4 Promising Layer-2 Altcoins for The Next Bull Market

Layer 2 altcoins are expected to be at the center of crypto and blockchain ecosystem development. Thanks to its scalability solutions, L2 tokens will be an attractive option in the next bull market. Is this the case? What are some interesting L2 tokens to collect? Check out the full review in the following article.

Article Summary

- ⚡ The development and high adoption rate make L2 altcoin tokens such as ARB, OP, MATIC, and IMX very promising for the next bull market.

- 🔵 With the largest TVL, Arbitrum is the market leader in the L2 sector. It has Arbitrum Orbit, a technology that enables Layer 3 creation.

- 🔴 Optimism is a tough competitor to Arbitrum. It has OP Stack technology that allows the creation of new high-quality L2s without starting from zero.

- 🟣 Polygon has EVM parallelization technology, which is expected to be one of the main narratives in 2024. This technology allows EVMs to process multiple transactions simultaneously without sacrificing speed or efficiency.

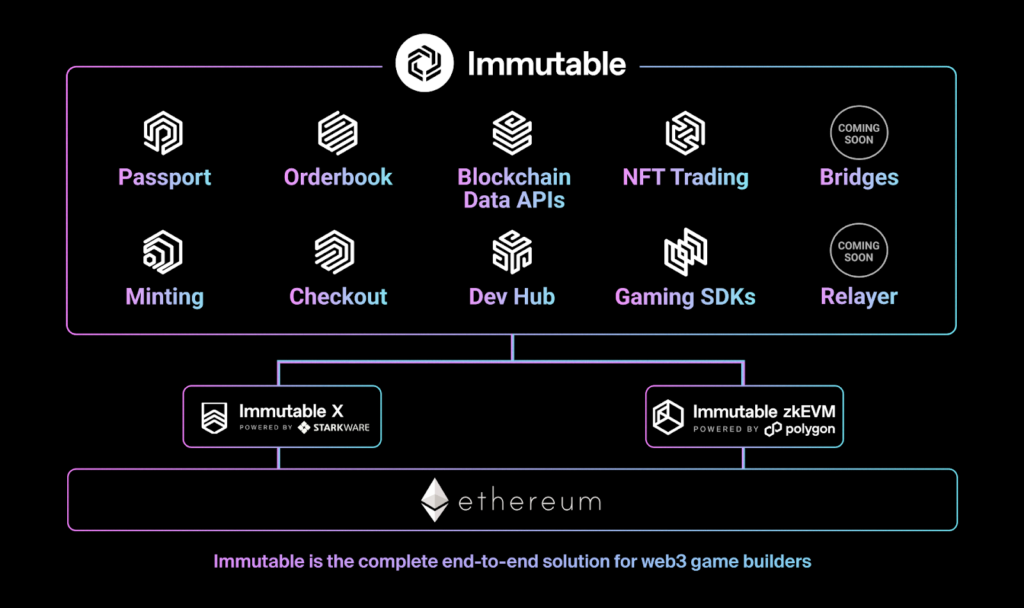

- 🟢 Immutable X is the L2 that houses many AAA games. With Immutable zkEVM, they aim to create a dedicated chain for gaming blockchains that offers EVM compatibility, low fees, scalability, and Ethereum security.

Layer 2 Altcoin Potential in the Next Bull Market

In the previous bull market, layer 1 (L1) altcoins showed off and dominated the altcoin season. However, the same thing may not happen again in the next bull market.

Thanks to technological developments, layer 2 (L2) has arrived. They had a much better scalability solution than its predecessor, L1. Inevitably, many believe that altcoins from L2 will dominate and have more promising potential in the next bull market.

Before proceeding, let's first understand the concept of L2 in the following article.

The potential for L2 altcoins in the next bull market is seen in the growing number of projects built on the L2 blockchain. In addition to a stronger dApps ecosystem and more advanced technological breakthroughs, L2 has a big role in the crypto industry.

