Download Pintu App

3 Altcoins that Crypto Whale Hunted at the End of March!

Jakarta, Pintu News—In the last week of March, crypto whales’ accumulation activity increased on some specific altcoins. Litecoin (LTC), Uniswap (UNI), and Virtuals Protocol (VIRTUALS) were in the spotlight due to the increased number of large wallets involved.

This phenomenon is often considered a bullish indicator signaling growing confidence and potentially stronger price movements.

Check out the full information below!

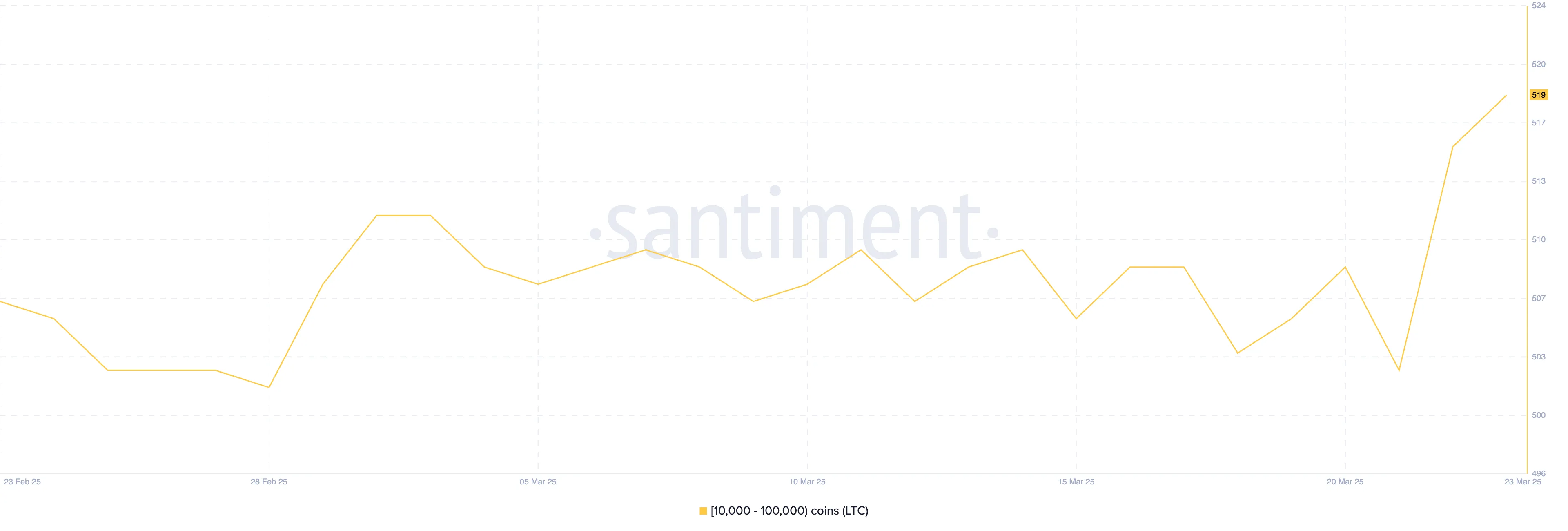

Litecoin (LTC): Increased Interest from Large Investors

In recent days, the number of whales accumulating Litecoin (LTC) has increased. The number of wallets holding between 10,000 and 100,000 LTC increased from 503 on March 21 to 519 on March 23.

This indicates a significant increase in interest from large holders. If this momentum continues, LTC prices could attempt to break through resistance levels at $97.29 and $109.

If it crosses that barrier, Litecoin (LTC) could potentially head towards the $130 price in the next few weeks. However, if momentum fails to build, LTC could return to the support level at $87, and if it continues to decline, it could reach $83.

Also read: Michael Saylor’s New Strategy: $584 Million Bitcoin Acquisition!

