Bitcoin Price Dropped 5% Today (27/2/25): What’s Driving the Decline in BTC?

Jakarta, Pintu News – Bitcoin (BTC) price has declined sharply, hitting its lowest level since November 2024. The top cryptocurrency fell more than $12,000 in the space of three days, causing more than $1 billion in leveraged long positions to be liquidated.

Several factors have contributed to this decline, including market uncertainty, selling pressure from large-scale liquidations, and concerns about economic stability.

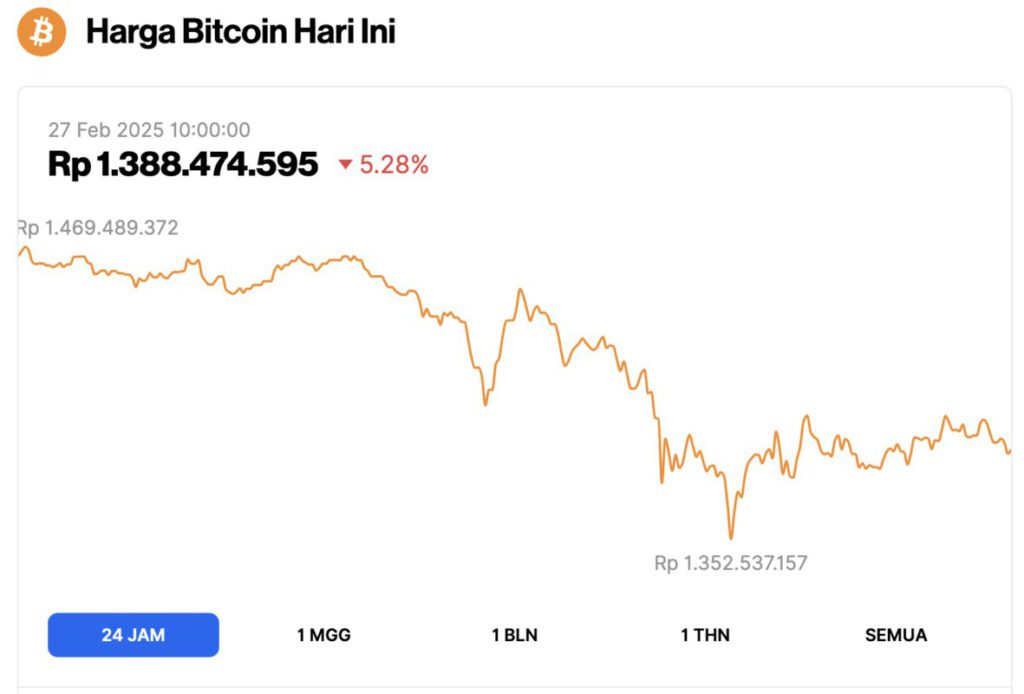

Bitcoin Price Drops 5.28% in 24 Hours

On February 27, 2025, the price of Bitcoin (BTC) dropped 5.28%, trading at $84,450, or approximately 1,388,474,595 IDR. In the past 24 hours, Bitcoin’s price declined from a high of 1,469,489,372 IDR to a low of 1,352,537,157 IDR, reflecting a significant market correction.

This drop has caused Bitcoin’s market capitalization to fall by 5.28%, bringing it down to $1.67 trillion, while the 24-hour trading volume also dropped 20%, totaling $66.84 billion.

Read also: 5 Crypto Struggling with Heavy Losses This Week!

