Surprising Prediction of Bitcoin Price According to Analysts: Will it Rise or Continue to Fall? (2/27/25)

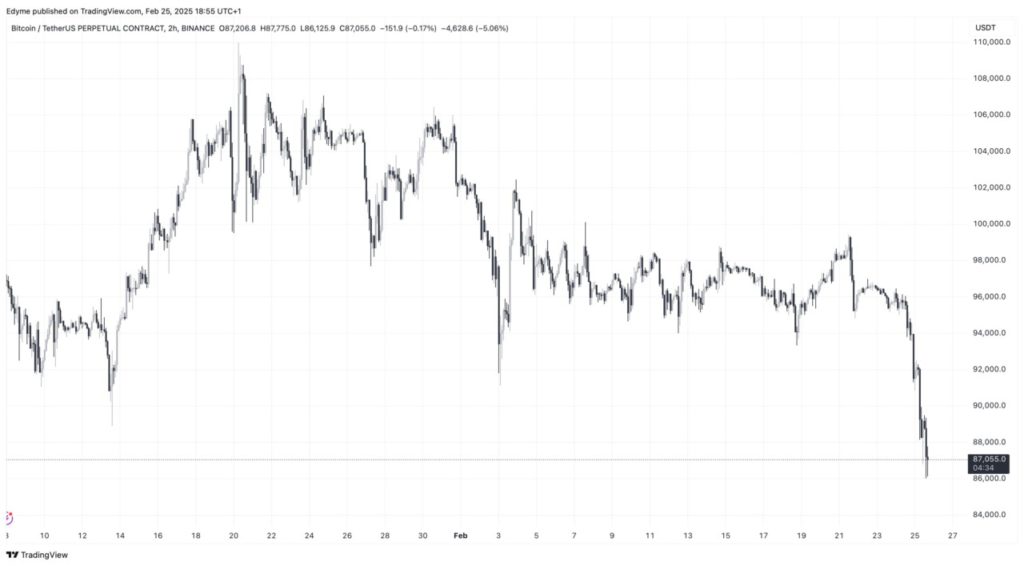

Jakarta, Pintu News – Bitcoin (BTC) continues to experience price declines, breaking several key levels in recent days. Currently, Bitcoin sits above $87,000, representing a weekly decline of around 7.7% and a 19.6% drop from its previous record high of over $109,000.

Technical Analysis and Price Predictions

Titan of Crypto, a leading crypto analyst, recently shared his views on Bitcoin. According to him, Bitcoin’s monthly close can provide important clues. “As long as Bitcoin holds above the 38.2% Fibonacci retracement, the bullish trend continues,” Titan said.

A strong monthly close above a key technical level may signal continued strength, whereas a close below that threshold may indicate further declines.

Gareth Soloway, a prominent trader, gave a broad forecast, suggesting that Bitcoin could fall to $75,000 or surge to $125,000 in the coming months. Although his prediction seems speculative, he does not rule out the possibility that Bitcoin could reach $200,000 by the end of the year.

Also Read: Bybit Recovers $600 Million Ethereum (ETH) After $1.5 Billion Crypto Robbery

Bearish Outlook and MicroStrategy Influence

Some analysts have a more bearish view of Bitcoin. Coinmamba, a well-known figure in the crypto community, highlighted the diminishing influence of MicroStrategy’s purchase of Bitcoin. “The main reason for Bitcoin’s outstanding performance is because of MicroStrategy’s buying, and that’s coming to an end,” Coinmamba wrote.

He is optimistic on altcoins but bearish on Bitcoin’s short-term prospects. Crypto Caesar suggests a possible drop to the $73,000 level, citing a combination of technical and fundamental indicators that point to a potential further decline. This analysis adds to concerns in a market already plagued by negative sentiment.

Optimism Amid Bearish Sentiment

Although many analysts are bearish, there are still investors who are confident in Bitcoin’s long-term prospects. Max Brown has strong convictions, stating, “Bitcoin will reach $150,000. Ethereum (ETH) will reach $15,000. Don’t let anyone tell you otherwise. We will survive and ride our coin to 10x-50x.”

The investor known as Lemon has a simple strategy for dealing with the current downturn: “I will start buying every day on every dip, from $85,000 to $75,000. I will sell at the end of the year above $110-$120,000.” This approach, which emphasizes steady accumulation and a clear exit strategy, reflects a more measured form of optimism among long-term Bitcoin supporters.

Conclusion

With many different predictions and strategies, the Bitcoin market is currently full of uncertainty but also opportunity. Investors and analysts alike are looking for signs that will determine the next direction for the cryptocurrency. Whether this will be a buying opportunity or the start of a further decline, only time will tell.

Also Read: Uniswap Successful, SEC Case Terminated: Will UNI Surge? (2/27/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin’s Ongoing Dip: Here’s What Analysts Are Saying. Accessed on February 26, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.