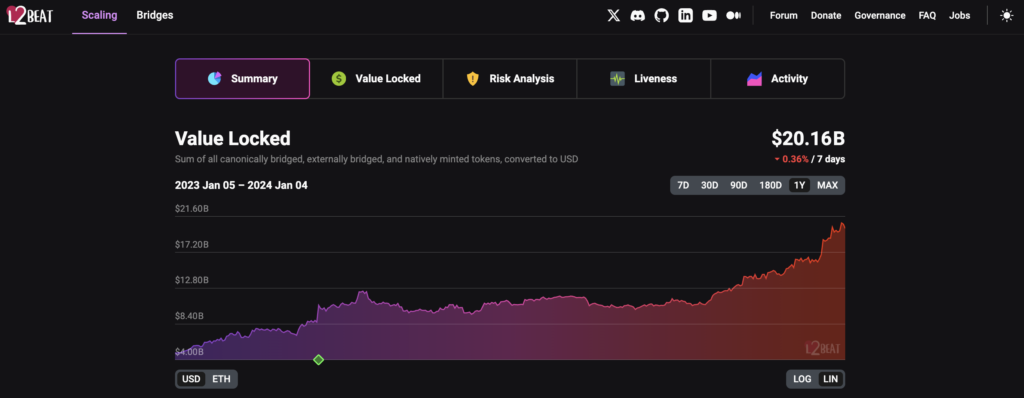

The significant growth of Total Value Locked (TVL) in the L2 sector is one of the indicators. Based on L2Beat data, the total value locked (TVL) in the L2 sector reached US$20.16 billion at the beginning of 2024. This is a significant increase from the US$4.88 billion TVL recorded at the beginning of 2023. The L2 sector has grown four times larger in just one year.

The altcoins that are the backbone of L2 growth are Arbirtum and Optimism . However, other L2 protocols, such as Polygon (MATIC) and Immutable X , are also worth noting.

1. Arbitrum

Arbitrum is a Layer 2 Ethereum blockchain that uses optimistic rollup technology. Rollup allows transactions to be processed in large numbers off-chain while maintaining the security and decentralization of Ethereum.

You can learn more about Arbitrum and its technology here. As for the development of the ecosystem, you can read about it here.

According to Arbitrum’s post on X, they have over 800 projects built in the Arbitrum ecosystem. No wonder they became the L2 with the largest TVL, US$ 3.17 billion. Arbitrum’s dominance is also reflected in its market share, which reached 58.64%.

Recent Development

GMX is the protocol with the largest TVL in the Arbitrum ecosystem. In addition, there are also Pendle, Radiant Capital, and Camelot, which are potential protocols in the Arbitrum ecosystem.

This year, Arbitrum expanded its ecosystem by launching the Arbitrum Orbit mainnet. The technology allows development teams to create their own L2 and Layer 3 (L3) on top of Arbitrum. In other words, they can create permissionless customizable chains.

Launched in March 2023, there are now 15 projects built using Orbit chains. One of them is XAI Gamings, a blockchain for L3-based decentralized gaming ecosystem. They also launched the Arbitrum Portal to make the navigation process in the Arbitrum ecosystem easier.

Arbitrum Catalysts Potential

- STIP Arbitrum. Arbitrum DAO has approved a proposal to increase the fund allocation for the Short-Term Incentive Program (STIP. They raised it from 50 million ARB to 71.4 million ARB. This move could keep Arbitrum competitive and attract both development teams and users with the incentive of earning ARBs.

- Arbitrum Orbit adoption. In 2024, the adoption of Orbit chains and L3 technology has the potential to become more massive. Moreover, Orbit has enabled gas fee payments using ERC-20 tokens, previously only ETH. This will undoubtedly make it easier and more attractive to the developer’s team.

