Bitcoin (BTC) is under pressure, has the crypto market bottomed out? (5/3/25)

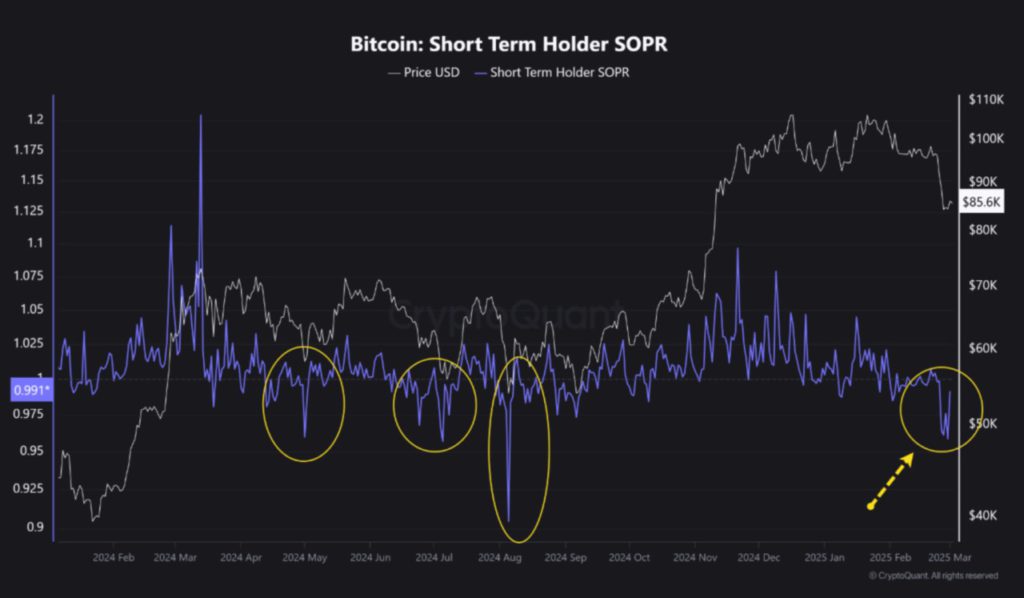

Jakarta, Pintu News – The crypto market has recently experienced significant turmoil, especially in Bitcoin (BTC). According to the latest analysis from CryptoQuant, short-term investors suffered losses as the Spent Output Profit Ratio (SOPR) dropped to 0.95. This drop signifies that many investors are selling BTC at a lower price than when they bought it.

SOPR is an indicator that measures the gains or losses experienced by BTC holders within a period of one hour to 155 days. If SOPR is above 1, it means investors are selling BTC at a profit. However, values below 1 indicate they are selling at a loss, which can be an indication that the market is capitulating before a potential trend reversal.

BTC Price Fluctuations and Potential Trend Reversal

Over the past week, BTC price experienced high volatility, dropping from $96,000 (Rp1,583,064,000) on February 23 to $78,258 (Rp1,291,303,862) on February 27. However, BTC managed to partially recover and climbed back up to $95,000 (Rp1,567,575,500).

Analysts are seeing indications that BTC may have bottomed out. One factor that supports this theory is the filling of the CME gap between $78,000 and $80,000, which often signals a market reversal. Additionally, BTC is currently at its most oversold level since August 2024, suggesting that selling pressure may be starting to ease.

Also Read: Bitcoin Faces New Price Barriers in the Crypto Market: Volatility and Its Impact on Crypto

Is Bitcoin (BTC) About to Turn Bullish?

Although some indicators point to a potential recovery, not all analysts agree that BTC will be bullish again soon. Andre Dragosch, Head of European Research at Bitwise, stated that although the market is under pressure, it could be an attractive buying opportunity for investors with long-term strategies.

On the other hand, Geoff Kendrick of Standard Chartered predicts that BTC could still experience further declines before eventually returning to an upward trend. Currently, the price of BTC hovers around $89,826 (Rp1,482,196,514), up 5.3% in the last 24 hours. With market conditions still fluctuating, investors need to remain vigilant and consider strategies that suit their risk profile.

Conclusion

Bitcoin (BTC) is currently in a phase of uncertainty after experiencing a sharp decline and partial recovery. The SOPR indicator dropping to 0.95 suggests that many short-term investors are incurring losses, which could be a sign the market is nearing its bottom. Some analysts see a chance of a trend reversal, while others still anticipate a possible further decline. With such high volatility, investment decisions in the crypto market need to be made with careful consideration.

Also Read: Cardano Price Movement Pattern Shows Positive Trend, This is Analyst’s Explanation! (5/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Sellers Incur Loss As SOPR Drops To 0.95. Accessed March 5, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.