Market Analysis Oct 7th, 2024: Bitcoin Market Stabilizes Above $60,000 Following Satoshi Nakamoto’s Unmasking

As we enter the first week of October, crypto investors and traders are divided in their outlook. One group is optimistic about “Uptober,” predicting a bullish trend, while the other foresees “Octobear,” expecting a bearish market. Check out the analysis below to see where Bitcoin might be headed.

Market Analysis Summary

- 📝 BTC is currently trading within a descending channel, finding support at the $60,000 level, which aligns with the daily 0.5 Fibonacci retracement line.

- 📈 The core PCE inflation rate, which excludes food and energy, stands at 2.7%, both the monthly PCE and core indexes rose by only 0.1%, below the expected 0.2%.

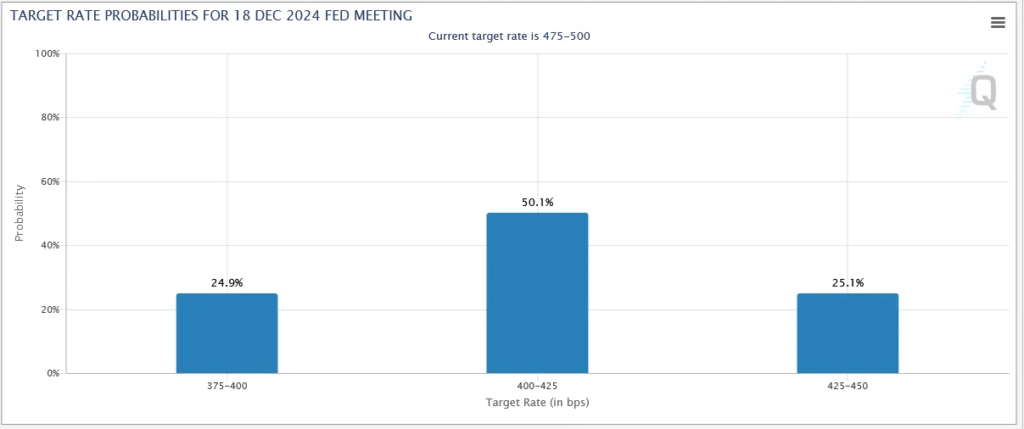

- 🟢 Market now assigns a 50% probability that the Fed will cut rates by a total of 75 basis points by year-end.

- 💼 JOLTs Job Opening: An estimated 8.04 million job openings were reported in August, up from an upwardly revised 7.71 million in July.

