Download Pintu App

3 Bitcoin Scenarios 2026: Failure to Survive $100K Could Trigger a Major Crash

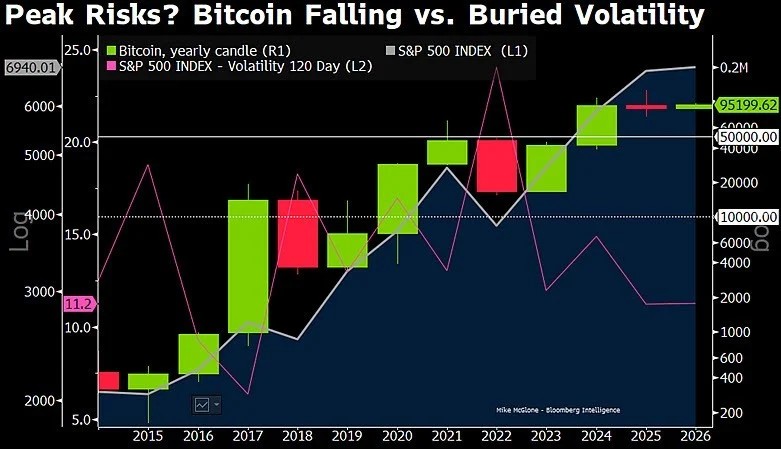

Jakarta, Pintu News – The crypto market is facing an important momentum in 2026 as Bitcoin’s (BTC) movement at the psychological price level of $100,000 is considered a critical pivot point by a number of market analysts. According to a market strategist, Bitcoin’s failure to maintain a position above $100K could be a major risk signal leading to a sharp and prolonged price drop. Understanding this scenario is important for both short- and long-term investors.

1. Bitcoin Fails to Maintain $100,000 Level Could Signal “End-Game” Risk

One market analyst warned that Bitcoin is at an important crossroads: if the price is unable to hold above $100,000 in the medium term, this could signal “end-game risk”, i.e. a phase where the momentum of the big run-up begins to weaken. This price range is often seen as a psychological threshold by market participants, and failure to stay below this mark could trigger a larger sell-off.

Such changes are often followed by a sharp drop in volatility, narrowing the price space. As bullish momentum subsides and investor demand weakens, selling pressure may increase, resulting in a sharp price reversal. Under these conditions, BTC could enter a long consolidation phase or even a significant correction in the coming time.

Technical failure to defend key levels is often taken by analysts as a sign of a changing market structure. For example, when BTC is unable to capitalize on the technical push to break and hold above $100K, it shows that demand is not supporting prices at high levels. This is a sign that the main uptrend has weakened technically.

Also Read: 7 Trump Meme Coin Facts and Impact on US Crypto Policy

2. Sharp Downside Risk to Potentially Low Levels

A more extreme scenario presented by some analysts is the possibility of Bitcoin heading for a sharp decline towards numbers well below key psychological levels. In this scenario, the price of BTC could experience a reversion to the mean, where the market returns to a historically lower price range. Even some predictions from other analysts allude to the possibility of Bitcoin falling further, even approaching figures that were once support levels before, such as $10,000.

While such predictions are not the mainstream market consensus, the existence of such comments reflects the structural uncertainty that still exists in the crypto market. As technical momentum weakens and capital flows out, selling pressure could accelerate the correction and cause a shift in sentiment from bullish to bearish.

This can create significant price turbulence in the short term. Such risks are also influenced by external factors such as market reactions to macroeconomic policies, interest rate changes, and global inflation dynamics. This kind of uncertainty has the potential to create a risk-off mode for investors, putting risky assets like Bitcoin under pressure.

3. Stability Scenario and Potential Trend Reversal

On the other hand, there is also a more moderate or bullish view that the $100K level is not a kill line if the market shows strong structural accumulation. Spot Bitcoin ETFs and institutional capital inflows could be positive drivers for BTC prices to stay afloat or even set new records.

Institutional investors, such as some companies that continue to add to BTC holdings despite volatile prices, suggest that long-term demand still exists. The location of the price near the psychological level could be an area for large buyers to enter, keeping the price stable.

This is the reason why some analysts are more optimistic despite the technical risks to watch out for. Another group of analysts also argue that as long as BTC remains in a relatively high range historically, the crypto market remains in a healthier state compared to major corrections in the past. This approach sees Bitcoin as a long-term instrument with growing adoption fundamentals even though volatility remains high.

Attention to Bitcoin Critical Levels

The prediction of what will happen if Bitcoin fails to sustain the $100,000 level by 2026 is not a definitive forecast, but rather a warning of significant technical risks. Investors should combine technical, fundamental, and macroeconomic views when formulating their investment strategies. Demand from ETFs and institutional adoption could help support prices, but market dynamics remain sensitive to selling pressure if key momentum weakens.

Also Read: 7 Facts XRP Longs Liquidated $5 Million: Analysis of Impact and Crypto Market Direction

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoin News. $10K Bitcoin Path: Strategist Warns Failure to Hold $100K Signals End-Game Risk. Accessed January 27, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.