Download Pintu App

5 Shocking Facts on the Fall in Crypto Sentiment as BTC Plunges 38% to US$60K!

Jakarta, Pintu News – The crypto asset market was under great pressure in early 2026. The price of Bitcoin (BTC) fell sharply from its peak and triggered the lowest market sentiment index since the great crash of 2022. This decline not only affected BTC, but also reflected widespread concerns among investors, both novice and institutional, making it important to understand the factors behind this bearish sentiment in a concise and clear manner.

1. Crypto Sentiment Lowest in Over 3 Years

Cryptocurrency market sentiment is now at an extreme level of “fear” that hasn’t been seen since mid-2022, and the index number is at its lowest point in three and a half years.

The Fear & Greed Index plummeted dramatically as a large sell-off sent Bitcoin down to around US$60,000, reflecting market panic as well as a lack of short-term buying interest. This situation resembles previous bear market bottom phases, but this time occurred when global sentiment towards risk assets also weakened significantly.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

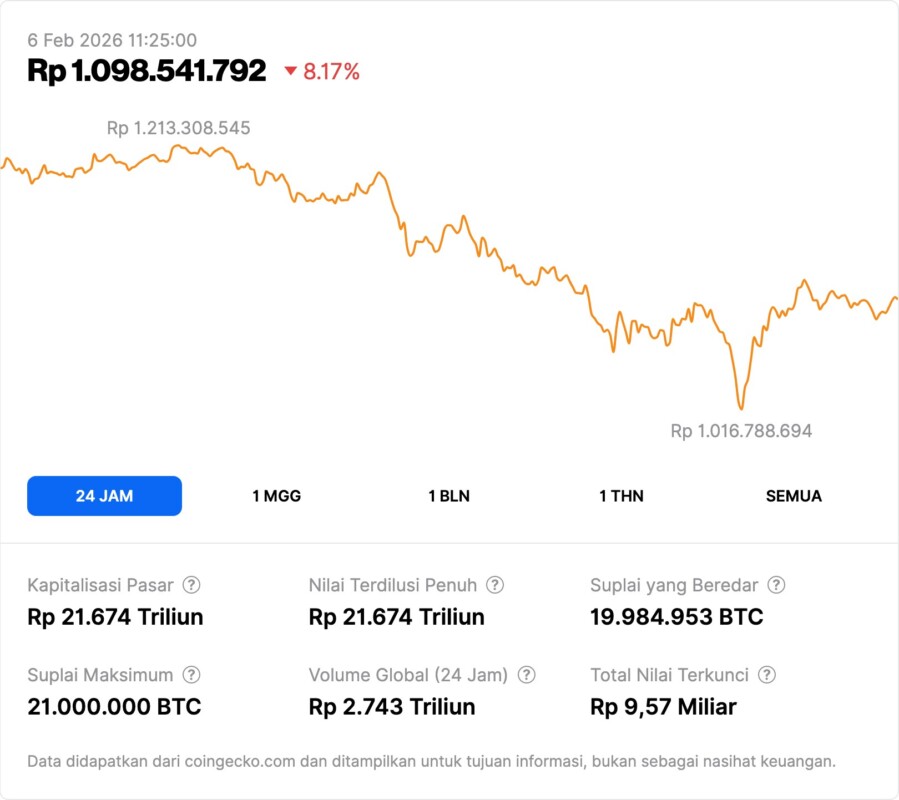

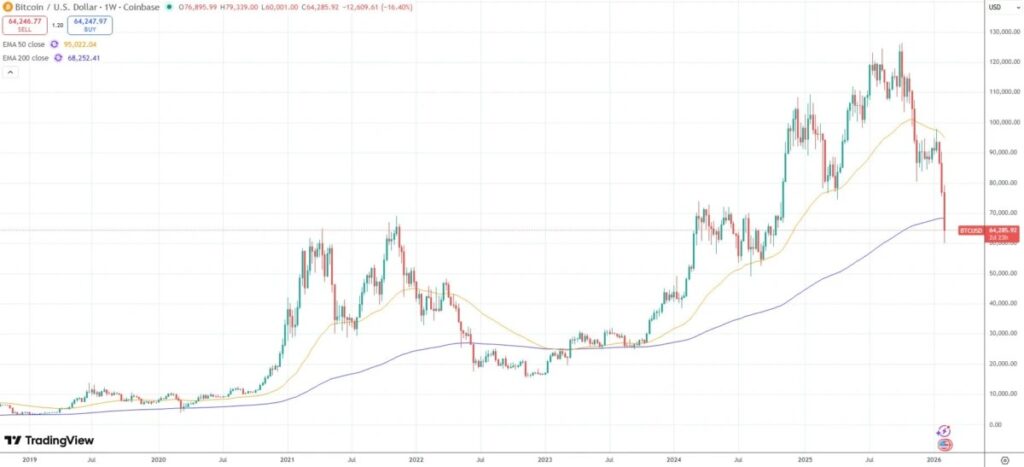

2. Bitcoin Price Drops by 38% in a Short Time

Bitcoin (BTC) lost around 38 percent of its value from its annual high in a matter of weeks, reflecting the extraordinary volatility and contributing to a decline in investor confidence across cryptos.

The drop brought the price of BTC to around US$60,000 and triggered a wave of liquidation of large leveraged positions. As a result, over a hundred thousand traders saw billions of dollars worth of liquidation in that period.

3. Mass Liquidation Worsens Investor Sentiment

The huge selling pressure on Bitcoin (BTC) led to hundreds of thousands of margin trading positions being liquidated, especially those using leverage.

More than US$2.7 billion worth of positions were erased during the period of market stress, with most of it dominated by leveraged long positions. This phenomenon shows that many investors are taking high risks in fragile market conditions.

Mass liquidations like this often have a domino effect on the entire crypto market, accelerating the price decline of other assets like Ethereum (ETH) and other altcoins.

4. Global Economic Factors Weighing on Crypto Market Pressure

The sharp correction in Bitcoin (BTC) price was partly influenced by a wave of selling in the tech stock market and broader macroeconomic concerns.

Traders attributed the crypto’s decline to expectations of an economic slowdown, the cessation of aggressive interest rate cuts, as well as decreased appetite for risky assets. The combination of macro factors exacerbated the negative sentiment in the market.

When traditional capital markets come under pressure, this usually hits riskier assets like cryptocurrencies, triggering portfolio rebalancing from large investors.

5. Downside Impact to Beginner and Institutional Investors

This decline in sentiment was not only felt by retail investors, but also by large institutions that have significant exposure to Bitcoin (BTC) and other cryptos.

Institutional investors are often regarded as a buffer of stability in the market, yet when they face liquidity pressures or overhaul risk strategies, the overall sentiment of the market becomes increasingly bearish. This decline in confidence drives capital retraction from crypto assets, reduces market liquidity, and increases anxiety among novice investors.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- TradingView/Cointelegraph. Crypto sentiment at lowest point since 2022 crash as Bitcoin tanks to 60K. Accessed February 6, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.