Download Pintu App

Bitcoin Holds Steady at $93,000 as Buying Activity Among Holders Strengthens

Jakarta, Pintu News – Bitcoin (BTC) price continues to rise after breaking out of the latest consolidation pattern. This breakout signals increased confidence that BTC may be preparing for a bigger move.

The growing inflows into spot Bitcoin ETFs reflect the historical conditions that previously preceded sharp price spikes, reinforcing the growing optimistic sentiment towards this asset.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 0.67% in 24 Hours

On January 7, 2026, the price of Bitcoin was recorded at $93,005 or equivalent to Rp1,566,141,373, experiencing a slight correction of 0.67% in the last 24 hours. During this period, BTC touched its lowest level at Rp1,540,631,225 and its highest price at Rp1,587,814,624.

As of writing, Bitcoin’s market capitalization stands at around IDR 31,409 trillion, with trading volume in the last 24 hours rising 18% to IDR 817.82 trillion.

Read also: Ethereum Hits $3,250 Today — Is ETH Showing Signs of Strong Resilience?

Bitcoin ETFs Show Increased Demand

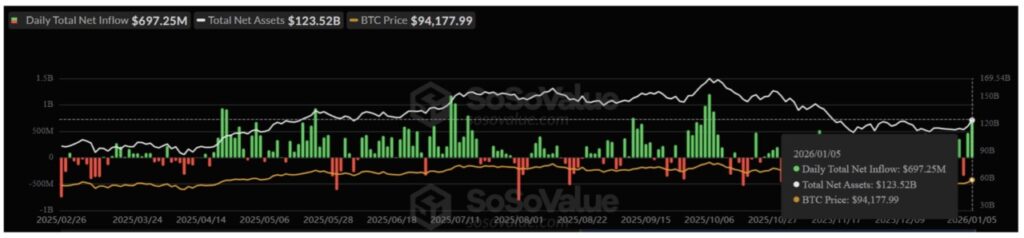

The spot Bitcoin ETF recorded inflows of $697 million on Monday (Jan. 5), becoming the largest daily entry since October 2025. These significant inflows reflect the return of institutional participation.

Historically, periods of strong ETF accumulation have often coincided with short-term price accelerations in Bitcoin.

Similar spikes in inflows in the past were usually followed by rallies that lasted for several weeks. Current conditions appear comparable, provided inflows remain steady throughout the week. The sustained demand for ETF products helps to reduce the circulating supply and strengthen the optimistic sentiment among both retail and professional investors.

The demand driven by ETFs often acts as a counterweight during volatile market conditions. Unlike leverage-based speculation, these inflows reflect long-term investment positions.

Its consistency will most likely support higher price discovery, instead of a sharp reversal triggered by short-term trading behavior.

Bitcoin Holders’ Purchasing Power Strengthens

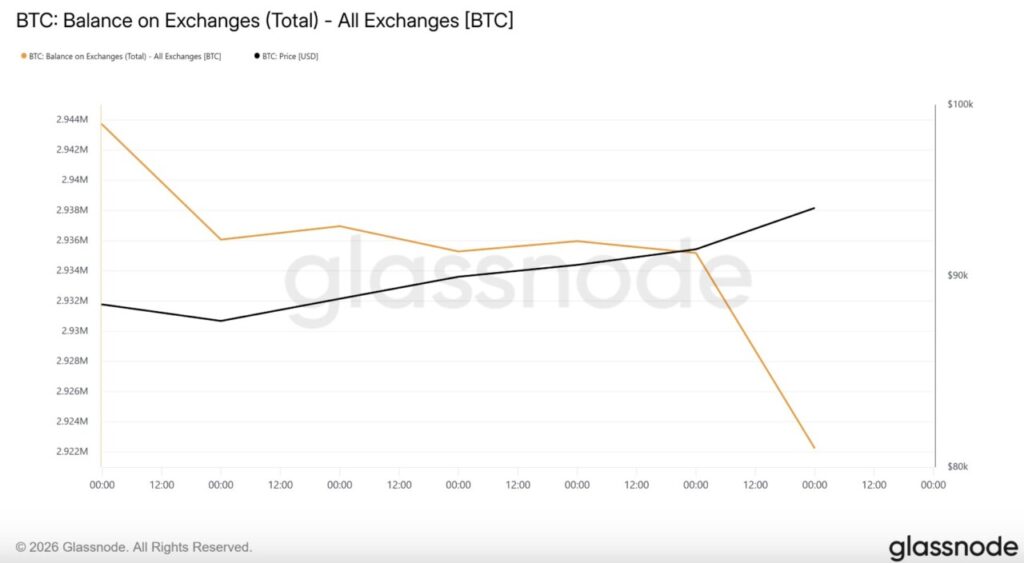

Selling pressure remains limited, according to recent Bitcoin flow data on exchanges. Over the past week, exchanges have consistently recorded net outflows of Bitcoin. This trend suggests that investors prefer to keep their assets in-house rather than sell them outright, a positive signal amid rising prices.