- ARB Unlock Token. On March 16, 2024, the Arbitrum core team and early investors will do a token unlock with a total value of US$ 1.26 billion. After that, every 16th will be another token unlock for the next four years. This agenda can potentially affect the supply and price of ARB tokens.

Arbitrum Roadmap

- Launch of Arbitrum Stylus. Arbitrum Stylus, a programming ecosystem designed for the entire Arbitrum chain, is scheduled to launch in the first quarter of 2024. It supports coding in Rust, C, and C++ programming languages while remaining composable with solid smart contracts.

- Developing BOLD. Bold is a permissionless validator concept. BOLD is currently being prepared for the testnet phase. The goal is to allow users to validate Arbitrum chains that implement BOLD.

- Setting up a decentralized sequencer project with Espresso. Offchain Labs and Espresso System are working to bring Timeboost, a decentralized sequencer. The protocol supports rollups to achieve interoperability, fast finality, and decentralization without compromising scalability.

2. Optimism

Like Arbitrum, Optimism is also an L2 on Ethereum that utilizes optimistic rollup technology. After falling behind Arbitrum, they started to catch up, thanks to the Bedrock update. The update lowers transaction fees on Optimism while improving compatibility with Ethereum.

An in-depth discussion about Optimism and its technology can be read here. As for the development of the Optimism ecosystem can be read in the following article.

In 2023, Optimism launched OP Stack through Bedrock updates to continue to compete with Arbitrum. As a result, Optimism’s TVL throughout 2023 grew from US$ 540 million to US$ 950 million. In terms of market share, Optimism ranks second with 28.41% of the overall L2 sector.

Recent Development

Velodrome is a native protocol in the Optimism ecosystem that has significant potential. It managed to rank as the second-largest TVL. Velodrome is an Auto Market Maker (AMM) designed as a center for marketplace trading and liquidity on the Optimism network.

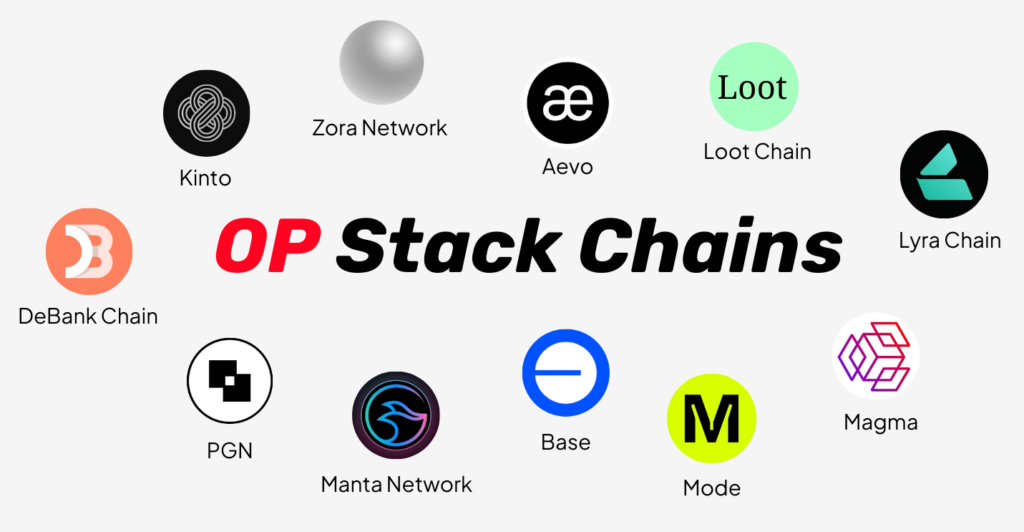

In response to Arbitrum’s launch of Orbit, Optimism also launched OP Stack. OP Stack helps the developer’s team create a new high-quality L2 without starting from 0. Currently, there are at least 14 projects built using OP Stack.

Base, Coinbase’s L2 is one of the projects that utilizes OP Stack. In addition, various new L2s such as Zora, Worldcoin, Manta Pacific, Aevo Open Mainnet, Lyra, and Andromeda also use OP Stack’s code base.