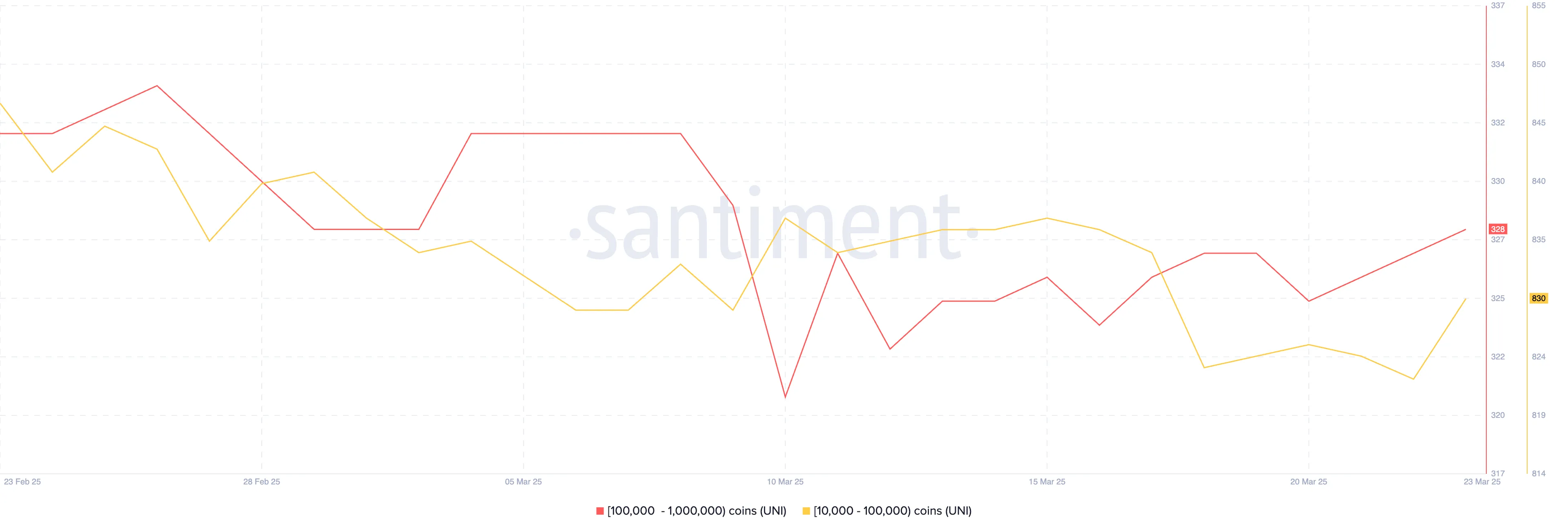

Uniswap (UNI): Return of Positive Sentiment

Uniswap (UNI) experienced mixed sentiment after the launch of the Unichain Layer 2 mainnet. However, sentiment began to improve after the community approved a $165.5 million investment in its ecosystem.

From March 20 to 23, the number of wallets holding between 10,000 and 1,000,000 UNI increased from 1,151 to 1,158. If this bullish momentum continues, Uniswap (UNI) price could try to break the resistance levels at $7.69 and $8.33.

If successful, the price could continue to rise up to $9.64. However, if the momentum weakens, UNI could return to support at $6.82, and if it continues to fall, it could reach $5.97 or even $5.50.

Read also: Polygon (MATIC) Shows Upside Potential as Network Activity Increases

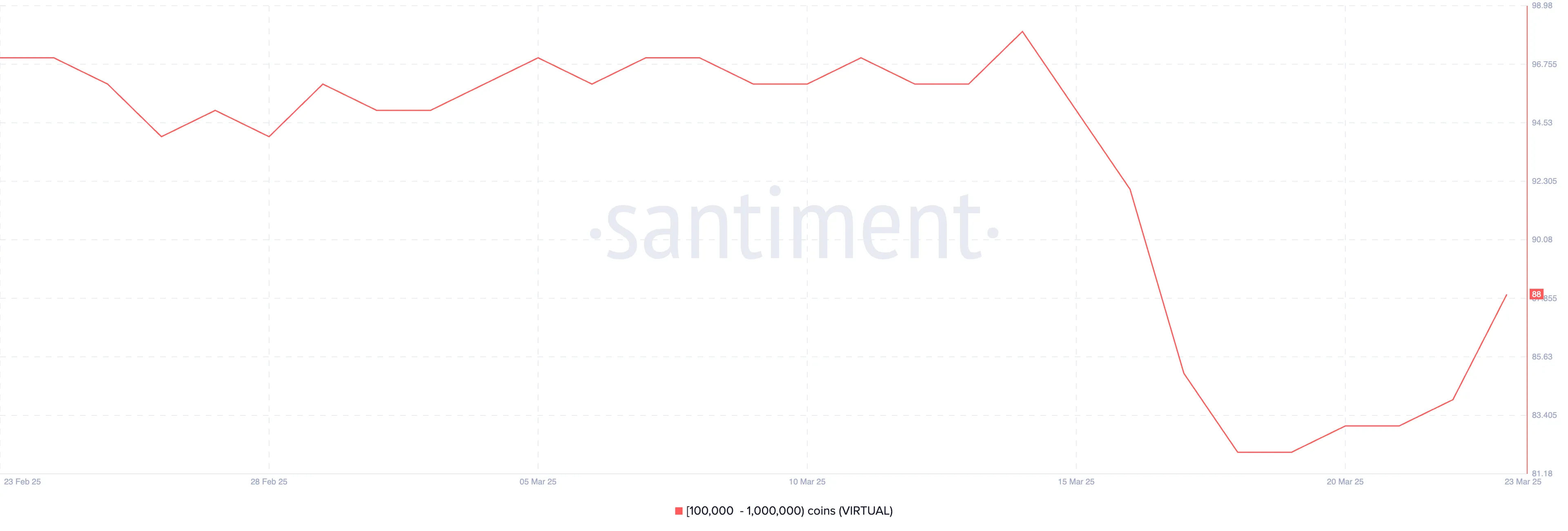

Virtuals Protocol (VIRTUALS): Hope in the AI Crypto Sector

Virtuals Protocol (VIRTUALS) has seen increased activity from whales after hitting a low in recent months. Recently, the number of addresses holding between 100,000 and 1,000,000 VIRTUALS risen from 82 to 88. This indicates a significant increase in interest.

If the AI crypto sector rebounds, VIRTUALS could benefit greatly. The token could try to break the resistance at $0.97 and, if successful, climb above $1 for further targets at $1.24 and $1.49. However, if the sector’s correction continues, VIRTUALS could return to support at $0.80, and further declines could push the price down to $0.51.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoins: Crypto Whales Buying Last Week of March. Accessed on March 27, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.