Macroeconomic Analysis

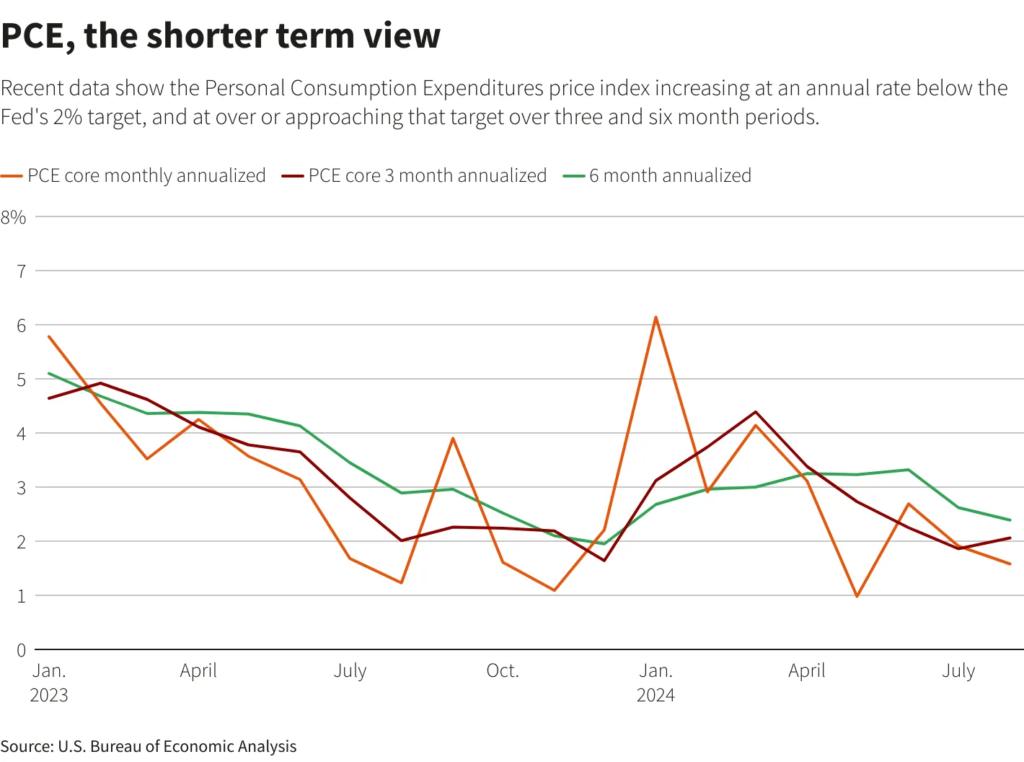

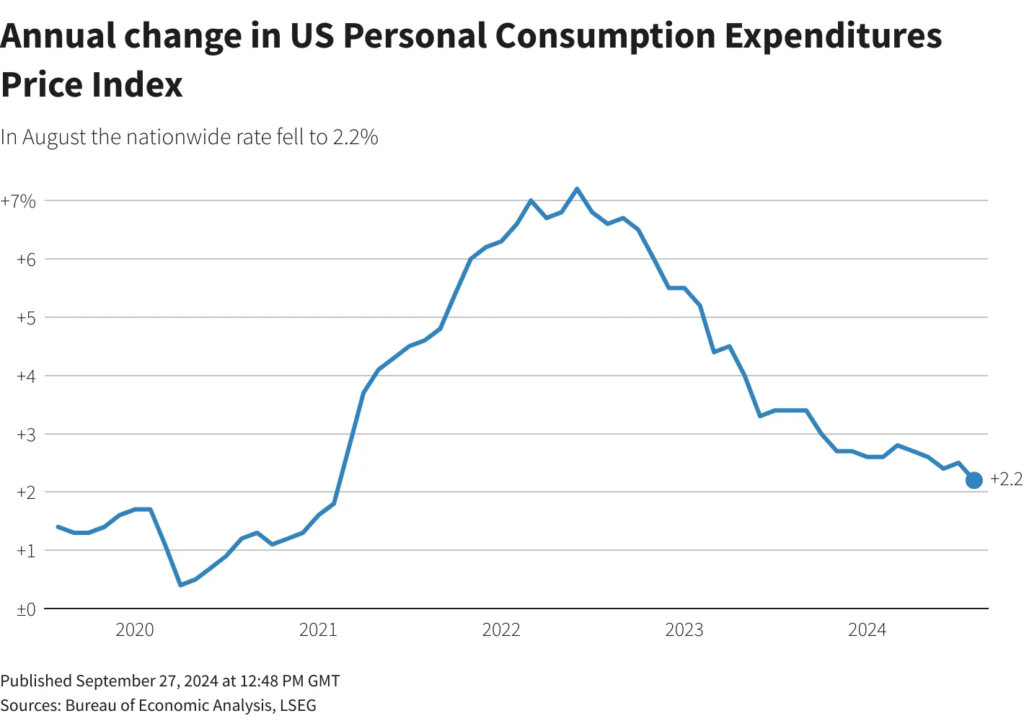

Core PCE Price

The Fed received encouraging news from the PCE price index. The Fed’s preferred inflation gauge dropped to 2.2% year-over-year, the lowest since February 2021. This brings the Fed’s 2% inflation target for PCE within reach, potentially as soon as the end of the year. However, the core PCE inflation rate, which excludes food and energy, stands at 2.7%, indicating that more progress is needed on the inflation front. Despite this, the data was favorable for the market: both the monthly PCE and core indexes rose by only 0.1%, below the expected 0.2%. Over the past four months, the monthly core PCE price index has been increasing at an annual rate of 1.5%.

