Bitcoin Surges to $93.000 Again (3/3/25) – Trump’s Influence Sparks Rally!

Jakarta, Pintu News – As reported by Coingape (2/3/25), the price of Bitcoin (BTC) surged 10% over the weekend, mainly driven by President Trump’s executive order to accelerate the creation of the Crypto Strategic Reserve as well as investor buying that capitalized on the massive liquidation in the market last week.

This rise also coincides with the planned implementation of tariffs against Canada and Mexico on March 1, further boosting demand for Bitcoin. Traders see BTC as a hedge against macroeconomic uncertainty, prompting further price spikes.

Then, how will BTC price move today?

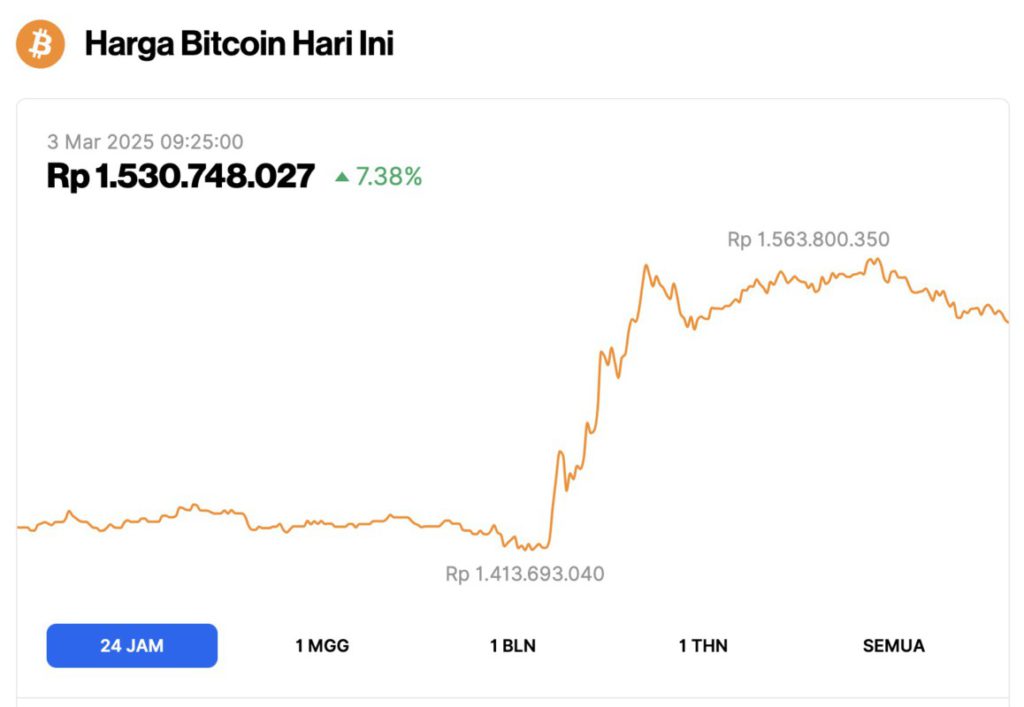

Bitcoin price rises 7.38% in 24 hours

Read also: CME Group Unveils Solana Futures on March 17 – Is a SOL ETF Next?

At the start of March 2025, Bitcoin (BTC) was recorded at $93,045 (approximately 1,530,748,027 IDR), marking a significant 7.38% surge in the past 24 hours. During this period, BTC dipped to a low of 1,413,693,040 IDR before rebounding sharply, nearing its peak at 1,563,800,350 IDR.

According to CoinMarketCap, Bitcoin’s market capitalization has now risen to $1.84 trillion, with trading volume in the last 24 hours also jumping 126% to $63.8 billion.

Bitcoin (BTC) Recovers to $90K as Bullish Investors Enter at Low Point

After losing more than 25% of its value throughout February, Bitcoin finally found a turning point over the weekend when strategic buyers started to enter the market. The price decline bottomed out on February 28, with BTC falling to $78,200, its lowest level in the past 120 days.

President Trump’s decision to impose import tariffs on Canada and Mexico led to massive capital withdrawals from risky assets globally. This triggered double-digit declines in major indices such as the S&P 500, Japan’s Nikkei, and Germany’s DAX in the week leading up to the tariffs being imposed on March 1.

Interestingly, Bitcoin hit its lowest point on February 28, with the price dropping to $78,200. However, market data over the weekend showed that strategic investors started buying at the lowest point, just before the tariff policy took effect on March 1.

As a result, the price of BTC got a huge boost, rising from Friday’s 120-day low, and closing Saturday’s trading above $85,000.

