10x Research: Only 44% of Bitcoin ETF Investments in the U.S. Are Used for the Long-Term

Jakarta, Pintu News – Investment in Bitcoin (BTC) exchange-traded funds (ETFs) in the United States has seen a huge surge since the product’s launch in January 2024.

Although a large amount of funds have been flowing in, only a small portion has actually been used for long-term investment.

A large part of this fund flow is apparently being used for arbitrage strategies that exploit the price difference between the Bitcoin spot and futures markets.

This suggests that investor interest in Bitcoin (BTC) as a long-term asset may not be as great as often heralded by the media.

Check out the full news below!

Bitcoin ETF Fund Flows: Mostly for Arbitrage, Not Long-Term Investment

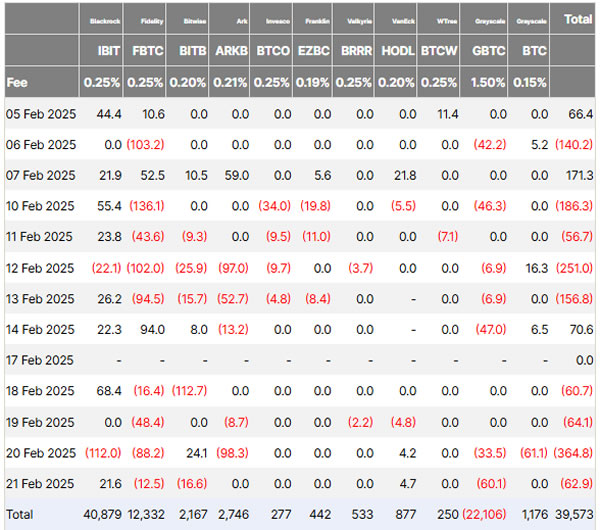

According to Markus Thielen, Head of Research at 10x Research, around $39 billion has flowed into Bitcoin (BTC) ETFs in the United States since these products were launched. However, of that total, only about $17.5 billion (IDR286 trillion) is a “long-only” investment.

The rest of the fund, which is about 56%, is mostly used for arbitrage strategies. These include tactics such as “carry trades”, where investors buy Bitcoin (BTC) through ETFs while going short on Bitcoin (BTC) futures contracts to take advantage of the price difference between the spot and futures markets.

Thielen explained that while there is widespread recognition of Bitcoin (BTC) ETFs as a sign of institutional adoption, the reality is that many investors are more interested in short-term arbitrage opportunities than buying Bitcoin (BTC) to hold it in a long-term portfolio.

In practice, the buying and selling of Bitcoin ETFs is influenced more by funding rates and basis opportunities than by real demand for Bitcoin (BTC) as an investment.

Read also: Bitcoin and Altcoins Plummet, Why Did the Crypto Market Crash Today (2/25/25)?

Arbitrage Strategy Makes Hedging More Profitable than Holding Bitcoin

The largest holders of Bitcoin (BTC) ETFs such as BlackRock’s IBIT are hedge funds and trading firms that are more interested in the potential profits that come from price imbalances in the Bitcoin (BTC) market.

These are not investors who hold Bitcoin (BTC) for long-term gains, but rather they capitalize on the price difference between the Bitcoin (BTC) spot and futures markets for short-term gains.

With this strategy, when funding levels and basis opportunities are too low, the profit potential from arbitrage is drastically reduced. This has caused hedge funds and trading firms to start reducing their positions in Bitcoin (BTC) ETFs, and even unwind their existing positions.

This process, while it may affect market sentiment, has essentially no significant impact on the price movements of the Bitcoin (BTC) market itself as the sale of ETFs is accompanied by the purchase of Bitcoin (BTC) futures contracts.

Also read: 3 Token Unlocks to Watch Out for in the Last Week of February 2025

Bitcoin ETF fund flows decline, but there are signs of recovery after the US election

In recent weeks, the Bitcoin (BTC) ETF market has seen a decline in fund flows, with four consecutive days of outflows reaching $552 million, according to a report from Farside Investors.

Nonetheless, Thielen notes that this decline is not necessarily a bearish signal. This process of reducing Bitcoin (BTC) ETF positions is market-neutral, as investors who sell ETFs also buy futures contracts to balance their positions.

However, Thielen notes that there have been positive signs since the US Presidential Election, with fund flows for long-term Bitcoin (BTC) purchases starting to increase. Nonetheless, declining retail trading volumes and falling funding rates have made arbitrage strategies less attractive to most professional traders.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Only 44% of US Bitcoin ETF buying has been for hodling – 10x Research. Accessed February 25, 2025.

- Featured Image: CNBC

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.