While it’s too soon for the Fed to declare victory over inflation, the recent PCE data and other inflation trends should give them confidence to continue lowering rates. Moreover, if the labor market continues to weaken, they might cut rates more aggressively than they or the market currently anticipate. As we mention below, the market now assigns a 50% probability that the Fed will cut rates by a total of 75 basis points by year-end. Additionally, there is an equal 25% chance that they will cut rates by either 100 basis points or 50 basis points.

Other Economic Indicators

- Personal Spending: Consumer spending increased by 0.2% last month after an unchanged 0.5% gain in July, according to the Commerce Department’s Bureau of Economic Analysis. Economists had expected consumer spending to rise by 0.3%. The spending increase was concentrated in services, which grew by 0.4% following a 0.3% advance in July. Top contributors included expenditures on housing and utilities, as well as financial services and insurance.

- Personal Income: Personal income rose by 0.2% in August amid decreases in personal interest and dividend income. Wages and salaries increased by 0.5% after a 0.3% rise in July. The saving rate slipped to a still-lofty 4.8% from an upwardly revised 4.9% in July; it was previously reported at 2.9%. The higher saving rate bodes well for future consumer spending.

- Goods Trade Balance: After reaching its highest level in over two years in July, the U.S. trade deficit in goods narrowed by 8.3% to $94.3 billion in August, according to the Commerce Department’s advanced estimate released on Friday. This represents the smallest trade gap since March. Economists had expected the deficit to decrease to $100 billion from July’s $102.7 billion gap.

- Michigan Consumer Sentiment : Consumers are feeling increasingly optimistic as inflation continues to ease, leading to a rise in consumer sentiment in September. The Michigan Consumer Sentiment Index concluded September at 70.1, surpassing both its earlier preliminary result and the 69.3 forecasted by economists.

- S&P Manufacturing PMI: The U.S. Manufacturing PMI decreased to 47.3 in September from 47.9 in August but still surpassed the consensus estimate of 47.0, S&P Global reported on Tuesday. With the index moving further below the 50 threshold, the manufacturing sector slipped deeper into contraction territory, as both output and new orders declined at a faster pace last month.

- ISM Manufacturing PMI: The Institute for Supply Management (ISM) has released its latest Manufacturing Purchasing Managers Index (PMI) report for the month, revealing an actual figure of 47.2. Based on data compiled from over 400 industrial companies, this figure is identical to the previous month’s number but falls short of the forecasted 47.6. Analysts had anticipated a slight uptick in the PMI, reflecting a more optimistic outlook for the manufacturing sector.

- JOLTs Job Opening: An estimated 8.04 million job openings were reported in August, up from an upwardly revised 7.71 million in July, according to new data released Wednesday by the Bureau of Labor Statistics. This latest figure equates to 1.1 available jobs for every person seeking employment, according to BLS data.

- ADP Employment Change: Private sector hiring increased in September, indicating that the labor market is maintaining its strength despite some signs of weakness, payroll processing firm ADP reported on Wednesday. Companies added 143,000 jobs for the month, an improvement from the upwardly revised 103,000 in August and surpassing the consensus forecast of 128,000 jobs from economists.