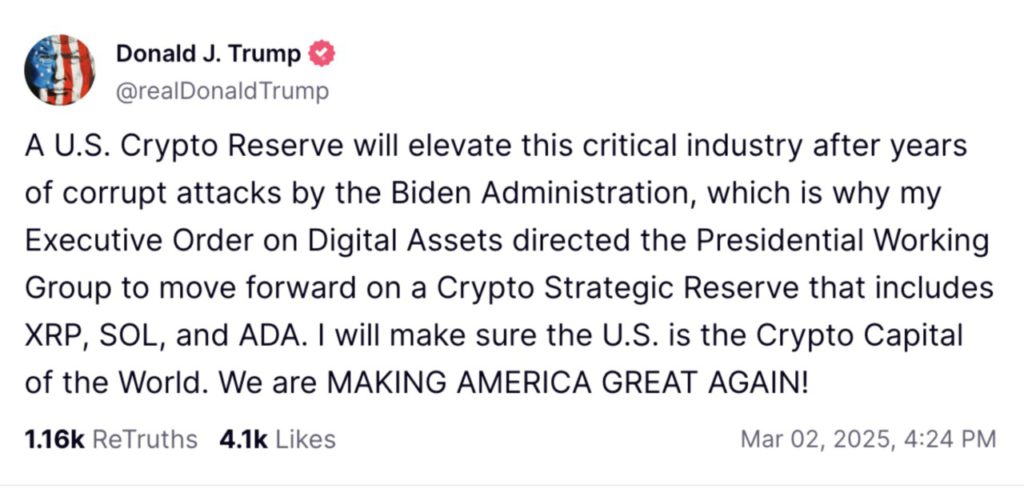

Trump gives green light to crypto strategic reserve

After Bitcoin returned to the $86,000 level in the European trading session, prices surged again following US President Donald Trump’s executive order establishing the Crypto Strategic Reserve.

Read also: 5 Next Crypto to Explode in 2025!

According to an official announcement on the Truth Social platform, which is owned by Trump, this reserve will initially include some major crypto assets, namely Bitcoin (BTC), Solana (SOL), Ripple (XRP), and Cardano (ADA).

The move reflects a diversified approach in US digital asset holdings and in line with Trump’s pro-crypto stance, signals official recognition of digital assets in the US financial system.

Within just an hour of Trump’s announcement, Bitcoin price jumped another 3%, briefly breaking $91,000 on Sunday, March 2.

How Will Trump’s Crypto Strategic Reserve Affect BTC Price?

Inspired by countries like El Salvador and Bhutan, which have incorporated Bitcoin into national balance sheets, many analysts initially predicted that BTC would be the only asset in the US crypto reserve.

However, Trump’s decision to include Solana (SOL), Ripple (XRP), and Cardano (ADA) aims to reduce concentration risk as well as allow the US to benefit from each project’s unique advantages.

With capital spread across four crypto assets, BTC’s upside potential may not be as great as if Bitcoin were the only asset in the reserve. While this may temporarily suppress Bitcoin’s market dominance, the long-term benefits of a stronger and more stable crypto ecosystem could potentially push BTC prices beyond $150,000 in the medium to long term.

In the short term, Bitcoin may experience a temporary decline in its relative market share, as capital flows into newly incorporated cryptocurrencies in reserve.

However, official recognition through a reserve backed by the US government is expected to boost institutional confidence, ultimately strengthening Bitcoin’s long-term growth prospects.

Market sentiment strengthens, BTC ready to test $100K

After experiencing a sharp correction last week, the Bitcoin price prediction chart is now turning bullish, with technical indicators showing a potential breakout past $100,000. Short traders are facing immense pressure, driving further BTC rallies.

On the 12-hour chart, Bitcoin recorded a 16.84% recovery in two days, rising from a low of $78,200 to return to $90,558.

Read also: Whale-Favorite Memecoins: 3 Top Picks with Massive Potential!

This recovery is in line with the surge in trading volume, signaling returning investor confidence. In addition, the MACD indicator has broken into the bullish zone, with the blue MACD line crossing the signal line, indicating a change in momentum to the upside.

As BTC prices approach the key resistance level around $100,000, short traders who previously reaped profits from the February drop are unlikely to put up much resistance. This is because the main catalyst for BTC’s current price rise has the direct support of the US government through the Crypto Strategic Reserve.

Although unlikely, a bearish scenario could emerge if BTC fails to close trading above $88,000, which could trigger a new wave of liquidation.

However, the momentum is currently in favor of buyers, and with shorts starting to weaken, BTC could potentially break $95,000 before testing the psychologically important level of $100,000.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Why is Bitcoin Price Going Up? Trump’s Crypto Executive Order Could Spark $150K Rally in March. Accessed on March 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.