Q4 2025, with the number of monthly active users dropping from tens of millions to less than one million. This decline in activity is often attributed to reduced transaction momentum and short-term market interest.

Decreased activity often contributes to selling pressure, as low network usage can lower revenue from transaction fees and affect market participants’ perception of cryptocurrency utility.

6. Technical Factors & Price Resistance

SOL did not manage to break the technical resistance level of around $150 during Q4, which held back the upward momentum and reinforced the downward pressure. The price rejection at this level was an important indicator in the technical analysis of SOL’s price during the quarter.

In addition, indicators such as the short-term simple moving average (SMA) showed that the SOL briefly rallied above its seven-day average, reflecting some positive technical signals despite the overall trend still being bearish.

7. Market Outlook & Outlook 2026

This sharp decline gives market participants the view that 2026 could be a year of structural evaluation for Solana, especially if technical pressures and crypto market demand factors change. Some analysts hope that institutional momentum as well as long-term network adaptation could dampen future price volatility.

Given the context of volatility and mixed performance throughout 2025, the price dynamics of SOL in early 2026 will be an important indicator for the direction of trends in the overall cryptocurrency market.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What does Solana’s 39.1% drop in Q4 2025 mean?

The decline shows that Solana had its worst quarter in 2025 based on price declines from Q4 market data.

What is the current SOL price according to reports?

Solana was trading around $127.02 at the time of the report, having bounced off an intraday low.

How did Solana perform in the previous quarter?

Solana showed a strong recovery in Q2 and Q3 2025, with gains of more than 24% and almost 35%, respectively.

Does the decline indicate weak network fundamentals?

Despite the price drop, annualized earnings are expected to remain high and the possibility of institutional capital infusion suggests long-term interest remains.

What are the implications of decreased network activity?

A significant decrease in network activity could depress transaction revenues and put further pressure on prices, as per a number of network metrics in Q4 2025.

Reference:

Godfrey Benjamin/U.Today. Solana Falls 39%:Officially Worst Quarter of 2025. Accessed December 23, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.