Download Pintu App

5 Facts about Ethereum (ETH) Experiencing the Biggest Liquidation Since 2021, Risks & Impacts

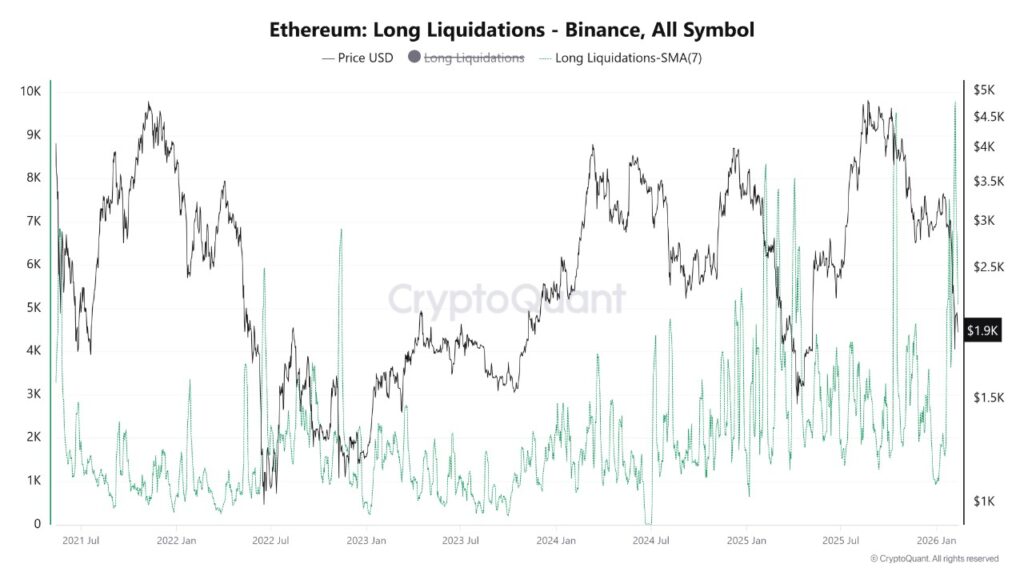

Jakarta, Pintu News – Ethereum (ETH), the second largest crypto asset after Bitcoin (BTC), has faced significant market pressure in recent weeks. On-chain data shows the Ethereum market experienced the most substantial prolonged liquidation phase since 2021, with the average liquidated long position reaching thousands of ETH during the period. This phenomenon not only reflects short-term price uncertainty but also provides an important lesson about the leverage risk and volatility of the crypto derivatives market.

1. Prolonged Liquidation at Longest Since 2021

Ethereum is experiencing what is being called the most prolonged liquidation phase since mid-2021, especially in the derivatives market. Data shows that the average liquidation of long positions on exchanges reached about 9,000 ETH over 7 days, signaling continuous selling pressure. This phase differs from a one-day sharp liquidation, as it reflects a repeated deleveraging process and weakens market sentiment.

The gradual liquidation of long positions means that many highly leveraged traders are forced to close their positions as prices move downwards. Such a situation usually occurs when the market loses bullish momentum and experiences a reversal. This narrows liquidity and triggers higher volatility in both spot and derivatives markets.

Read More: Silver Price Projections 2026 Based on J.P. Morgan Outlook

2. Ethereum Continues to Trade Below US$2,000

During this liquidation phase, Ethereum failed to reclaim the psychologically important level around US$2,000. The inability to hold above that level put additional pressure on the price and stifled bullish sentiment. Prices that stagnate or drop below key levels often trigger more liquidations due to margin calls on leveraged positions.

The price movement below US$2,000 also amplifies the risks for traders using high leverage, as any minor correction could trigger their margin debt. As ETH prices remain under pressure, some analysts think the market is searching for a new equilibrium point before a short-term direction can be determined.

3. Derivative Pressure Signals Deleveraging

This prolonged liquidation is an indication that the derivatives market is deleveraging or reducing leveraged positions. In this context, traders who previously held large long positions were forced to close when prices fell. As a result, many leveraged positions are lost from the market, which in turn may reduce volatility in the future.

The continued deleveraging removed most of the speculative excesses in the Ethereum market. This can be viewed positively in the long term as it reduces the risk of accumulating high-risk positions that could exacerbate price declines. But in the short term, the impact is often still negative price pressure until sentiment stabilizes.

4. Risk Management Lessons for Crypto Traders

This large liquidation phase is an important reminder that the use of leverage in the crypto market can accelerate losses in bearish conditions. Traders who use margin and high leverage should be aware of the risk of automatic liquidation if the market moves against them. Risk management such as setting stop-losses and being mindful of leverage levels is especially important in times of high volatility.

For both novice and experienced investors, understanding that prolonged liquidation phases can occur even in a major asset like ETH is part of a wise investment strategy. Portfolio diversification and careful exposure placement are important strategies to mitigate the impact of extreme volatility.

5. Ethereum’s Future & Recovery Prospects

While prolonged liquidation reflects market pressure, the deleveraging process may provide an opportunity for price recovery if spot demand picks up again. Ethereum price could receive support if there is a trend reversal and increased buying interest below key levels. But it all depends on global liquidity conditions, crypto market sentiment, and broader macroeconomic catalysts.

Overall, this liquidation phase shows that crypto markets remain vulnerable to price pressure and short-term volatility direction. Investors need to balance between potential gains and significant risks in a market that is still heavily influenced by leverage and macro expectations.

Also Read: 3 Scenarios of Martabe Gold Mine & Its Impact on Crypto: Price Could Reach Rp84 Million per Ounce?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Endures Historic Liquidation Week: Largest Sustained Liquidation Phase Since 2021. Accessed February 13, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.