BTC Price Analysis

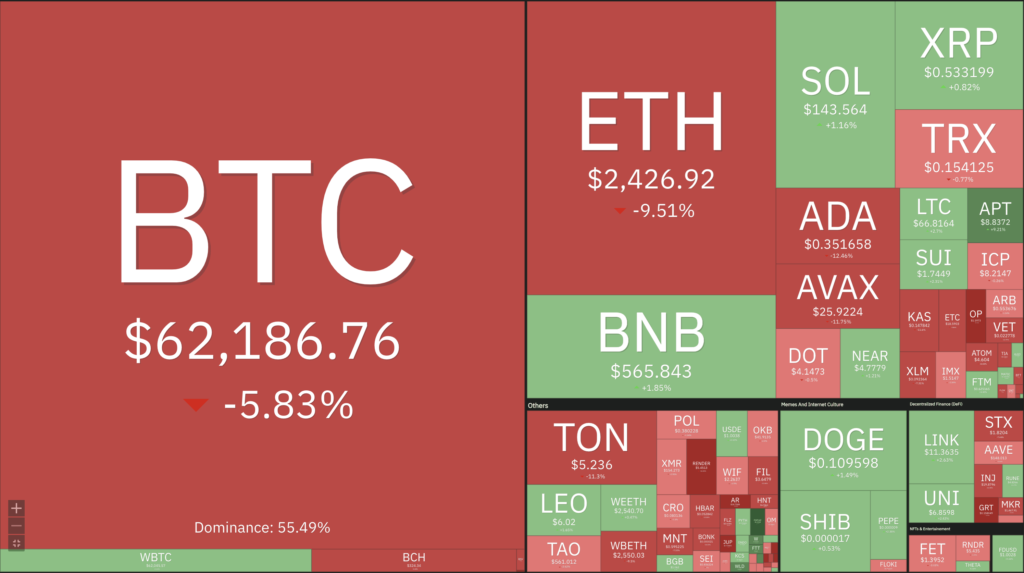

Despite ongoing geopolitical tensions, BTC has held steady above $60,000, while ETH experienced a 4% drop to $2,300. The cryptocurrency market is still grappling with the aftermath of Iranian airstrikes on Israel, which has dampened investor enthusiasm for risk assets.

BTC is currently trading within a descending channel, finding support at the $60,000 level, which aligns with the daily 0.5 Fibonacci retracement line. A break below $60,000 could lead to further price declines, with initial support at $57,500 and additional support at $54,000. Resistance levels are positioned at $63,000 and $64,000.

Amid the overall market downturn, significant accumulation of BTC by large investors, known as “whales,” suggests anticipation of a future bull run. Entities are making sizable purchases despite the challenging macroeconomic environment.

The broader crypto market declined by over 3% as investors continued to sell off major cryptocurrencies. Bitcoin ETFs saw outflows totaling $91.76 million during Wednesday’s U.S. trading session. In contrast, Ethereum ETFs defied the trend with inflows of $14.45 million, ending a two-day streak of outflows.

XRP faced a substantial setback, plunging more than 10% in the past 24 hours following the SEC’s decision to appeal a court ruling that had limited its ability to regulate crypto markets. The SEC plans to ask the 2nd U.S. Circuit Court of Appeals to review the July 2023 decision, which determined that XRP tokens sold on public exchanges do not meet the legal definition of a security.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- TON Memelandia: A Decentralized Utopia for Memecoin Communities. TON Memelandia, an initiative created by the TON community and supported by the TON Foundation and TON Society, is a decentralized world where memecoin communities can thrive, compete, and create. With the backing of the TON ecosystem and its integration with Telegram’s large audience, Memelandia offers a unique space for memecoins to grow. This was exemplified by the success of $DOGS, which broke blockchain records in August 2024. Through events, rewards, and collaborative initiatives, Memelandia aims to establish itself as a major hub for memecoins in the crypto ecosystem, while driving trading growth and increasing global exposure for these tokens.

News from the Crypto World in the Past Week

- HBO Documentary Claims to Reveal the Identity of Bitcoin’s Creator. An upcoming HBO documentary titled “Money Electric: The Bitcoin Mystery” is stirring speculation within the crypto community regarding the identity of Bitcoin’s creator, Satoshi Nakamoto, who has remained anonymous to this day. Directed by Cullen Hoback and executive produced by Adam McKay, the film delves into the controversial question of who really invented Bitcoin and the significant impact of their work on the global economy. The trailer features an interview with Adam Back, who has been suspected of being Satoshi, though he has denied the claim. Other speculation points to Len Sassaman, an American cryptographer who passed away in 2011, as a possible candidate for Satoshi.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Popcat (POPCAT) +29,53%

- MANTRA +10,25%

- Aptos +9,91%

- Wormhole (W) +8,93%

Cryptocurrencies With the Worst Performance

- Notcoin (NOT) -24,25%

- Ethena (ENA) -22,83%

- FLOKI -21,07%

- Lido DAO -20,36%

References

- TON Society, Exploring TON Memelandia: A New World for Memecoins to Reign, ton.org, accessed on 6 October 2024.

- Sander Lutz, Satoshi Nakamoto Unmasked? New Documentary Claims to Reveal ‘Bitcoin Mystery’, decrypt, accessed on 6 October 2024.

Share

Related Article

See Assets in This Article

1.1%

0.0%

0.0%

0.0%

0.0%

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-