Download Pintu App

Dogecoin Price Weakens Today: 21Shares Files Final Prospectus for DOGE ETF!

Jakarta, Pintu News – 21Shares has filed a final prospectus with the US Securities and Exchange Commission (SEC), paving the way for its spot Dogecoin ETF to list on Nasdaq under the stock symbol TDOG. The product could potentially begin trading as soon as this week.

If officially launched, Dogecoin (DOGE) will join a small group of crypto assets that have several spot ETFs active in the US market. Similar products from Grayscale and Bitwise are already available. Before we go any further, how has the Dogecoin price moved today?

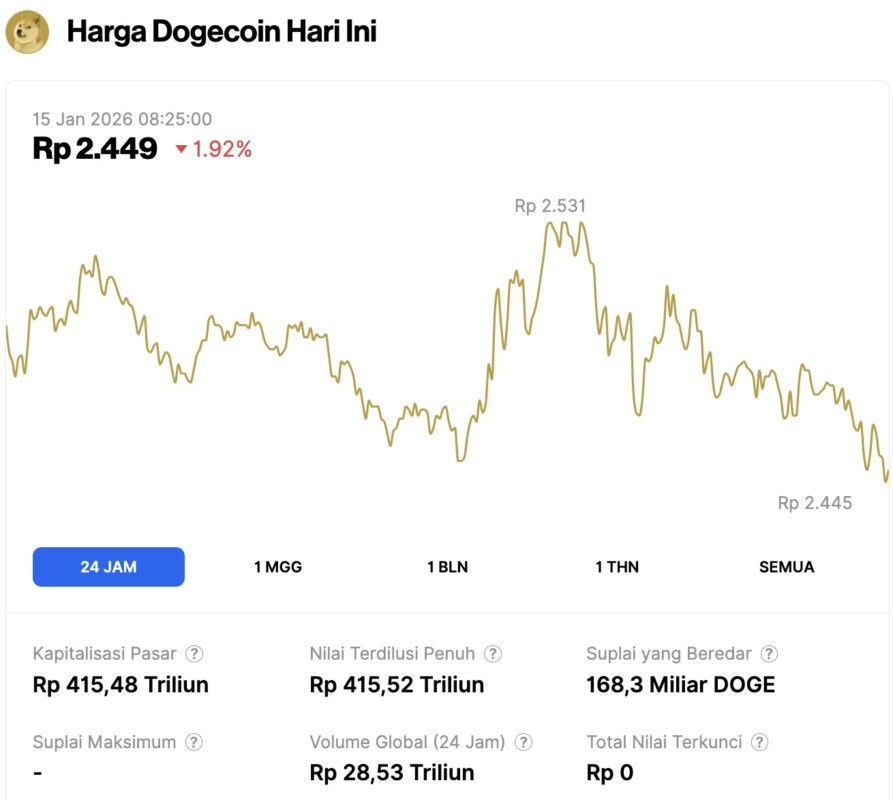

Dogecoin price drops 1.92% in 24 hours

On January 15, 2026, the price of Dogecoin recorded a 1.92% correction within 24 hours, trading at $0.1456 or the equivalent of Rp2,449. In the last 24-hour period, the price of DOGE moved in the range of Rp2,531 to Rp2,445.

As of writing, Dogecoin’s market cap stands at around IDR 415.48 trillion, with a trading volume of around IDR 28.53 trillion in a 24-hour period.

Read also: Bitcoin Climbs to $97,000 as Whales Accumulate — Is a Return to $100,000 on the Horizon?

21Shares files final prospectus for Dogecoin ETF

As reported by CoinSpeaker, this ETF from 21Shares tracks the spot price of DOGE using the CF Dogecoin-Dollar US Settlement Price Index. This product does not use leverage or derivatives. DOGE will only enter or exit the trust when shares are created or redeemed in bundles of 10,000 units.

The fund charges a management fee of 0.50% per annum, payable weekly in DOGE. There is no fee waiver.

Fund administration was handled by Bank of New York Mellon, while asset custody was split between Coinbase Custody Trust, Anchorage Digital Bank, and BitGo. Wilmington Trust acted as trustee.

Dogecoin Price Analysis: What’s Next?

DOGE was trading at around $0.14 after several months of up-and-down movement.

Read also: Following Trump and Melania, Former New York City Mayor Launches Latest Coin Meme!

The chart below shows that the price is still holding above the $0.089 low, while pressuring the long-term downtrend line. On the other hand, the RSI indicator is around its mid-level, which indicates neutral market conditions – neither overbought nor oversold. Trading volume is still relatively low.

As long as DOGE is able to stay above the $0.12-$0.10 support zone, downside risks remain. If the price breaks cleanly below the zone, there is potential to retest the low at $0.089 – which is the last major support on the chart.

However, if DOGE is able to break the downtrend line, the first target that opens up is $0.18. If the price can cross $0.18, then there is a chance to continue to the $0.30 level. If ETF fund inflows increase and general market conditions remain favorable, the chart shows a potential follow-on target of $0.50, even up to the $1 zone in a longer-term scenario.

Conversely, if DOGE fails to hold above $0.12, the bullish technical structure will weaken. A drop below $0.10 will invalidate the existing positive pattern.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Dogecoin Price Prediction: Spot ETF Set to Launch on Nasdaq This Week – Billions Incoming? Accessed on January 15, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.