Download Pintu App

XRP Prediction in 2030: Potential to Break $20?

Jakarta, Pintu News – The crypto market is back in a pressure phase after a series of price corrections that occurred in recent months. The latest drop sparked widespread concern, especially among retail investors who entered at a high price phase.

However, in the history of cryptocurrencies, correction phases are often seen as strategic moments to build long-term positions. In this context, Ripple’s (XRP) price drop has reignited the narrative of entry opportunities that some analysts find attractive.

From Euphoria to Correction: XRP’s Price Journey

Ripple (XRP) had recorded a huge rally from late 2024 to mid-2025, with prices jumping from below USD 1 or around IDR 16,797 to an all-time record high of USD 3.65 or around IDR 61,309 in August 2025. This surge was widely attributed to improving market sentiment following the settlement of a legal case between Ripple and US regulators.

The regulatory clarity boosted investor confidence and reopened institutional access to these assets. However, the rally was short-lived as the crypto market entered a massive liquidation phase in October.

The liquidation event has been called one of the largest in the history of cryptocurrencies, suppressing almost all major assets. XRP was dragged down and has yet to build consistent recovery momentum.

Since then, the market has been on the defensive, with risk appetite weakening. This has left the price of XRP well below its peak, creating a sharp contrast between the previous euphoria and the current sentiment.

Read also: Bitcoin Enters February: What are the Chances of a Rebound Based on History?

Fundamentals Persist Amid Market Pressure

Although the price is under pressure, the long-term outlook for XRP is not completely bleak. One of the main factors often cited is the launch of a number of XRP-based spot ETF products at the end of last year.

The presence of this instrument has the potential to open up greater institutional capital flows, especially from investors who were previously hampered by regulatory aspects. In addition, mainstream media exposure has also increased, with a CNBC report earlier this year naming XRP as one of the hottest crypto deals in 2026.

On the other hand, bearish market conditions keep short-term sentiment fragile. Macro pressures, liquidity fluctuations, and the dominance of Bitcoin (BTC) in determining the direction of the global crypto market also limit XRP’s room for maneuver.

However, some analysts believe that this consolidation phase forms the foundation for the next cycle. In this perspective, low prices do not necessarily reflect weakening fundamentals, but rather a temporary adjustment to broader market conditions.

Read also: Crypto Market Crucial Week: Rise from Correction or Fall Deeper?

Long-term Projection: $20 by 2030?

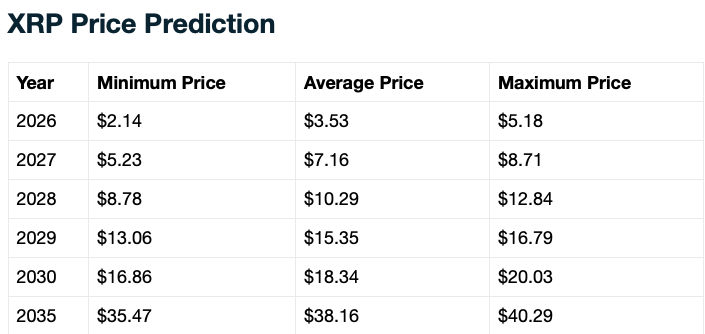

Reporting from Watcher Guru, analysts from Telegaon expressed a relatively optimistic view of XRP’s prospects. The platform estimates that XRP could set a new price record around USD 5.18 or equivalent to IDR 86,975 within this year.

The projections are based on the assumption of a gradual recovery of the crypto market and increasing institutional adoption. In the long term, Telegaon even predicts the price of XRP to potentially break USD 20 or around IDR 335,940 by 2030.

If that scenario is achieved, the increase from the current price level will exceed 1,000 percent. Mathematically speaking, investments in the low-price phase have the potential to generate returns of more than 10 times.

However, these projections remain dependent on many variables, including global macro conditions, regulatory dynamics, as well as Ripple’s ability to expand its network utility. With the high volatility inherent to cryptocurrencies, the opportunity for huge gains always goes hand-in-hand with significant risks.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- WatcherGuru. Is XRP’s Crash The Perfect Entry? Prices May Hit $20 By 2030. Accessed February 8, 2026.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.