XRP Surpasses Ethereum: Time for Portfolio Rebalancing? Here’s the Analysis! (3/2/25)

Jakarta, Pintu News – In the next few days, it will be seen whether Ripple (XRP) can maintain its lead over Ethereum (ETH). Despite its decline in February, Ripple (XRP) still shows a strong bullish structure in the daily chart.

Currently, Ripple (XRP) is trading more than 300% above its Election Day opening price and has managed to maintain support above $2. Meanwhile, Ethereum (ETH) has lost all of its post-election gains and is now trading 8% lower than $2,400 support.

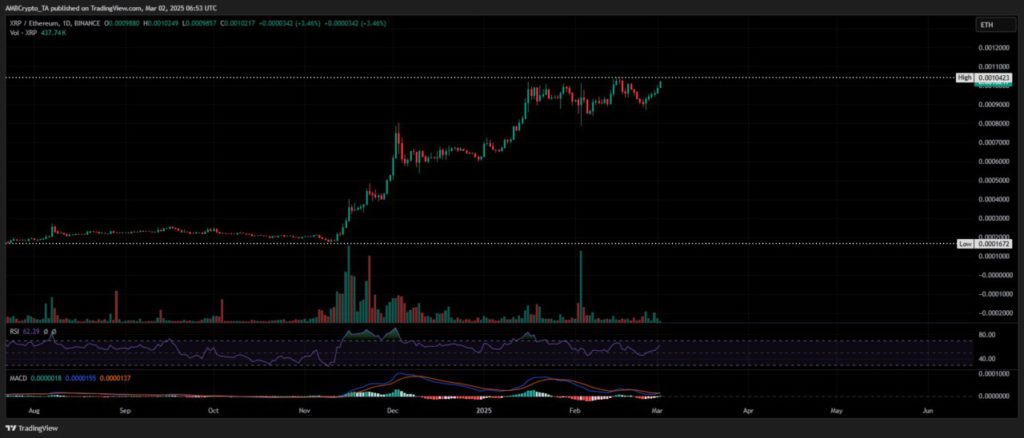

Ripple (XRP) vs Ethereum (ETH) performance

Ripple (XRP) has recorded a gain of 3.63% in the last 24 hours, while Bitcoin (BTC) is consolidating around $85,000, indicating resilient demand. On the other hand, Ethereum (ETH) seems to be losing momentum after breaking critical support. Analysts project a potential upside of 25% on the XRP/ETH pair, signaling that Ripple (XRP) may be preparing to become a stronger asset.

In extreme market conditions, Ripple (XRP) against Bitcoin (BTC) has recorded a 3% gain, while Open Interest (OI) for Ripple (XRP) has increased by 3.77% to $3.16 billion. This indicates increased buying interest at a time when prices are falling, which is an important indicator for a possible accumulation phase.

Also Read: The Future of Pi Coin (PI) in the Cryptocurrency World: Will PI Capi $5? Here’s the Technical Analysis!

Demand and Supply Analysis

While Open Interest for Ethereum (ETH) also increased, by just 2.21% to $20.13 billion, the rise in reserves on exchanges amounted to just 0.16%, in stark contrast to the 4.87% surge in Ripple (XRP). This suggests weak spot demand for Ethereum (ETH), making it vulnerable to further selling pressure.

On the other hand, Ripple (XRP) is showing signs of strong accumulation, which could trigger a price increase if market conditions stabilize. As Bitcoin (BTC) loses its appeal as a high-risk investment, and Ethereum (ETH) does not show strong demand, Ripple’s (XRP) price action suggests that there could be an accumulation phase. This makes Ripple (XRP) an important asset to watch in the coming days.

Investment Strategy and Recommendations

With the current market conditions, investors may need to consider capital rotation to Ripple (XRP). Although $2 appears as a potential local bottom, confirmation is still needed. Key metrics should align in the next few days to validate this trend.

If Ripple (XRP) manages to maintain its momentum, it could be a good time for asset reallocation in portfolios. Investors should continue to monitor the dynamics between Ripple (XRP) and Ethereum (ETH), as well as its effect on their asset allocation strategies. Given the significant upside potential, Ripple (XRP) may offer better growth opportunities in the short term.

Conclusion

With in-depth analysis and constant market monitoring, investors can make informed decisions in allocating their assets. Ripple (XRP) is currently showing potential as an attractive investment option, especially in the face of greater uncertainty in the crypto market.

Also Read: Pi Network Price Plunges 18% After Legal Warning from Vietnam (3/2/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP gains against Ethereum: Is it time to reallocate?. Accessed on March 3, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.