Download Pintu App

XRP Price Prediction: Price Consolidation Amid Rising DeFi Narratives Across Blockchains

Jakarta, Pintu News – XRP (XRP) remains in a consolidation phase after a strong rally at the end of the year, with prices trending steady around the $2.04 level on the 4-hour chart (12/1) on Bitstamp.

The market seems to be experiencing a pause, not a reversal, while traders evaluate previous gains and adjust their leverage exposure.

As a result, short-term volatility has narrowed, although the overall market structure still shows a positive trend. The longer-term trend still reflects a price pattern that continues to print higher highs and higher lows, indicating that the latest decline is more of a consolidation (market digestion) phase, rather than a distribution.

However, the direction of the near-term move now increasingly depends on the buyers’ ability to reclaim the nearby resistance zone.

XRP Technical Levels Determine Short-Term Movement Direction

On the 4-hour time frame (12/1), XRP is moving below its major moving averages, indicating that momentum is starting to weaken. Additionally, the narrowing price range suggests a potential price expansion phase in the near future.

Read also: Meme Coin Market Crashes, 11.6 Million Crypto Tokens Failed in a Year!

The nearest resistance is in the range of $2.09 to $2.11, where the 50-period EMA aligns with the 0.5 Fibonacci retracement level. If the price manages to break this area convincingly, it is likely that the bullish momentum will return. Above that, the $2.17 level is the next trigger for the upside, with the supply zone between $2.28 to $2.30 as an advanced target.

Meanwhile, the support area is also quite clear. The $2.02 to $2.01 zone is the initial defense, reinforced by the 0.382 Fibonacci level. Therefore, the ability of the price to stay above the psychological level of $2.00 is crucial.

If it fails, the price correction could continue towards the $1.92 to $1.93 range, which is the area that buyers previously defended.

Derivatives and Spot Flow Indicate Market Reset

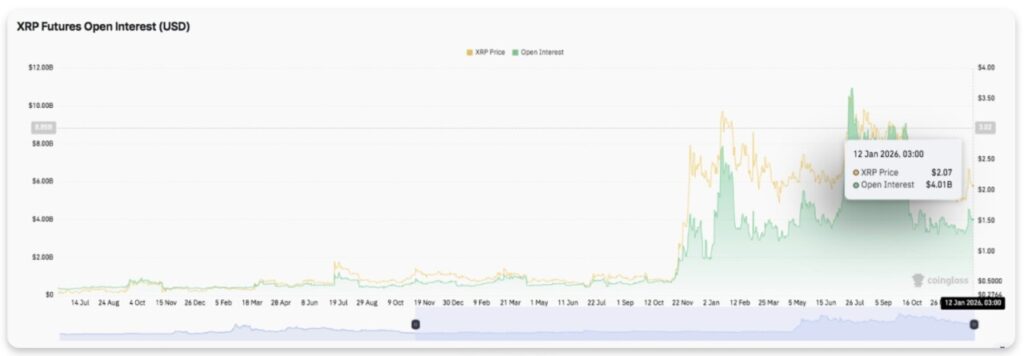

XRP futures market data shows that open interest increased sharply during the 2025 year-end rally, confirming new participation utilizing leverage. However, after reaching its peak, open interest began to decline as the price consolidated.

As a result, there was a partial deleveraging process that reduced excessive speculation without completely eliminating market interest. Currently, open interest is stable around the $4.0 billion level, still relatively high compared to historical averages.

Meanwhile, data from the spot market showed cautious signals. Net inflows-outflows remained negative, reflecting the dominance of sellers and outflows from the bourse. In fact, large spikes in outflows often coincided with price weakness locally.

Although there was a large inflow, the movement did not continue. Ahead of the latest session, netflows remained negative at around $28 million, while the price moved around $2.05.

Cardano Shows Cross-Chain DeFi Opportunities

In addition to price movements, developments in the broader ecosystem also influence market sentiment. In a recent discussion, Charles Hoskinson revealed that Cardano (ADA) plans to support Bitcoin and XRP-based DeFi through the Midnight protocol.

Read also: RENDER Price Surges Above $2, Can Bulls Sustain Rally?

He explained that Midnight’s architecture allows assets from other networks to interact with smart contracts privately.

Additionally, Hoskinson expressed interest in working with Ripple, especially after the success of previous airdrop initiatives. He also confirmed that support for the project will be available through Lace Wallet.

XRP Price Technical Outlook

Important levels for XRP remain evident as the price consolidates after its latest rally.

On the upside (resistance), the range of $2.09-$2.11 is the initial resistance zone. If the price is able to break this area consistently, then there is a potential to continue rising towards $2.17, and then to the main supply zone at $2.28-$2.30.

Meanwhile, on the downside (support), the initial support is in the range of $2.02-$2.01, which aligns with the short-term Fibonacci support, making it a crucial level. If the price drops deeper, the psychological level of $2.00 becomes the next line of defense. Failure to defend this level could pave the way for a drop towards $1.92-$1.93.

Technically, the current price structure suggests that XRP is in a consolidation phase after the previous upward impulse. Narrowing volatility is usually a sign of price expansion (range breakout).

Momentum in the lower time frames did slow down, but in the higher time frames, the structure still shows bullish tendencies with the higher high pattern maintained.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. XRP Price Prediction: XRP Consolidates as DeFi Narratives Expand Across Blockchains. Accessed on January 13, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.