Dogecoin (DOGE) Movement Analysis: Important Test at Critical Price Level (2/28/25)

Jakarta, Pintu News – Dogecoin (DOGE) is under significant pressure after breaking a key support level on the daily chart (1D). In recent weeks, the price of DOGE has fallen by 50% from its fourth quarter (Q4) 2024 peak, with $0.20 (Rp3,266 ) being the crucial price level tested for the third time this year.

The heavy selling pressure is also reflected in the overall decline in the meme coin sector’s valuation. In the past week, the sector’s valuation fell by $15 billion (IDR244.95 trillion), while Dogecoin itself lost $8 billion (IDR130.64 trillion) of its market capitalization. Given these conditions, DOGE’s ability to stay at current price levels is a big question for investors.

Dogecoin Network Growth Slows

In addition to the price drop, on-chain data shows that Dogecoin’s network growth has also contracted sharply. The creation of new DOGE addresses plummeted from 1.29 million addresses when the price was at $0.38 (€6,205) in November 2024 to just 31,000 addresses today, representing a 97% drop.

The imbalance between demand and supply further exacerbated the selling pressure. Long-term holders (HODLers) are starting to offload their holdings, while inflows of new funds remain weak. If network activity does not experience a significant recovery, DOGE’s long-term outlook will become increasingly bearish. The optimistic target of returning to $0.48 (IDR7,838) post-election seems increasingly distant, while DOGE’s ambition of reaching $1 (IDR16,330) remains difficult to realize in the near term.

Also Read: Cardano (ADA) Price Prediction by Alex Becker: Upside Potential or Excessive Speculation?

Can Dogecoin Survive the $0.20 Support Level?

Amid sluggish market conditions, Dogecoin has lost 18% of its weekly gains, with $7.64 million worth of long positions liquidated in the last 24 hours.

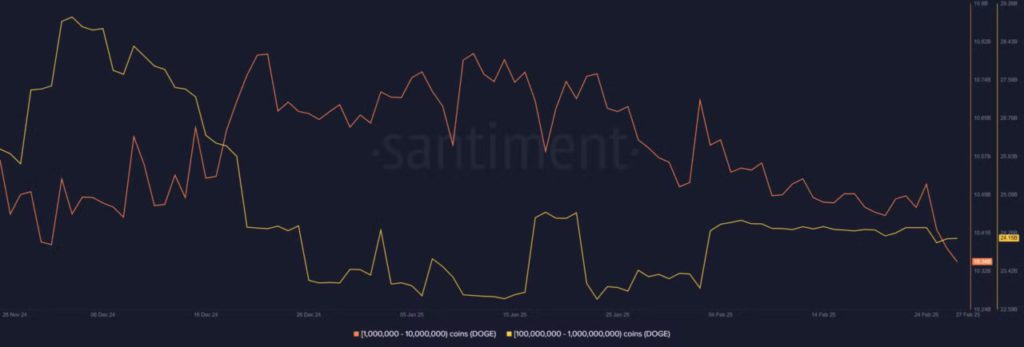

Network data shows that DOGE holdings in wallets holding 1 million to 10 million tokens have hit a six-month low, with more than 460 million DOGE released to the market. Meanwhile, whale wallets holding 100 million to 1 billion DOGE have sold 6 billion DOGE since the post-election rally, adding to the growing selling pressure.

In the short term, DOGE’s chances of recovering to $0.25 (IDR4,082)-the previous resistance level-are still unclear due to weak accumulation and unfavorable macroeconomic conditions. If external factors worsen further and Bitcoin (BTC) drops below $84,000 (Rp1.37 billion), Dogecoin could face a major challenge to maintain the $0.20 (Rp3,266) price level as a key support.

Conclusion

Dogecoin (DOGE) is in a critical phase with high selling pressure and slowing network growth. With a continuously shrinking market capitalization and bearish whale activity, DOGE faces a huge challenge to maintain the $0.20 (IDR3,266) level as a key support. A price recovery to higher levels still depends on stronger accumulation as well as the overall cryptocurrency market conditions.

Also Read: Bitcoin (BTC) Trend Not Over? CryptoQuant CEO Analyzes!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. Analyzing How Dogecoin’s Next Move Hinges on Holding This Price Level. Accessed February 28, 2025.

- Featured Image: Bitcoin News

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.