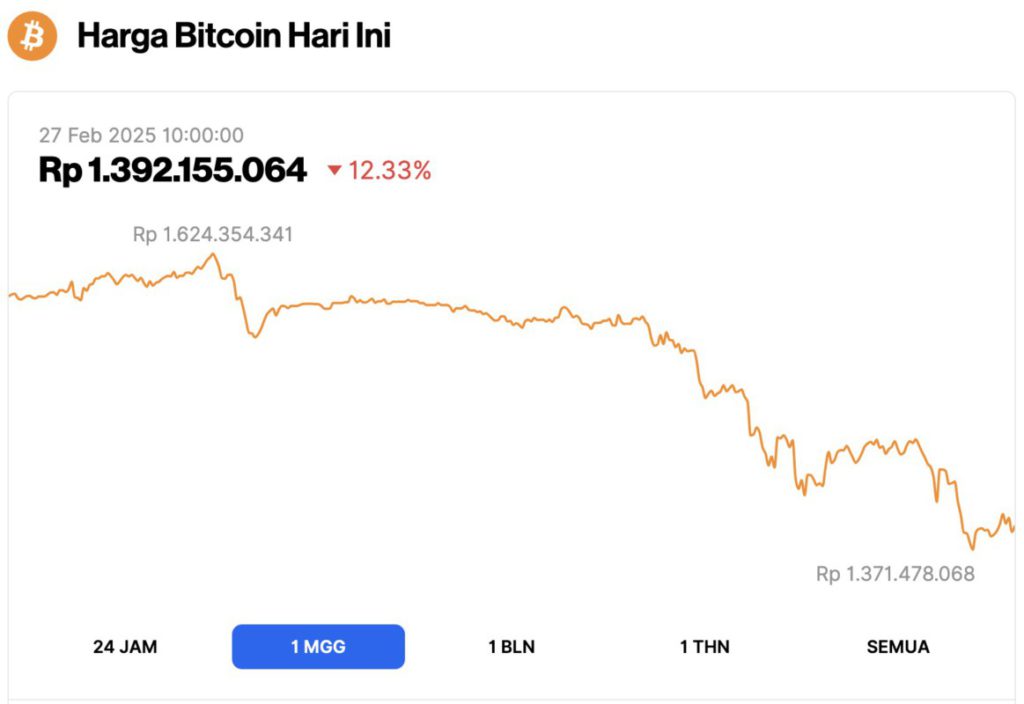

Bitcoin price falls 12% in 7 days

On February 27, 2025, Bitcoin dropped to $84,450, registering a 12.33% drop in the last seven days. This sharp decline caused huge losses for traders holding long positions.

Reporting from Coingape (2/26/25), data from CoinGlass shows that this drop led to the liquidation of more than $1 billion in leveraged positions, which increased selling pressure.

The decline in BTC prices is also in line with broader market concerns, including anxiety about a possible global economic downturn. Investors are now turning to safer assets such as US Treasury Bills and gold amid rising uncertainty.

Other analysis also points to the Bybit hack as a major factor exacerbating concerns in the crypto market, further adding to the selling pressure.

In addition, activity in the derivatives market has affected Bitcoin’s price movements. Analysts note that the expiration of $5 billion worth of Bitcoin options on February 28 has led to increased volatility.

Read also: 3 Crypto Facing a Downturn by March 2025!

The “max pain” level for options is around $98,000, which suggests that investors might try to keep Bitcoin’s price within a certain range.

Options Expiration Increases Market Uncertainty

One of the main factors affecting the price of Bitcoin is the expiration of $5 billion worth of Bitcoin options on February 28, 2025. Most of these options are currently set at higher strike prices, which means they are likely to expire unprofitable.

According to Deribit, almost 78% of Bitcoin options that will expire, with an estimated value of $3.9 billion, will not make a profit.

Market participants will probably attempt to influence the price of Bitcoin to reduce losses before expiration. However, extreme fear in the market and recent liquidations make it difficult for the bullish side to seize control.

Analysts suggest that unless Bitcoin can recover to at least $88,000 before expiration, traders holding call options may face losses, which will further exacerbate the selling pressure.

Global Recession Fears, Tariffs, and Weak Corporate Earnings

In addition, macroeconomic factors also played a role in Bitcoin’s price decline. Economic uncertainty increased after reports of new US tariffs on imports from Canada and Mexico.

According to reports, Trump’s 25% tariff on imports from the European Union has sparked market uncertainty, with crypto investors anticipating heightened volatility. Analysts argue that Bitcoin and other digital assets could benefit as investors seek alternatives amid rising trade tensions.

Read also: Despite the Market Downturn and Criticism, Pi Network Remains Stable!

These policies have encouraged investors to turn to safer assets like long-term US Treasury bonds, which reduces demand for riskier investments like Bitcoin.

Meanwhile, concerns about corporate earnings have added to market uncertainty. Nvidia’s upcoming earnings report sparked concerns about the growth of the AI sector, impacting the tech market.

In addition, Bitcoin-related companies, such as MicroStrategy, have seen their stock prices drop, reflecting investor skepticism towards the stability of crypto prices.

Simultaneously, the spot Bitcoin ETF has experienced a wave of outflows, contributing to the downward price trend. On February 24, more than $1.1 billion exited the spot Bitcoin ETF, which is the largest single-day outflow recorded to date. This suggests that institutional investors are reducing their exposure to Bitcoin amid heightened market volatility.

Additionally, data from IntoTheBlock shows that $1.3 billion worth of Bitcoin has been deposited on crypto exchanges. This influx of Bitcoin onto trading platforms often signals increased selling pressure.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Why Is The Bitcoin Price Dropping? Accessed on February 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.