In the last 24 hours alone (Jan. 6), around 12,946 BTC has been withdrawn from exchanges, worth around $1.2 billion. This movement indicates active buying, not just defensive repositioning. Bitcoin’s declining balance on exchanges shrinks the available supply, helping to maintain the price’s upward momentum.

When prices rise in tandem with outflows from the exchanges, the rallies tend to be healthier. Buyers appear ready to absorb supply without triggering a panic sell-off.

Short-term holders capitalize on opportunities

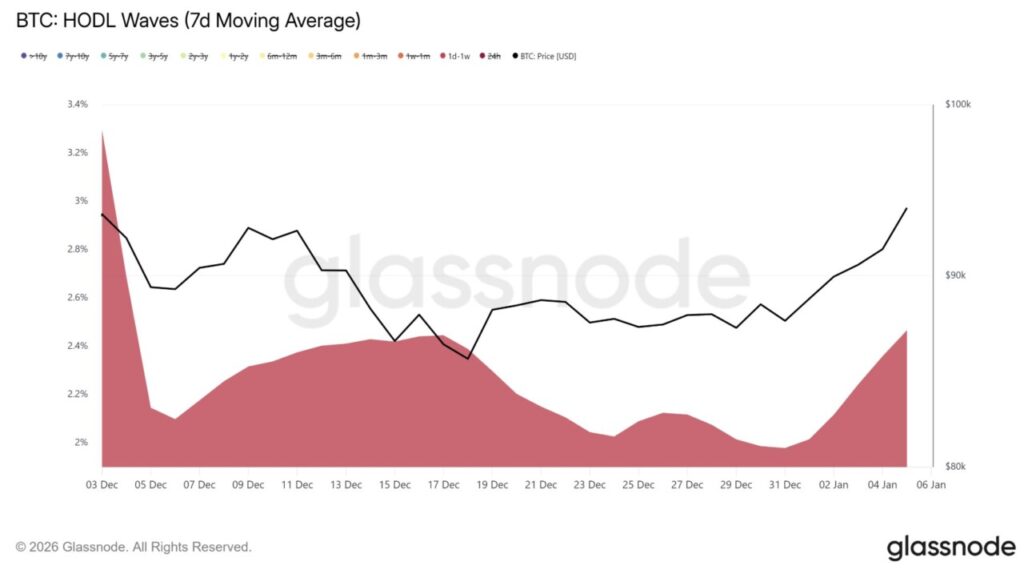

Short-term holders (STHs) are starting to emerge as the dominant buyers in this phase. Addresses that acquired BTC in the span of the last one day to one week have increased their proportion to the total supply. In seven days, STH holdings rose from 1.97% to 2.46%.

Read also: Dogecoin Price Weakens Today: DOGE Chart Shows Accumulation

This increase reflects new demand coming into the market. New buyers are coming in despite the high price of BTC, signaling confidence in the potential upside in the near future. This kind of participation often drives momentum in breakout phases, not typical of late-cycle phases.

STH-driven rallies can be more volatile, but are effective when supported by broader accumulation. When combined with ETF inflows and outflows from exchanges, this demand structure leads to solid market strength, not weakness. Current momentum remains in line across different investor segments.

BTC price aims for two-month high

Bitcoin traded at around $93,329 on January 6, continuing its breakout movement over the past three days. The price’s exit from the recent descending wedge pattern carries a projected upside of around 12.9%. This technical target places BTC around the $101,787 level.

Although these levels are still quite far away, current market conditions favor a gradual rise. Strong buying pressure could potentially push Bitcoin through $95,000. If the level is successfully converted into support, a path to $98,000 or higher could open up in a matter of days, reinforcing the breakout structure that is forming.

However, risks remain if investor behavior changes as prices rise. Selling pressure around $95,000 could disrupt the momentum. In the event of a reversal, BTC prices could drop towards support at $91,511. If this level is broken downwards, the bullish scenario will fall and the risk of returning to the consolidation phase will increase.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Targets $101,700 After Spot ETFs’ $700 Million Inflows, Here’s Why. Accessed on January 7, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.