Download Pintu App

Prediction vs Reality: Where Will the Crypto and Bitcoin Market Go by the End of 2025?

Jakarta, Pintu News – Towards the end of 2025, the crypto market was supposed to show a return to its historical strength in the fourth quarter. But in reality, the market is experiencing a deep correction, far from the optimistic predictions that were widely reported a few weeks ago.

From Eric Trump’s bold optimism to Michael Saylor and Tom Lee’s lofty year-end projections, the fourth quarter did bring surprises-though not the kind that many were expecting.

Eric Trump’s “Great Fourth Quarter” Meets Bitter Reality

At the end of September, Eric Trump predicted that the fourth quarter of 2025 would be an “extraordinary” period for the crypto market. This prediction was based on increasing money supply (M2), the resumption of quantitative easing policies, and historically favorable seasonal patterns.

Read also: BTC Dominance Collapses as Bitcoin Drops Below $90K, Analysts Beware of Further Declines?

Historically, Bitcoin (BTC) has averaged a 77% gain in the fourth quarter, while Ethereum has typically posted double-digit gains. However, the mid-quarter reality is far from these expectations.

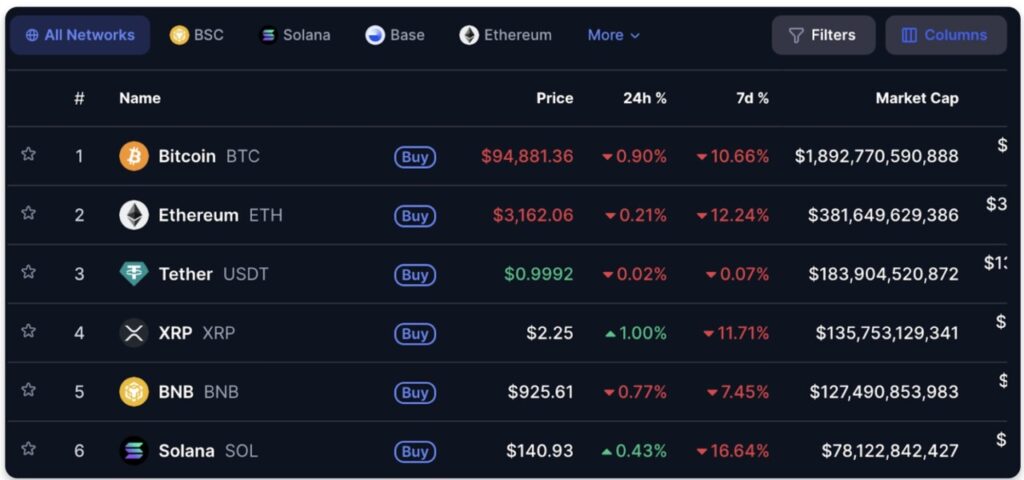

Since September 30, Bitcoin price has plummeted by 16.76%, from $114,056 down to below $93,000. Ethereum has even seen a drop of more than 23% over the same period.

Instead of experiencing a surge due to a flood of liquidity, the market is now grappling with the pressures of tight macro conditions, profit-taking at the peak of the cycle, and volatility returning.

Still, Eric Trump urged investors not to get too hung up on short-term declines, emphasizing that Bitcoin’s average annualized return is around 70%, far outpacing traditional assets. For him, corrections are a natural part of the market cycle, and the long-term outlook remains strong.

Saylor, Lee, and the Unrealized Christmas Rally

Back in September, the crypto industry went into the fourth quarter with a lot of confidence. Michael Saylor, in an interview with CNBC, mentioned that a number of equity analysts expected the price of Bitcoin to surpass $150,000 by Christmas – a potential 33% increase from the initial September price of $112,210.

Tom Lee is even more optimistic, projecting that Bitcoin price will reach $200,000 by December 25. He reasoned that Bitcoin is very responsive to interest rate cuts, coupled with the usually bullish fourth quarter trend. Similar predictions were also voiced by analysts from Canary, Steno Research, and Standard Chartered.

But in reality, those targets now seem even further out of reach. Instead of strengthening, Bitcoin has corrected 24% from its October record high of $126,000.

Cycle Peak Reached? Bearish Signals Begin to Strengthen

Today, there was a major shift in market sentiment after a statement from “Mr. Wall Street,” a well-known Bitcoin cycle analyst. He stated that Bitcoin has likely reached its cyclical peak at $126,000, and is now entering a long-term correction phase that could last for several years.

Read also: XRP is still in the red! Favorable Supply Drops to Lowest Point Since November 2024

In his chart analysis, he identified several important levels:

- Next support: $82.000 – $74.000

- Main accumulation zone: $60.000 – $54.000

- Estimated bottom time: By the fourth quarter of 2026

The price structure formed since Bitcoin lost support at the $104,000 level shows a pattern of lower highs and lower lows – typical of a downward trend. However, not all analysts agree with this pessimistic view.

Is the Rally Over? Analysts are Divided

Some on-chain analysts think that Bitcoin’s market structure has not really turned bearish.

CryptoQuant CEO Ki Young Ju highlighted that the average cost of a medium-term holder (6-12 months) currently stands at $94,635-a price that Bitcoin is currently testing. As long as the price stays above this level, according to him, the bullish market structure still holds.

Meanwhile, Michael Saylor urged investors to be patient and remain optimistic about a brighter future. Tom Lee also reiterated his long-term view in a recent post, saying:

- Since 2017, Bitcoin has experienced six crashes of more than 50% and three crashes of more than 75%.

- But for investors who are able to persevere, Bitcoin still provides a 100x return in the long run

Indeed, the Bitcoin price in the fourth quarter was far below expectations. Many optimistic predictions from prominent figures now seem to have missed the mark. Analysts are divided between two camps: those who believe that this is the beginning of a major correction, and those who believe that the bull market will continue in the long run.

Whether the fourth quarter can still be “saved” or whether it will deviate even further from the historical pattern all now depends on how the market reacts in the next few weeks. What is certain is that predictions have collided with reality-and reality seems to be writing its own script.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Bitcoin and Crypto Q4 Predictions vs Reality: Where the Market Stands Now. Accessed on November 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.