Download Pintu App

Will Crypto Surge by December 2025? Fed’s QT Termination is a Catalyst!

Jakarta, Pintu News – On December 1, 2025, the Federal Reserve (Fed) ends its Quantitative Tightening (QT) policy, freezing its balance sheet at $6.57 trillion. This move is expected to have a significant impact on the crypto market, similar to what happened in 2019.

History Repeats, New Opportunities for Crypto

The Fed’s termination of QT has caught the attention of crypto analysts, who recall a similar period in August 2019 when the same policy ended and altcoin markets bottomed out. While past performance is not always an indicator of future results, there are some indicators that support cautious optimism.

The QT halt is expected to inject up to $95 billion per month in liquidity, which will support major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and BNB. The recent rise in gold prices to record highs also provides an additional correlation, as Bitcoin (BTC) prices often follow gold price movements with an interval of about 12 weeks.

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

Market Optimism and Economic Indicators

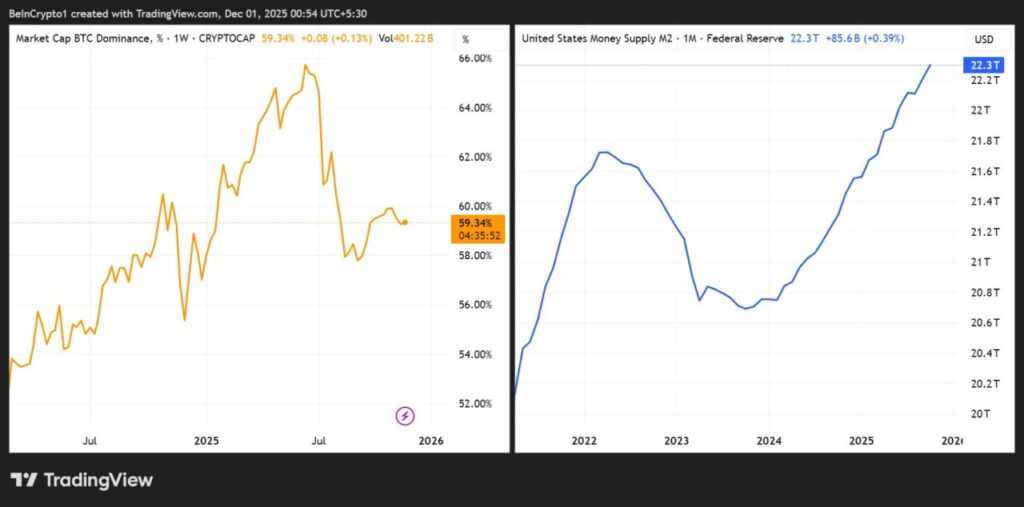

With the end of QT, the Fed emphasized that future federal funds rate adjustments will depend on incoming data and changing economic risks. Investors are advised to pay close attention to interest rate guidance, Treasury liquidity operations, and M2 money supply trends in the coming weeks. This is a critical moment that could remove one of the big headwinds for risk assets.

The consensus among market participants is that liquidity, not just Bitcoin hype or cuts, has historically driven the crypto cycle. December 1 may be an important turning point, when Fed liquidity could trigger both a mini-rally and the early stages of a broader Supercycle.

Investment Outlook and Strategy

Although the QT ends on December 1, it is important for investors to stay alert to changing market dynamics. They should consider factors such as the Fed’s next policy, global economic conditions, and their potential impact on the crypto market.

With increased liquidity, this could be an opportunity for investors to reassess their portfolios and possibly capitalize on the momentum offered by the crypto market. The crypto market may respond in different ways, ranging from rapid gains to gradual growth. Therefore, it is important to keep up with market developments and adjust investment strategies accordingly.

Conclusion

With the Fed ending QT, the crypto market may be on the verge of a new phase. While there are many factors to consider, increased liquidity could be the long-awaited catalyst. Investors and market watchers should remain vigilant and be ready to adjust their strategies according to the evolving market dynamics.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Quantitative Tightening (QT)?

A1: Quantitative Tightening (QT) is a policy undertaken by the central bank to reduce the money supply by selling its financial assets.

Q2: When will the Fed end QT?

A2: The Fed is scheduled to end QT on December 1, 2025.

Q3: What is the Fed’s balance sheet balance after QT termination?

A3: The Fed’s balance sheet will be frozen at $6.57 trillion after QT termination.

Q4: What impact will the QT halt have on the crypto market?

A4: The QT halt is expected to inject liquidity into the market, which could support the prices of big cryptos like Bitcoin (BTC), Ethereum (ETH), and others.

Q5: What factors should investors consider after QT termination?

A5: Investors should consider interest rate guidance, Treasury liquidity operations, and M2 money supply trends, as well as global market dynamics that may affect crypto markets.

Reference

- BeInCrypto. Federal Reserve Ends QT, Crypto Liquidity Shift. Accessed on December 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.