Download Pintu App

Crypto Whales Prepare to Sell — Here Are the Key HYPE Price Levels Experts Are Watching

Jakarta, Pintu News – Hyperliquid’s HYPE token fell 2% on September 16 as traders feared a potential massive $107 million sell-off by a whale.

The whale, which bought and staked 2 million HYPE nine months ago, has now started moving funds.

Whale HYPE Movement Analysis

According to data from LookOnChain, the whale initially deposited $17.4 million USDC through three wallets and bought Hyperliquid (HYPE) at an average price of $8.68 per token.

Read also: Ethereum Holds Steady at $4,500 — Is a Push Toward $6,000 Next?

After dividing the tokens into nine wallets for staking, the whale submitted an unstake request a week ago and received its tokens back on September 15.

As of September 16, HYPE was trading at around $52.6. This made the investor’s total holdings worth about $107.2 million. As such, he recorded a paper profit of almost $89.8 million, which sparked fears of a massive sell-off.

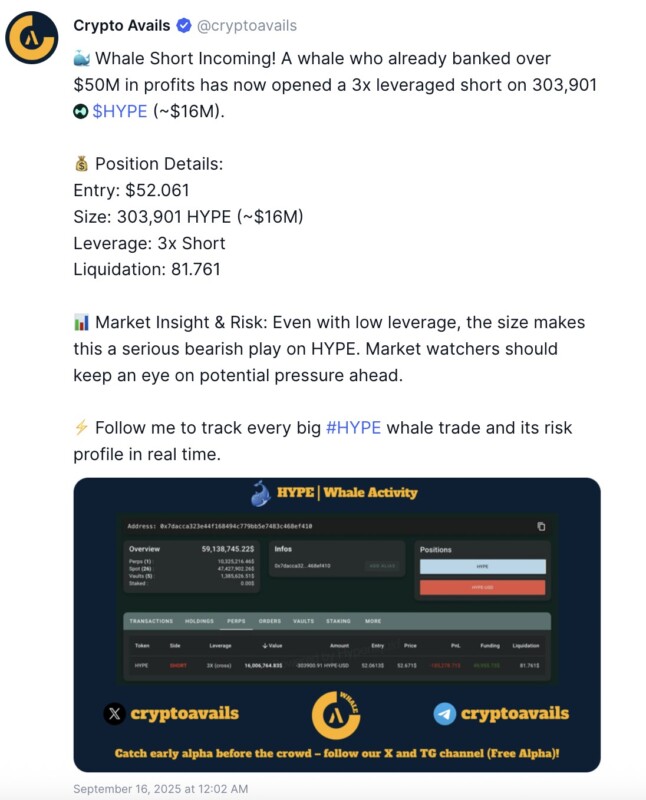

On the other hand, another large investor who had previously realized profits of more than $50 million, recently opened a 3x leveraged short position against 303,901 HYPE, or about $16 million. Analysts think this move reflects a stronger bearish sentiment in the short term.

Current HYPE Market Dynamics

Despite the pressure, HYPE’s price remains around the midpoint of the rising parallel channel pattern formed since late July. Crypto market observers say that if HYPE touches the lower limit of the channel again, the $50 and $47 levels become important support areas that can be utilized for a buy the dip strategy.

Read also: Shiba Inu Team Establishes “War Room” to Address Shibarium Exploitation

Many believe that the current price drop provides an attractive entry opportunity before the rally. This is also driven by Hyperliquid’s planned launch of the USDH stablecoin, which is expected to increase long-term confidence in HYPE’s upside potential.

On the daily chart (16/9), the RSI indicator is currently in the neutral zone, indicating a balance between buying (bulls) and selling (bears) pressure.

Meanwhile, the MACD line has started to approach the signal line, indicating a weakening bullish momentum. If a bearish crossover occurs, this will confirm a potential price drop in the short term towards the $50-$47 support zone.

However, if the MACD moves up again, HYPE prices could potentially face resistance around $55, and if it manages to break through, it is likely to continue rising towards $60, which is the upper limit of the current trend channel.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Hype Buy Zone: $107M Selloff Fears. Accessed on September 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.