Download Pintu App

5 Important Things about the $1.77 Level being the “Make-or-Break” for XRP Price

Jakarta, Pintu News – The latest technical study shows that Ripple (XRP) is at a crucial price level in the crypto market movement. According to analysts, the support level around $1.77 is an important point that determines whether the short-term bullish trend remains intact or slips deeper. This focus is relevant for both young and novice investors who want to understand how technical levels affect cryptocurrency price dynamics amid volatile markets.

1. What the $1.77 Level Means for XRP

The $1.77 level is seen as important support that has not been broken on XRP’s daily chart in recent weeks. The XRP price briefly dipped below $2.00 when the broader market came under pressure, but has remained above this level. As long as this level is not broken to the downside, the short-term technical bias can still be considered bullish.

Technical supports like these reflect areas where market demand is expected to be strong enough to withstand selling pressure. When these levels hold, the potential for a rebound often increases as market participants judge the price to be more attractive for purchase.

Also Read: 5 Key Facts on Silver vs Gold Supply Gap and Its Impact on Crypto & Commodity Assets

2. Recent XRP Price Dynamics

XRP is trading below the $2.00 psychological level after Bitcoin (BTC) experienced a sharp correction, which technically affected most crypto assets. Nonetheless, analysis shows that the price has not reached the key support point below $1.77, so there is still room for buyers to maintain momentum.

Indicators such as the Chaikin Money Flow (CMF) and Money Flow Index (MFI) reflect continued capital outflows, which is often a signal that price declines may still continue before positive momentum returns.

3. Technical Implications If $1.77 Breaks

If the price of XRP drops and decisively breaks below the $1.77 level, this could trigger further selling pressure as the support is considered to have failed to sustain the price. A major support break is often considered a signal that the bearish trend is getting stronger, which could attract more selling pressure in the cryptocurrency market in general.

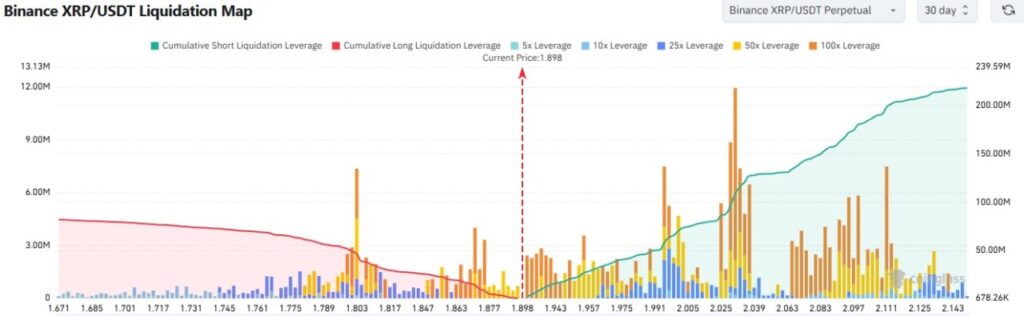

A drop below this level could also attract additional liquidity from leveraged positions, which could deepen the correction as automatic stop-losses are executed. Such conditions increase the risk for aggressive short-term trading strategies.

4. Rebound Scenario and Buyer Interest

Although selling pressure is still present, technical analysts also note the potential for a rebound if $1.77 holds. This level is an area where buyers can enter more aggressively, triggering a short squeeze and pushing the price back to the nearest resistance zone above $2.00.

Rebounds from support levels often occur when the market is filled with enough buying power to withstand selling pressure, especially if other positive fundamental news supports market sentiment.

5. Lessons for Beginner Investors

For young and novice investors, understanding support levels like $1.77 is an important part of learning basic technical analysis. These levels are not price predictions, but an indication of how market participants respond to prices at certain points.

Price interaction with support and resistance levels is a key concept in cryptocurrency trading that can help understand market direction. Applying disciplined risk management remains an important aspect if choosing to trade based on these technical levels.

Read More: Altcoin Price Spikes: A Seasonal Phenomenon Not to be Missed!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Akashnath S / AMBCrypto. XRP price prediction:Why $1.77 is the bulls’ make-or-break level. Accessed January 28, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.