Download Pintu App

Dogecoin Price Rises to $,012 Today: What Will Happen Next?

Jakarta, Pintu News – Dogecoin (DOGE) is under pressure again as the market is sluggish today. As of January 19, the Dogecoin price has begun to slide near the important support zone of $0.1200.

Market participants are also confused, whether the DOGE price will be able to maintain the zone or will experience a further decline. Then, how will the Dogecoin price move today?

Dogecoin price rises 1.02% in 24 hours

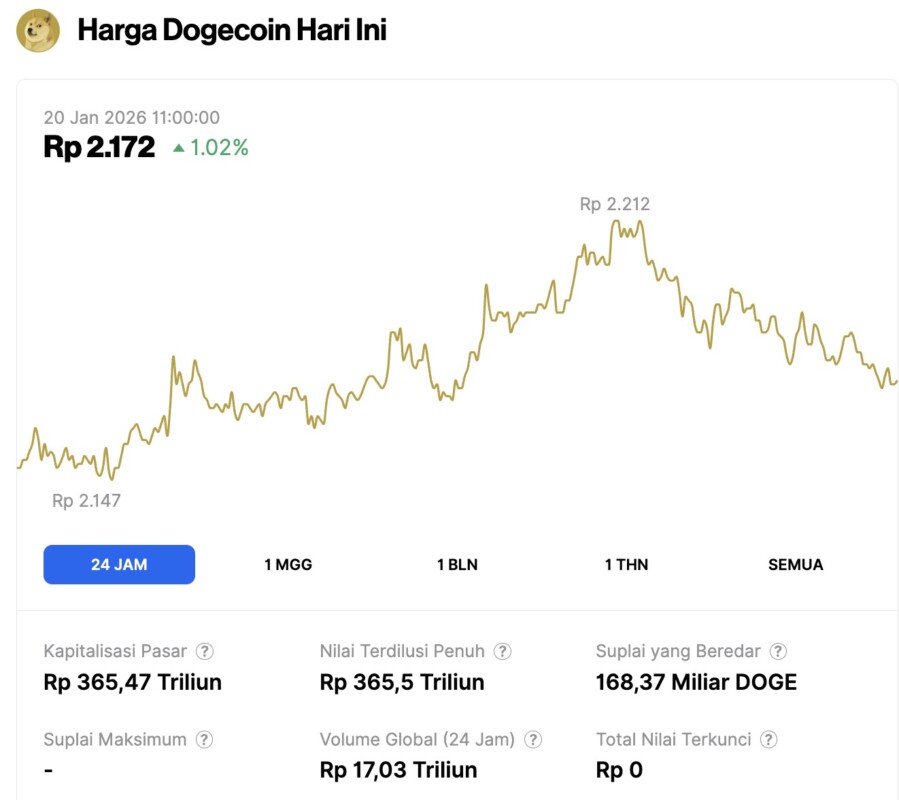

On January 20, 2026, Dogecoin saw a 1.02% gain over the past 24 hours, trading at $0.1279, or approximately IDR 2,172. During this period, DOGE fluctuated between IDR 2,147 and IDR 2,212.

At the time of writing, Dogecoin’s market capitalization is around IDR 365.47 trillion, with a 24-hour trading volume of approximately IDR 17.03 trillion.

Read also: Ethereum Holds Around $3,100 — Whale Scoops Up $33 Million in ETH Amid Price Dip!

Why Dogecoin is currently under pressure

The recent decline in Dogecoin is not something that happened out of the blue. After having previously rallied on positive sentiment from ETF-related news, buying interest slowly dissipated as fund inflows were unable to drive sustained demand. This prompted profit-taking and increased selling pressure, especially as the DOGE price approached the crucial $0.1200 zone.

On the other hand, the overall crypto market is also showing signs of indecision and is in the grip of bearish sentiment. As momentum slackened, DOGE became vulnerable to downward pressure, and sellers took control again.

Dogecoin Price Tests the Demand Zone: What Will Happen Next?

Dogecoin’s price movement is currently focused on retesting an important structure, as the impetus from the buyers’ side disappears. After weeks of forming lower and lower highs, DOGE continues to move in a clear downward channel pattern, and now faces resistance from the trendline.

This area, which is in the $0.13-$0.14 range, has resisted upside attempts several times, reinforcing the dominance of the bearish trend in the short term.

Read also: Bitcoin Holds Steady at $92,000 — Will the Bulls Break Through the Bearish Wall?

More crucially, the price of DOGE is still holding in the demand zone around $0.12, making it a decisive point for further direction. The clustered short-term moving averages indicate uncertainty, not an acceleration of the trend.

If the price of DOGE fails to hold at the $0.12 demand zone, then a potential further decline towards the $0.10-$0.11 range could occur. Conversely, if there is a bounce from this support area, then DOGE has the opportunity to retest the nearest price resistance at $0.1320, and then $0.1400 in the next few trading sessions.

Conclusion

Dogecoin is now at a crucial point where negative sentiment is colliding with a price pattern that tends to stabilize. Although the bearish structure is still dominant, the easing selling pressure and tight consolidation pattern indicate that the next move is more likely to be determined by technical structure rather than market sentiment.

For now, DOGE is worth monitoring, as the price reaction around the $0.12 level may determine the direction of future movements.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Dogecoin Price Tests $0.12 Support as Selling Pressure Mounts: What Comes Next? Accessed on January 20, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.