Apart from OP Stack, Optimism is still focused on developing Superchain. It aims to create an ecosystem of L2 blockchains that shares the same bridging, governance, upgrades, and communication layer built on top of the OP Stack. Furthermore, Superchain will decentralize Optimism Mainnet with various other blockchains joining the OP Chains.

Optimism Catalysts Potential

- OP Stack adoption. Base has been an OP Stack-based L2 protocol that has shown satisfying performance. In 2024, potential projects such as Manta and Andromeda will also spice up the Optimism ecosystem. The Optimism Superchain ecosystem also has the potential to grow rapidly in 2024.

- Canyon Update. This is Optimism’s first update since the Bedrock update. In the Canyon update, one of the updates is the simplification of multichain contract upgrades. Currently, all OP Chains have separate contract implementations. The update will allow superchain users to share one contract implementation tool and perform multichain protocol upgrades on a single transaction.

Optimism Roadmap

- Creating a decentralized sequencer. Unlike Arbitrum, which has partnered with Espresso to set up a decentralized sequencer, Optimism is still looking for ways to do so. Optimism still focuses on sequencer rotation, which rotates the sequencer with a particular frequency to reduce the risk of hacking and the like.

3. Polygon

Polygon’s primary L2 is Polygon PoS, a unique sidechain with a consensus mechanism that still utilizes Ethereum’s security features. However, Polygon is starting to transition to the Zero-Knowledge-based Polygon 2.0 iteration. The development team can use Polygon to create ZK rollups or off-chain technology.

Read more about Polygon's evolution here and its scalability solutions here.

Based on Polygon Labs’ posts on X, throughout 2023, they have recorded 16.5 million transactions with 390 million unique addres. In terms of TVL, Polygon tends to move in a limited range in 2023, which is US$ 800 million to US$ 1 billion.

Recent Development

Polygon’s success in 2023 came from Ethereum Virtual Machine (EVM) parallelization. It’s a technology that allows the EVM to process multiple transactions simultaneously without sacrificing speed or efficiency. The result can be seen in Polygon’s high number of inscriptions.

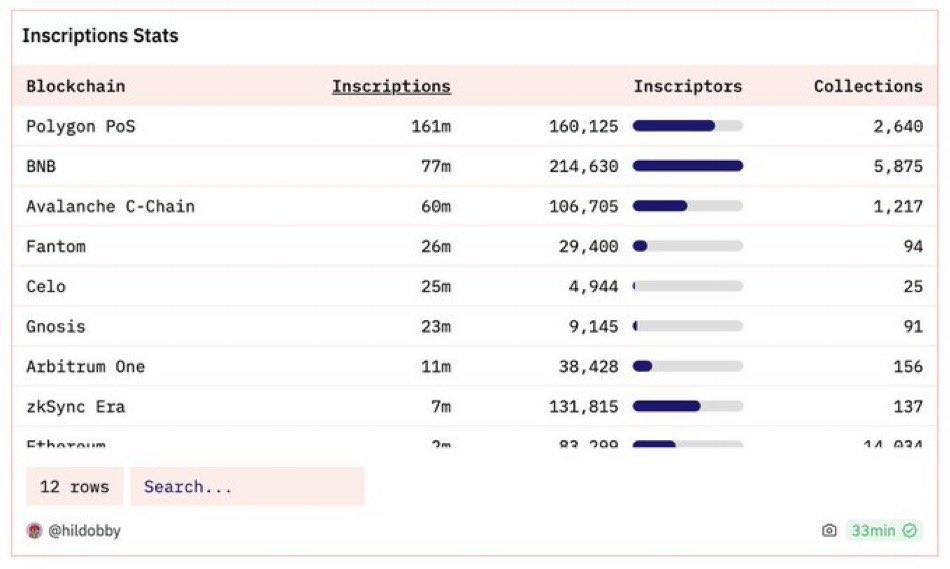

Inscriptions refer to the number of interactions between transactions and smart contracts recorded on the network. Throughout 2023, Polygon PoS recorded 161 million inscriptions, more than double of second-placed BNB at 77 million.

