Download Pintu App

Ethereum Jumps 6% Today as Over $5 Million Flows Into Ethereum ETF

Jakarta, Pintu News – The price of Ethereum (ETH) is showing a bullish trend, staying above the support level formed by the long-term uptrend line.

Despite an important resistance barrier on the 4-hour chart (1/13), the positive flow of the ETH ETF on Monday gives new hope. So, how will Ethereum price move today?

Ethereum Price Rises 6.91% in 24 Hours

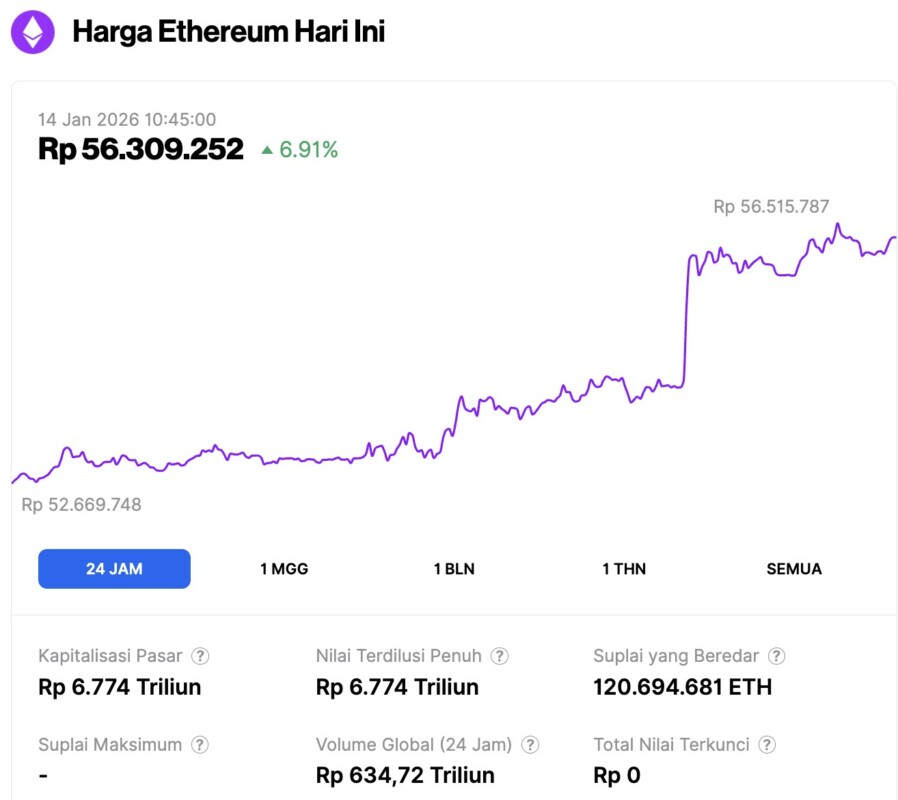

On January 14, 2026, Ethereum was trading at approximately $3,336, or around IDR 56,309,252 — marking a 6.91% increase over the past 24 hours. During this time, ETH reached a low of IDR 52,669,748 and climbed as high as IDR 56,515,787.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 6.77 trillion, while its 24-hour trading volume has surged by 67% to IDR 634.27 trillion.

Read also: Bitcoin Price Surges to $95,000 Today: Whales Continue to Accumulate BTC!

More than $5 Million Into Ethereum ETF, Fueling ETH Price Spike

Ethereum price continues to show strength, at least on the 4-hour chart, driven by ETF inflows worth more than $5 million on Monday (12/1).

Data from SoSoValue shows that on January 12, the spot Ethereum ETF recorded a total net inflow of $5.042 million. With this achievement, the trend of three consecutive days of net outflows came to an end.

However, amidst the positive inflows, BlackRock’s ETHA ETF experienced outflows of $79.9 million-the only outflow recorded on the day. On the other hand, Fidelity, Bitwise, VanEck, Invesco, and Franklin Templeton recorded neither inflow nor outflow movements (zero flows).

In contrast, 21Shares recorded positive inflows of $5 million, followed by Grayscale with inflows of $50.7 million and $29.3 million through its investment products, ETHE and ETH.

As of January 12, cumulative net inflows into Ethereum ETFs totaled $12.44 billion, with total trade value reaching $940.66 million and total net assets of $18.88 billion. Interestingly, these total net assets account for more than 5% of the Ethereum market capitalization.

On the other hand, the Bitcoin spot ETF recorded net inflows of $117 million, marking a change in trend after four consecutive days of net outflows. Meanwhile, the Solana spot ETF recorded inflows of $10.67 million, and the XRP spot ETF recorded inflows of $15.04 million.

Ethereum Price Outlook After $5.04 Million Worth of Inflows on Monday

Ethereum price is currently holding above the medium-term support formed by the uptrend line, indicating that the main trend is still bullish.

With the RSI (Relative Strength Index) indicator starting to increase, the momentum of the price strengthening has also strengthened. If this condition continues, ETH prices have the potential to print further gains. However, the position of the RSI which is still around the 50 level indicates uncertainty, where price movements are still vulnerable to potential reversals (bearish).

Read also: Vitalik Buterin: Ethereum Needs a Better Decentralized Stablecoin!

Nonetheless, as long as the RSI remains above the 50 level, the dominance is still in the hands of the bulls. This sentiment could get stronger if the ETH ETF inflows on Tuesday also show positive results.

For traders looking to go long, it is advisable to wait for confirmation in the form of a convincing candlestick close above the $3,150 resistance level. This confirmation can be strengthened if the price manages to break the level, retest, and stay above it in the 4-hour chart.

If such a scenario occurs, Ethereum price could potentially target the next supply zone in the range of $3,223 to $3,296 – a bearish order block area that could be an obstacle before ETH attempts to return to its peak price.

However, with ETH prices currently facing immediate resistance at $3,150, the volume profile shows that there is quite strong selling and buying pressure around the $3,134 level. This is reflected by the large nodes in the bullish (green horizontal line) and bearish (red) volume profiles on the chart.

With more bearish nodes than bullish, the Ethereum price is at risk of a pullback, which could be exacerbated if Tuesday’s ETH ETF flows turn out to be negative.

In the event of a correction, the bullish scenario for Ethereum price could become invalid if the support of the uptrend line fails to hold. In this situation, ETH is likely to retest the $3,058 level last seen on January 9.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Faces Key 2026 Resistance, but $5.04 Million ETH ETF Inflows Spell Hope. Accessed on January 14, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.