Download Pintu App

Bitcoin Climbs to $97,000 as Whales Accumulate — Is a Return to $100,000 on the Horizon?

Jakarta, Pintu News – Today, Bitcoin (BTC) surged past $97,000, as large traders returned to the spot market after weeks of ETF-fueled sell-offs. This rise reopens the door to the psychological $100,000 level and signals a change in the market movers.

Recent data from theon-chain and derivatives markets suggests that this rally has not been driven by leverage from retail traders. Instead, whales have been actively accumulating Bitcoin on the spot market, while smaller traders prefer to chase price movements through futures contracts.

This is important, as rallies led by spot buying tend to last longer than rallies that are only sustained by short-term speculation.

Bitcoin Price Up 2.18% in 24 Hours

On January 15, 2026, Bitcoin was trading at $97,060, equivalent to IDR 1,635,475,268 — a 2.18% increase over the past 24 hours. During this period, BTC reached a low of IDR 1,596,256,347 and a high of IDR 1,650,370,351.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 32,687 trillion, while 24-hour trading volume has climbed 11% to IDR 1,158 trillion.

Read also: Bitcoin Surges to 50-Day High as US-Iran War Risk Increases!

Whale Buys, While Retail Leverages

Data from CryptoQuant’s Futures Average Order Size chart shows a clear pattern. Large order sizes – usually associated with whales and institutions – have increased as Bitcoin’s price has risen from the $85,000 range to above $95,000.

At the same time, small transaction volumes surged in the futures market. This suggests that retail traders are mostly entering through leverage, rather than through direct purchases in the spot market.

This distinction is very important. At previous market peaks, retail traders usually lead the rally while whales sell. This time, however, it was the whales who bought first, and retail followed.

This kind of structure reflects the initial phase of an uptrend, rather than the final phase of a cycle that usually ends with a massive price surge(blow-off top).

Spot buyers drive recovery from $84,000 level

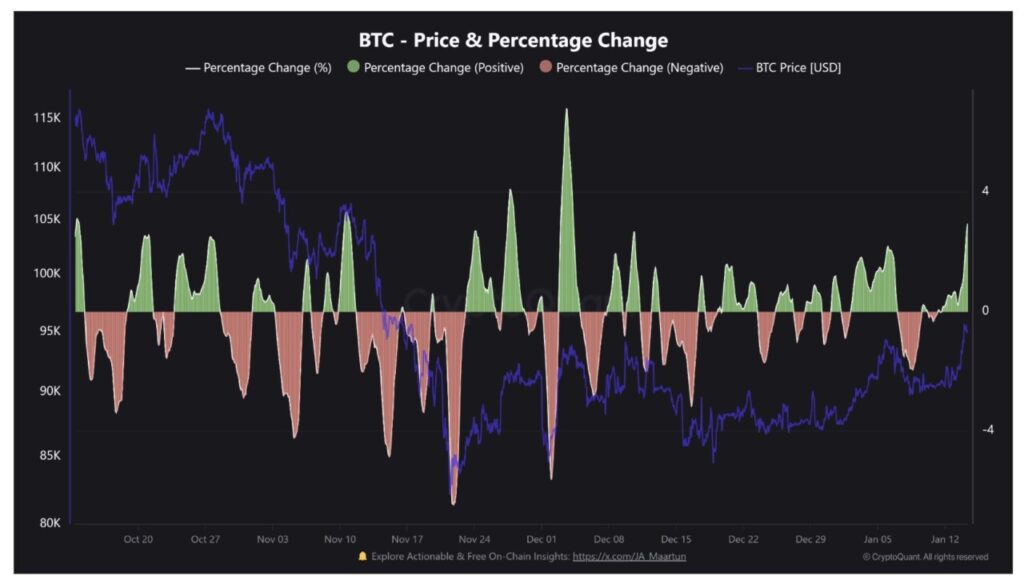

Another chart from CryptoQuant shows a change in Bitcoin’s daily movement pattern-from a sharp red spike in November to a more stable green streak in January.

This change reflects real buying pressure, not just the effects of a short squeeze. When prices rise gradually with shallow corrections, it usually signals that demand in the spot market is able to absorb selling pressure.

Bitcoin managed to bounce back from around $84,400 to break $96,000 following this pattern. The selling pressure that dominated the market in November has now subsided.

Read also: BNB Aims for $1,000 Level Amid Surge in Derivatives Activity: BNB Price Ready to Rise?

ETF Reset Opens New Paths

Earlier this month, spot Bitcoin ETFs in the US recorded outflows of more than $6 billion. These sales came from buyers who entered late after the price peak in October and ended up exiting at a loss.

However, Bitcoin price was able to hold around $86,000-an area that is in line with the average purchase price of the ETF. This level acts as a support zone. Once the redemption pressure subsided, the price began to stabilize.

This situation successfully “cleansed” theweak hands and re-positioned the market. After that, the whales started to rebuild their exposure at lower price levels.

Bitcoin Never Exits the Macro Bullish Trend

The price drop from $110,000 to $85,000 is not the end of the bull market, but rather the conclusion of the initial speculative phase.

The phase removes excess leveraged positions and forces less powerful ETF investors to exit the market. Afterward, the market enters a re-accumulation phase, where strong players start buying again as prices flatten out.

Now, Bitcoin is starting to enter another expansion phase. The price is breaking upwards and new capital is starting to flow in.

Currently, Bitcoin is holding above the $95,000-level which has been the upper limit since early December. This breakout shows that market control has returned to the hands of buyers. If the whales continue to lead the buying in the spot market and the selling pressure from ETFs remains low, the path to $100,000 opens up even more. A surge to new record highs is highly likely if demand continues to grow.

For now, the data suggests that this rally is backed by real capital, not by fragile leverage. This gives Bitcoin its strongest foundation in recent months.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Whales Return to Spot Markets as Price Nears $100,000 Again. Accessed on January 15, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.