Download Pintu App

Bitcoin (BTC) Strengthens: Will it Continue to Rise Until Early 2026?

Jakarta, Pintu News – Since the beginning of 2025, Bitcoin (BTC) has shown significant resilience by successfully maintaining a price above $80,000 at each monthly close. This stability continues to be a major point of support for the price of Bitcoin (BTC). However, recent market reports suggest a change in trend where volume driven by the US market continues to show selling, while long-term holders have started to reduce their distributions.

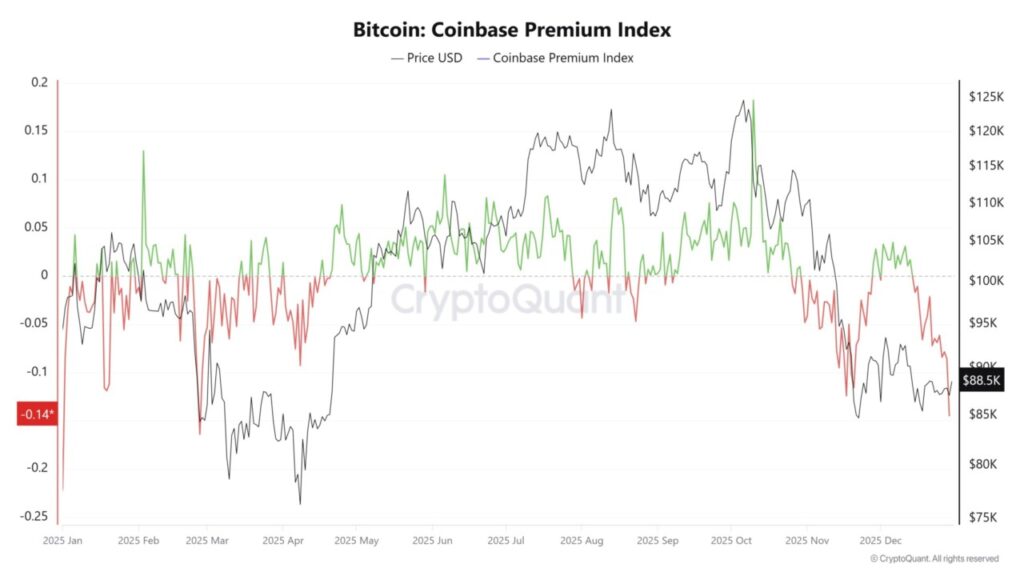

Coinbase Premium Index Shows Uncertainty

Data from CryptoQuant shows that the Coinbase Premium Index stood at -0.14 on December 30, the weakest figure since February. The index was in the red for 16 consecutive days at the end of December, during which Bitcoin (BTC) failed to record a weekly close above $90,000.

Analysts state that this prolonged weakness reduces the belief that a market bottom has been reached. The US-driven selling pressure is yet to show clear signs of reversal, according to analyst Johnny in a post on X.

Read also: 3 Altcoins that Have the Potential to Set New Record Highs in Early 2026

ETF outflows slow, bitcoin (BTC) holders rally

ETF flow data shows a more complex picture. In December, there were outflows from the Spot Bitcoin ETF for the second consecutive month, but the scale of withdrawals has continued to decline significantly since November. Analysts noted a similar decline in sales in February and early March 2025.

This suggests that selling pressure may be slowing down significantly, which could help stabilize prices. Although Bitcoin (BTC) may occasionally drop below $80,000, the modest selling strength could allow for a price recovery.

Also read: 5 Reasons XRP Could Rocket 330% by 2026 According to Standard Chartered

Long-term Holders Stop Selling

The on-chain record of long-term holders has caught the attention of many. According to CryptoQuant, the supply of long-term holders has switched from distribution to accumulation in late December, with around 10,700 Bitcoin (BTC) moving to long-term holding status.

Ki Young Ju, founder of CryptoQuant, explained that long-term holders of Bitcoin (BTC) have stopped selling. Although there are still sell signals from the US, the behavior of long-term holders provides a counterweight that might support Bitcoin (BTC) price recovery in the future.

Conclusion

With various dynamics at play in the Bitcoin (BTC) market, from selling pressure in the US to changes in long-term holder behavior, the outlook for Bitcoin (BTC) in 2025 remains uncertain. However, structural indicators point to a possible recovery, although there may be more price fluctuations below $80,000 before it reaches stability.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin Rises as Holders Return, Will BTC End 2025 in the Green? Accessed on January 1, 2026

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.