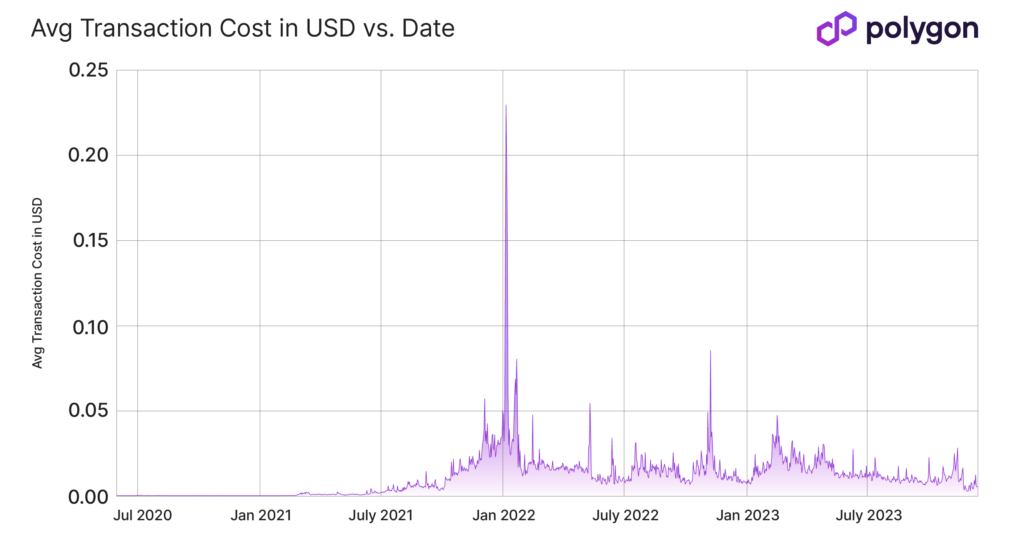

Besides dominating in inscriptions, Polygon also manages to handle high transaction volumes while keeping gas fees low. When compared to other L2s, it manages to maintain even up to 10x lower. This aspect is an important consideration for users and development teams, especially with the high gas fee conditions on the Ethereum network.

Polygon Catalysts Potential

- Polygon Miden launches. Miden is a zero-knowledge (ZK) roll-up technology for high-throughput private applications. Polygon Miden’s advantages include better privacy and security thanks to account abstraction, lower fees, and renewable transactions. It is expected to attract a lot of interest from development teams. Polygon Miden will enter the public testnet in the first quarter of 2024.

- EVM Parallelization. It is predicted to be one of the main narratives in 2024. Many EVM protocols are now working to develop EVM parallelization technology. As one of the market leaders in this sector, Polygon will undoubtedly benefit when more and more users use protocols based on EVM parallelization.

Polygon Roadmap

- Polygon 2.0 Roadmap. It’s a blueprint with a series of updates for the Polygon network. The main concept is that Polygon wants to become the value layer on the Ethereum network. Some of the updates in Polygon 2.0 are the MATIC to POL token transformation, the Polygon Chain Development Kit (CDK) launch, and the Polygon zkEVM.

- zkEVM. Currently, zkEVM is still in the beta phase. With zkEVM, development teams can port various Ethereum infrastructure tools and components to the new L2 solution without making significant code changes. Some projects created using zkEVM are Astar zkEVM, Canto, and Capx. Immutable zkEVM is also one of the chains using Polygon zkEVM for gaming applications.

4. Immutable X

Immutable X is an L2 blockchain that improves scalability on the Ethereum network using ZKrollup technology. Unlike other L2s, Immutable X is specialized for NFTs and Web3 gaming projects. Thanks to its technology, it is now one of the leading web3 gaming platform.

