Download Pintu App

Ethereum Price Prediction in November 2025: Is ETH Ready to Soar?

Jakarta, Pintu News – Ethereum (ETH) enters November with cautious optimism. Ethereum price rose 2.2% in the past week, but fell nearly 3% in 24 hours (10/30), despite a rate cut by the Fed. October closed with a weak performance, recording a monthly decline of 6.8%.

But historically, November tends to be favorable for Ethereum – with an average monthly gain of 6.93%, where last year’s surge was a major highlight.

With new on-chain trends emerging, all eyes are now on whether ETH can repeat its strong November pattern.

History Favors Ethereum, and the Incentive to Sell Begins to Fade

Ethereum’s track record in November shows bullish tendencies. Over the past eight years, ETH has averaged more than 6.9% gains, with the 47.4% rally in November 2024 being one of its best performances in history.

Read also: Ethereum Price Drops to $3,800 Today: ETH Loses $4,000 Support!

This time around, although the performance in October was quite weak, the market structure suggests the potential for a similar recovery, especially as one of the incentives to sell is starting to diminish.

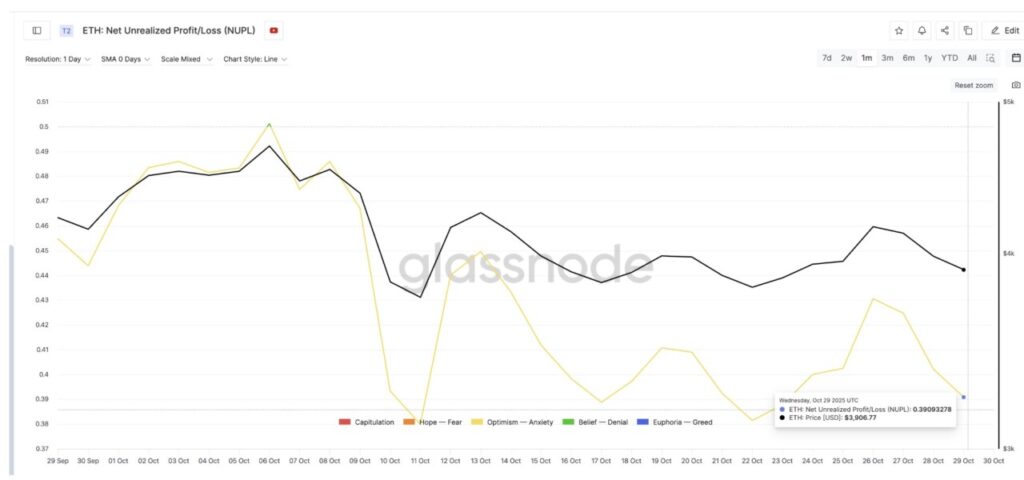

The Net Unrealized Profit/Loss (NUPL) indicator – which measures whether investors are currently in a profit or loss position – has fallen from 0.43 to 0.39 since October 26, a drop of about 9.3%. This figure is close to the monthly low of 0.38, which is the point that previously triggered a 13% rise in ETH prices (from $3,750 to $4,240).

This decline suggests that investors’ urge to sell is fading, which is often the first sign of price stabilization. If this historical pattern repeats itself, November could be the point where selling pressure turns into an accumulation phase again. In fact, some investor groups have already started accumulating.

November could be a tug-of-war between Whale and Holder

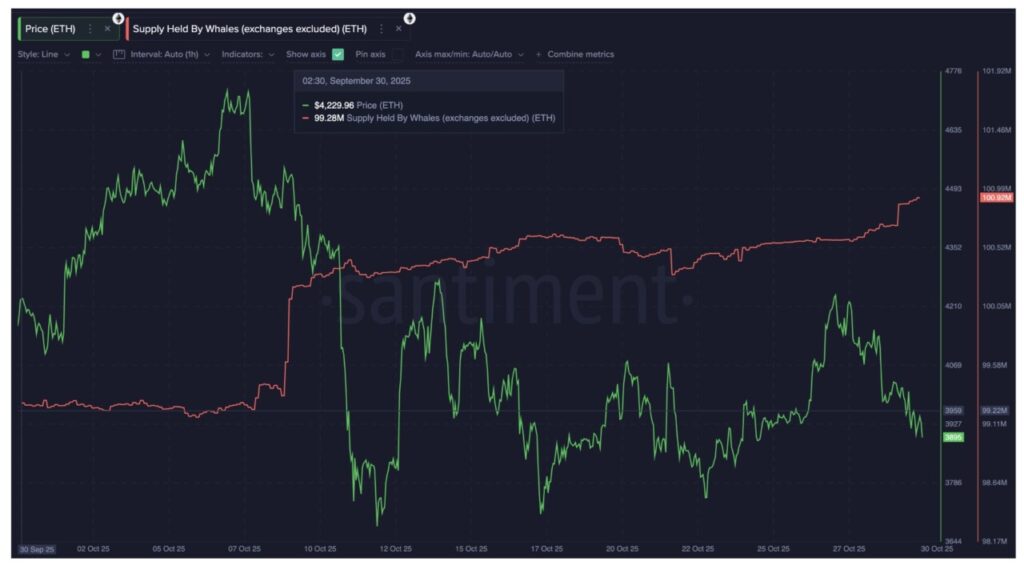

While long-term holders started to reduce their holdings, the whales quietly continued to add to their positions.

According to data from Santiment, wallets holding between 1,000 to 100,000 ETH have increased their balance from 99.28 million to 100.92 million ETH throughout the month of October – a consistent purchase despite Ethereum’s price dropping by around 7% in a month. This equates to an addition of about 1.64 million ETH, or about $6.4 billion based on current prices.

On the other hand, data from Glassnode shows a different trend. The Holder Accumulation Ratio (HAR), which measures how many addresses are increasing their holdings versus decreasing them – where higher numbers signify accumulation, while lower numbers indicate selling pressure – has actually decreased.

For Ethereum, HAR fell from 31.27% at the end of October to 30.45%, signaling that long-term holders are starting to reduce accumulation and actually reducing their exposure.

This difference suggests that demand is currently driven by whale action, while long holders are more cautious – a dynamic that could determine the direction ETH moves during November.

Read also: 3 Crypto with Strong Catalysts in November 2025 According to Analysts

Essentially, this reflects a shift in confidence levels. Whales seem to see the yield potential of Ethereum’s staking and tokenization infrastructure as a reason to continue accumulating, whereas holders are still waiting for stronger market confirmation.

If the Holder Accumulation Ratio stabilizes in November, it could be a signal that retail investor confidence is starting to catch up with whale optimism – and this could amplify the impact of this broader recalibration.

Ethereum Price Outlook and Technical Analysis for November

On the 2-day chart, Ethereum (ETH) is showing a hidden bullish divergence pattern – a condition where the price forms a higher low while the RSI indicator records a lower low.

Between August 21 and October 28, the ETH price formed a higher base, while the RSI fell, signaling that selling pressure was starting to weaken.

This pattern supports the view that the confidence of the whales could overpower the short-term weakness, strengthening the overall uptrend. Over the past three months, ETH has still recorded gains of more than 5% – supporting the uptrend. Currently, Ethereum is trading around $3,860, with resistance levels around $4,070 and $4,240.

The main support levels are currently at $3,790 and $3,510. If ETH drops below $3,510, then the bullish bias could be considered forfeited. However, the hidden divergence pattern and accumulation by whales suggest that the gradual recovery bias remains dominant until mid-November.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What to Expect from Ethereum Price in November 2025. Accessed on October 31, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.