Download Pintu App

5 PUMP 57% Breakout Signals, Has Great Potential to Explode in 2026?

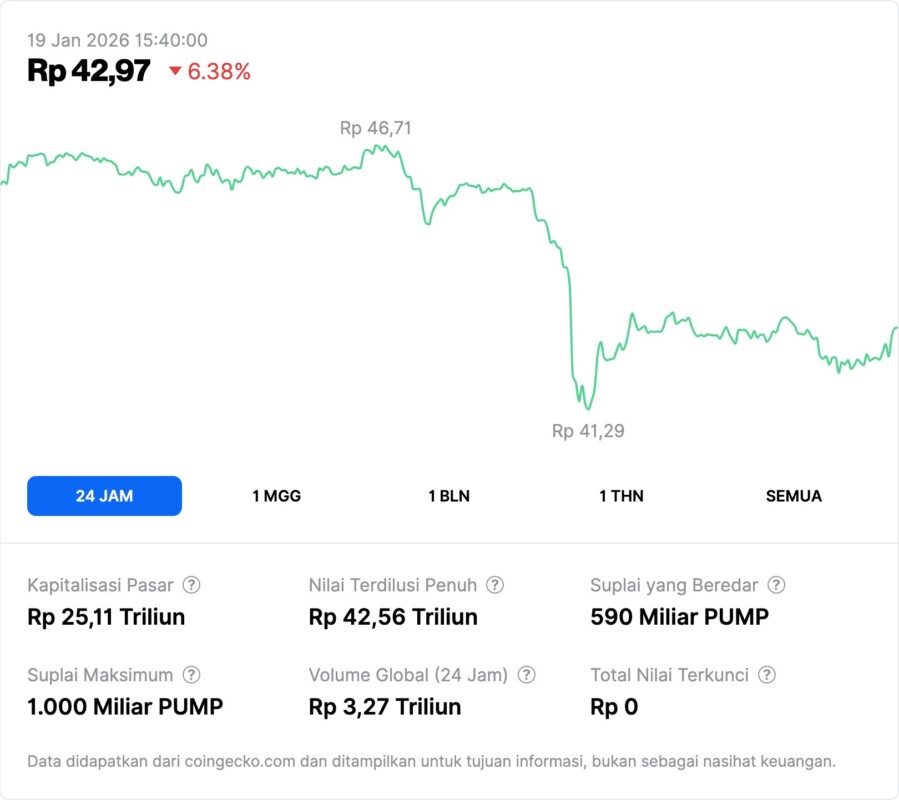

Jakarta, Pintu News – The Pump.fun (PUMP) token price had recorded a spike and signaled a breakout with an upside prospect of around 57 percent, but recent market indications suggest that momentum is starting to weaken as retail participation drops sharply and technical uncertainty increases.

1. PUMP Experiences Breakout but Momentum is Weak

PUMP noted a price movement that briefly broke out of a classic technical breakout pattern on the daily chart, opening up the prospect of significant gains. However, after the initial surge, buying momentum began to weaken due to a decline in demand from retail investors, which is usually the main driver. Technical indicators suggest that the breakout has not been fully confirmed and is prone to failure.

Although smart money – large capital from experienced entities – is still accumulating, signals from the market indicate an increased risk that the 57 percent rise will not continue. Smart money accumulation often helps to hold prices, but without fresh demand from retail, the structural trend remains vulnerable.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

2. The Role of Smart Money and Participation Change

Smart money activity was seen with the increase in PUMP holdings by large wallets in the past week. This reflects confidence from experienced investors that prices could stabilize or seek higher levels. This kind of accumulation is often a positive indicator in the medium or long term if supported by broad market demand.

But in this case, the sharp drop in the number of new addresses created suggests that retail participation is weakening. Retail participation usually helps expand the buyer base and drive market liquidity, so the lack of new addresses indicates a risk that momentum is declining.

3. Technical Risks at Resistance and Support Levels

PUMP managed to break out of the cup and saucer pattern, which is often considered a bullish pattern technically and could trigger a price increase. The initial upside target was projected to be around 57 percent of the breakout level. However, after the breakout, the price did not sustain the upside and instead showed signs of consolidation below the major resistance level.

If PUMP fails to convert the resistance into support, this positive technical pattern could be invalidated and the price could potentially drop again. Below key support levels, losses could accelerate stronger selling pressure. BeInCrypto

4. Implications on Crypto Market Sentiment

PUMP’s movements reflect the broader dynamics in the altcoin market, where strong momentum is often dependent on broad retail demand. When retail demand weakens, technical breakout patterns often fail to hold as there are not enough new buyers to sustain the price.

In the context of the crypto market as a whole, cases like this show that technical breakouts, while promising in terms of patterns, do not always lead to strong gains if fundamental support and broader market participation are not present.

5. Next Potential Scenario

If PUMP is able to hold the major support after the breakout and successfully convert the resistance level into a strong support, there is still a chance for a bigger upside potential. However, if the price drops and fails to hold the support level, the bearish scenario will take over the next direction.

Investors need to monitor volume and market activity around these important technical levels to understand whether the breakout will “stick” or end up as a false breakout which is usually followed by a price correction.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Aaryamann Shrivastava. Will PUMP Price Fail 57% Breakout, or Will Smart Money Save The Altcoin? Accessed January 23, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.