The following article can help you figure out how Immutable X works. As for the latest GameFi ecosystem developments, you can access it here.

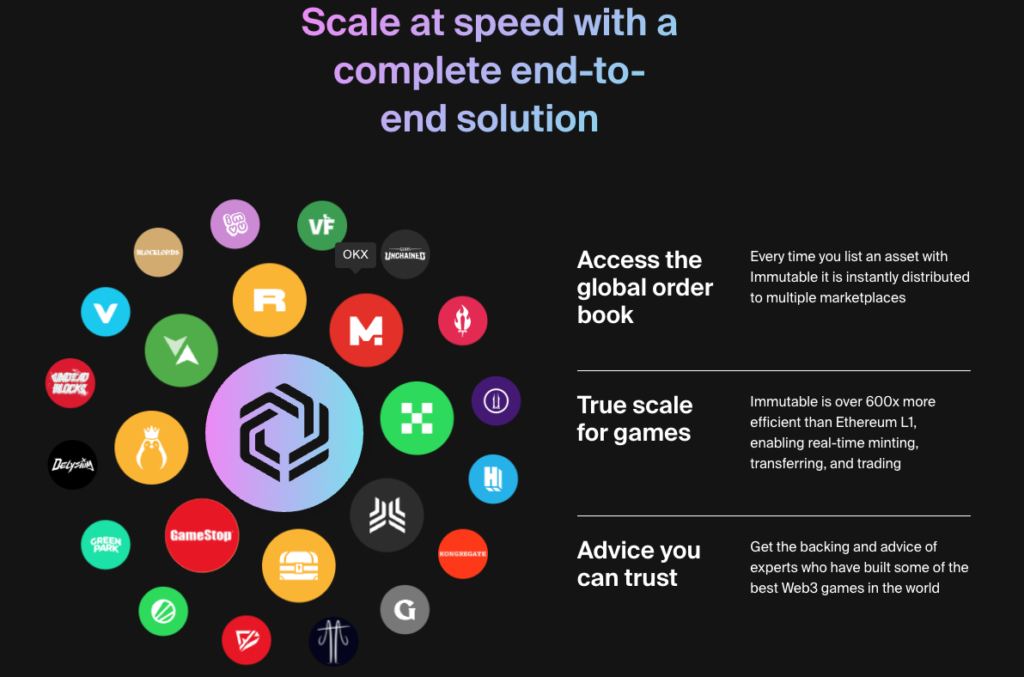

Immutable X currently has a TVL of US$ 184 million. This number has decreased, considering that at the end of last year, the amount reached US$ 268 million. In terms of ecosystem, Immutable has more than 150 games, 20 marketplaces, and ecosystem funding of US$1 billion.

Recent Development

Gods Unchained is the most attractive game in the Immutable ecosystem. It is a AAA game with a trading card concept. Based on DappRadar data, Gods Unchained has 12,26k active users with a volume of US$19.25 million in the last 30 days..

Currently, Immutable is developing various AAA games on its platform. In addition, these games will also implement a token model that cannot be easily farmed and have attractive gameplay. Some popular games on Immutable are Dark Machine, Illuvium, Gods Unchained, Guild of Guardians, etc.

Immutable is also focused on addressing the technical issues faced by Web3 gaming, which is wallet management. As a solution, they launched Immutable “Passport”. It allows users to log in to games and manage their game items. This is done simply through a single sign-on process while abstracting blockchain interactions.

Immutable X Catalysts Potential

- The Attractiveness of AAA Games. The presence of AAA games will determine the revival of the GameFi sector. These types of games can attract gamers because they prioritize gameplay rather than economic incentives to attract players.

- Partnership with Big Gaming Platforms. So far, Immutable has established partnerships with Ubisoft, Amazon Web Service, Epic Games Store, and GameStop. These partnerships can improve the quality of games on Immutable and simplify the distribution process. This could make blockchain-based games more mainstream and reach a broader market.

