Download Pintu App

Dogecoin Surges ~8% Today — Can DOGE Sustain Another Major Rally?

Jakarta, Pintu News – Dogecoin (DOGE) has maintained its standard so far in this market cycle, and analysts from Bitcoinsensus continue to follow this sideways price movement trend.

In his comments on Monday (12/1), the analyst questioned whether Dogecoin would perform as well as in previous cycles, where the coin had experienced large spikes after going through similar structural patterns.

The analysis specifically highlights Dogecoin’s price movements in previous market periods as well as how far it has progressed to date.

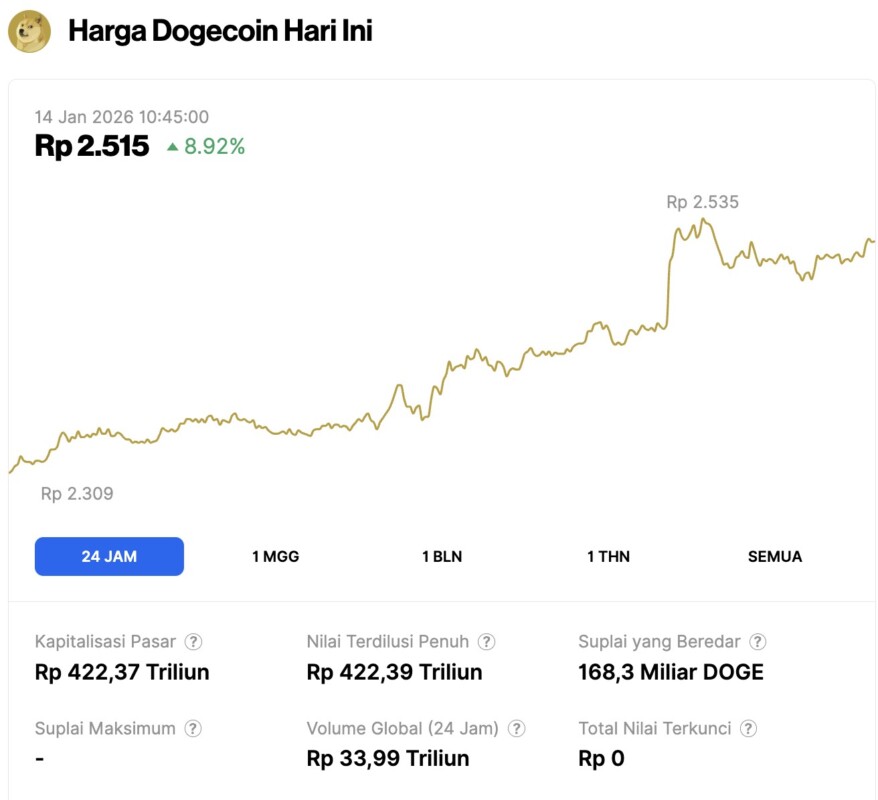

Dogecoin price rises 8.92% in 24 hours

On January 14, 2026, Dogecoin saw a notable 24-hour gain of 8.92%, pushing its price to $0.1491 — approximately IDR 2,515. During that period, DOGE traded within a range of IDR 2,309 to IDR 2,535.

As of the latest data, Dogecoin holds a market capitalization of around IDR 422.37 trillion, with a 24-hour trading volume reaching approximately IDR 33.99 trillion.

Read also: 21Shares’ Dogecoin ETF Set to Launch, Will DOGE Price Surge?

Key Data Points

- Dogecoin’s current price movements reflect patterns that have been seen in previous market cycles.

- Analysts from Bitcoinsensus have been monitoring this trend closely, and in their latest analysis questioned whether Dogecoin would follow previous cyclical patterns.

- The analysis highlights Dogecoin’s price movements across previous market cycles, noting that Dogecoin has moved in multiple waves for over 12 years.

- During this period, Dogecoin showed a consistent pattern: price correction, accumulation, then rally.

- The last two cycles followed this pattern and resulted in price growth of 5,858% and 21,457% respectively.

- Of the three cyclical fractal patterns identified, two have occurred since the 2022 market cycle began.

- If history repeats itself, Bitcoinsensus expects Dogecoin to bounce back from its latest low and aim higher.

Historical Data of Previous Dogecoin Cycles

Over the past 12 years, DOGE’s price movements have followed a clear pattern: correction, accumulation, then price rally. In its initial cycle, Dogecoin entered a correction phase in 2014, after experiencing a post-launch price surge that dropped to $0.0022.

This phase continued until early 2015, when DOGE began to move up in an ascending channel pattern from a low of $0.001. In March 2017, Dogecoin broke out of the channel and started to expand until it reached the peak of the cycle at $0.0041 – resulting in a growth of 5,858% according to analyst charts.

A similar pattern occurred again after the 2014-2018 cycle ended. This time, Dogecoin entered a triangle-like accumulation structure and consolidated until June 2020, when the price hit a low at $0.0022.

After that, DOGE was only in a brief accumulation zone for five months. In November 2020, the price of DOGE broke out of that zone and started moving impulsively until it reached a peak price in May 2021 of $0.7605 – which is still its highest price to date.

The movement reflected a surge of 21.457% from the breakout point of the accumulation zone.

Read also: Meme Coin Market Crashes, 11.6 Million Crypto Tokens Failed in a Year!

What it means for Dogecoin

Meanwhile, two of the three cyclical fractal patterns have occurred since the start of the 2022 market cycle.

After reaching an all-time high, Dogecoin formed a descending triangle pattern and consolidated to a low of $0.0569, before starting its latest accumulation phase in early November 2023.

Interestingly, the chart from Bitcoinsensus shows that Dogecoin’s current position is at what has historically been the start of a breakout phase. As this accumulation period comes to an end, the analysis shows similarities with previous cycles. Therefore, there is a high probability that the historical pattern will repeat itself.

However, how fast or how big the DOGE price increase will be if the bullish phase really starts is still uncertain. Therefore, analysts question whether this cycle will be as “explosive” as the previous one.

Risks to Consider

If history repeats itself, Dogecoin could potentially bounce back from its recent low and target a higher price. The magnitude of the percentage increase will largely depend on market momentum, adoption rates, and overall market conditions.

However, the opposite could also happen – Dogecoin could experience another drop to retest the previous price low. Therefore, Bitcoinsensus emphasizes that this analysis does not constitute financial advice, and any investment decisions should be made based on thorough research.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Will This Cycle Follow Dogecoin Past Rallies? Accessed on January 14, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.