Download Pintu App

Silver Trading Volume Reaches Nearly US$1 Billion on Hyperliquid as Bitcoin Stumbles

Jakarta, Pintu News – Trading of thesilver perpetual contract on crypto derivatives platform Hyperliquid recorded a very high volume of close to US$1 billion in the past 24 hours, indicating a change in focus of market participants amid Bitcoin’s (BTC) stagnation below key resistance levels. This phenomenon highlights how some traders are now using crypto infrastructure to express a macro view on commodities, rather than simply speculating on digital asset prices.

Hyperliquid Silver Volume Reaches Significant Levels

The SILVER-USDC contract has been one of the most active markets on Hyperliquid, trading at around US$110 per unit during the Asian session and recording a volume of around US$994 million in 24 hours based on CoinGecko data. This puts silver well ahead of many other crypto pairs such as SOL and XRP in terms of trading activity on the platform.

This high volume shows an unusual shift where commodity derivative contracts hold a large role in a venue that is generally dominated by crypto pairs. This movement also reflects the high interest in volatility and macro hedging strategies in the crypto market today.

Also Read: Gold Dominates, Bitcoin (BTC) Slumps on Yen Intervention Fears, Why?

Bitcoin Remains Under Consolidation Pressure

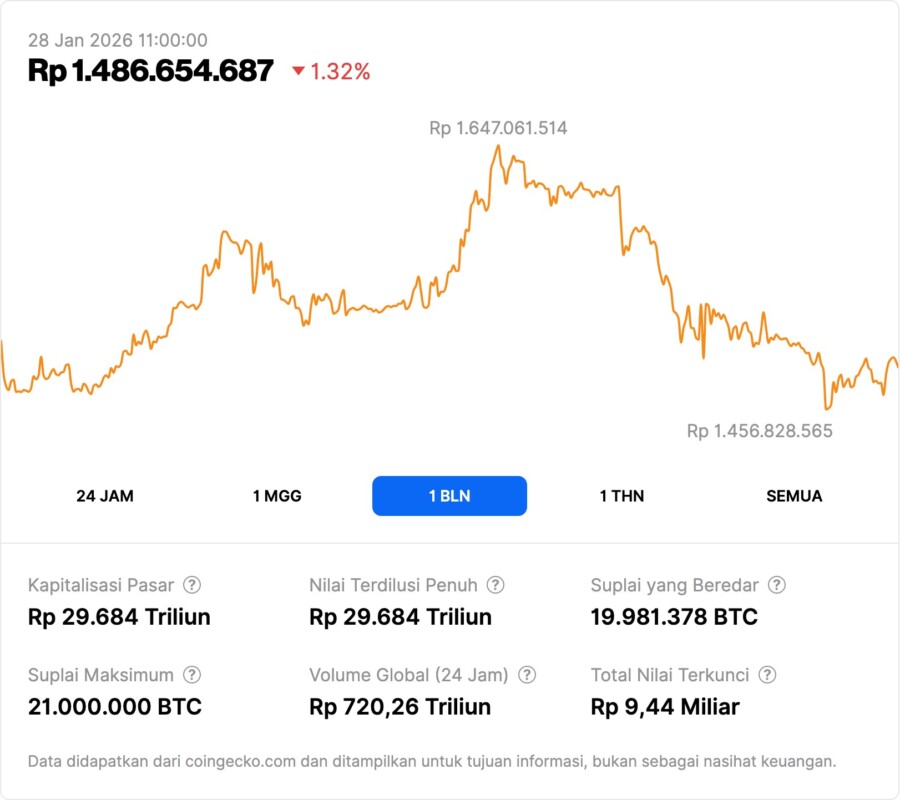

Meanwhile, Bitcoin is still stuck in a consolidation phase around US$88,000, with ETF inflows weakening and leverage interest falling. On-chain data suggests that BTC’s bullish momentum has yet to significantly return, so investors are cautious about taking large positions in the major cryptocurrency.

This explains why assets like silver attract high volumes on crypto derivatives platforms; market participants seem to be looking for different ways to express views on macro risks that are not fully reflected through BTC price movements.

What High Silver Volume Means for the Market

The large volume of silver trading on Hyperliquid indicates that markets are experimenting with new approaches to assessing volatility and economic uncertainty. Instead of simply making price direction bets on Bitcoin and Ether (ETH), market participants are now exploring commodity derivatives to gain exposure to macro risks.

This phenomenon also signals that crypto infrastructure can serve as a macro trading channel, not just a place to trade digital asset prices. As market volatility increases, derivative products like SILVER-USDC allow traders to place positions based on short-term risk expectations.

Implications for Crypto and Commodity Investors

For crypto investors, this dynamic demonstrates the importance of understanding that crypto markets are now influenced not only by the price of BTC or ETH, but also by how commodities and macro hedges are traded within the digital ecosystem. Hyperliquid silver trading can be a barometer of global macro sentiment, especially in the context of broader market volatility.

Meanwhile, these developments also signal that interest in traditional hedges such as gold and silver could reflect market concerns that are not yet fully reflected in crypto asset prices. Long-term investors need to consider these factors when evaluating their asset allocation strategies, both in crypto and in commodities.

Also Read: Ripple (XRP) Drastic Decline: Analysis and Outlook in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Silver Nears $1B in Volume on Hyperliquid as Bitcoin Remains Frozen:Asia Morning Briefing. Accessed January 28, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.