Immutable X Roadmap

- Immutable zkEVM. This is Immutable’s goal to deliver blockchain gaming that offers EVM compatibility, ZK technology, robust scalability, and Ethereum-style security.

- Immutable Checkout. It is an all-in-one payment solution that manages the checkout process in games and marketplaces. With Immutable Checkout, users can add funds, make instant purchases, exchange assets, and integrate various payment methods.

L2 Sector Potential

EIP-4844, or Proto-Danksharding, is a much-anticipated update to the development of the L2 sector. With EIP-4844, the transaction fees paid will be lower. Lower transaction fees will attract more developers and users to various L2 protocols.

Decentralized sequencers will be one of the focuses of L2 protocol development. So far, the majority of L2 still uses centralized sequencers, which are less efficient and expensive. There are also concerns about potential transaction censorship and security risks from centralized sequencers.

A decentralized sequencer will bring decentralization-as-a-service to the rollup. In addition to addressing censorship, it also provides cross-rollup composability that will open up new possibilities for development. Currently, Espresso, Metis, and Astria are the protocols that make up the decentralized sequencer solution.

Many developer teams are starting to look at creating protocols with specific functions. This can be done using L3 technologies such as Arbitrum Orbit or OP Stack. It can also be done by integrating EigenLayer or Celestia DA layers. The L3 ecosystem built on Arbitrum Orbit and OP Stack can create hundreds of apps with unlimited functionality.

Want to get familiar with the concept and technology of layer 3? Read the following article.

Conclusion

L2 altcoins have the potential to be one of the potential tokens in the upcoming bull market. Major L2 altcoins such as Arbitrum, Optimism, Polygon, and Immutable X have grown significantly through various innovations and ecosystem development.

Arbitrum with Arbitrum Orbit and Optimism with OP Stack have been at the forefront of ecosystem development and L2 adoption. Meanwhile, Polygon and Immutable X continue preparing their zero-knowledge technology to catch up.

On the one hand, technology updates such as EIP-4844, the focus on decentralized sequencers, and the integration of EigenLayer and Celestia are expected to further enhance the potential and functionality of L2 in the future. Making all four L2 altcoins attractive tokens to have.

How to Buy L2 Altcoin L2 on Pintu

Interested on L2 Altcoin? You can start investing in Arbitrum (ARB), Optimism (OP), Polygon (MATIC), dan Immutable X (IMX) by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for L2 token.

- Click buy and fill in the amount you want.

- Now you have L2 token!

In addition to L2 token, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Stacy Muur, The Year Ahead for Infrastructure 2024, X, accessed on 5 January 2024.

- Offchain Labs, Reflecting on 2023, Medium, accessed on 5 January 2024.

- Tenderly, 2023 EVM Network Landscape Report, accessed on 5 January 2024.

- Shivam Sharma, Ethereum’s Rollups are Centralized. A Look Into Decentralized Sequencers, Binance Research, accessed on 9 January 2024.

- Polygon Docs, Welcome to the Polygon Miden Documentation, accessed on 8 January 2024.

- Matthew Sigel, VanEck’s 15 Crypto Predictions for 2024, VanEck’s, accessed on 8 January 2024.

- Immutable, Immutable zkEVM Testnet is Finally Here: The Gold Standard of Gaming on Ethereum, accessed in 8 January 2024.

- Vitalik Buterin, Proto-Danksharding FAQ – HackMD, Ethereum.org, accessed on 9 January 2024.

- Macauley Peterson, Ethereum Improvement Proposals to watch in 2024, Blockworks, accessed on 9 January 2024

- Foresight Ventures, Layer 3 in-depth, Medium, accessed on 9 January 2024.

Share

Related Article

See Assets in This Article

0.0%

0.0%

0.0%

IMX Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-