Solana’s (SOL) Big Move: How Will It Impact the Cryptocurrency Market? (6/3/25)

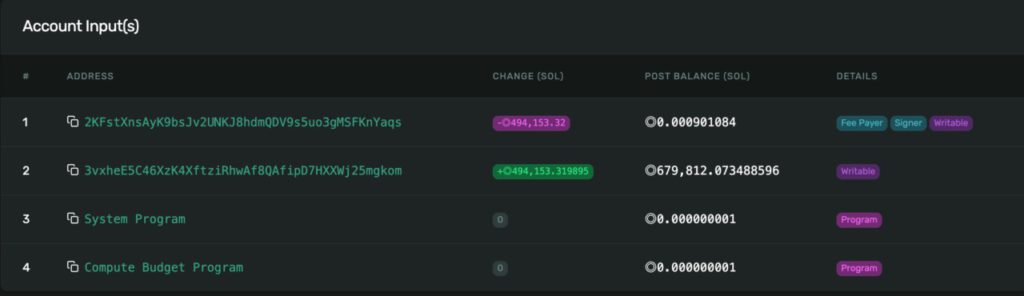

Jakarta, Pintu News – On Tuesday, a whale investor in the Solana (SOL) ecosystem was reported to have transferred 494,153 SOL worth approximately Rp1.18 trillion to the Coinbase trading platform. Such large transfers are often associated with potential selling pressure in the cryptocurrency market, which could affect the price of SOL going forward.

A surge in the supply of digital assets to exchanges like Coinbase could lead to price declines if demand is not strong enough to absorb the volume of selling taking place. Some analysts warn that this move could increase SOL price volatility in the short term, given the currently mixed market sentiment.

Impact of Market Sentiment on Solana Price

Apart from the increasing supply of SOL on the exchange, another factor affecting price movement is market sentiment. Based on recent analysis, Solana’s weighted sentiment stands at a negative -0.51. This shows that discussions and comments on various online platforms tend to be more pessimistic than optimistic regarding this asset.

Such negative sentiment could exacerbate selling pressure, reduce buying interest from new investors, and accelerate the decline in SOL prices. If this trend continues, it is likely that Solana will face a major challenge to maintain its current price levels. However, on the contrary, if there is an increased positive sentiment, SOL could regain its momentum.

Also Read: Arbitrum (ARB) Surges After Robinhood Entry: What Will Happen Next?

SOL Price Movement Forecast: IDR 2.28 Million or IDR 2.64 Million?

Currently, the price of Solana is trading at around Rp2.41 million per coin. If a massive selloff occurs due to this whale transfer, the SOL price is expected to drop to as low as IDR2.28 million.

However, technical analysis shows that there is upside potential. The Parabolic SAR indicator indicates that buying momentum is getting stronger. If this trend continues and buying interest increases, SOL prices have the potential to rise to IDR2.64 million in the near future. Therefore, investors are advised to monitor market movements closely before making investment decisions.

Conclusion

Solana’s big transfer to Coinbase has led to various speculations among investors and market analysts. With increased supply on the exchanges and market sentiment trending negatively, SOL prices could experience further selling pressure.

However, technical indicators point to potential resistance from buyers that could push prices back up. In such volatile market conditions, investors are advised to exercise caution and consider further analysis before making investment decisions.

Also Read: Binance Attracts Investors After Bybit Hack, Funds Flow Increases Sharply!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Whale Transfers 494,153 SOL to Coinbase, Impact on Market. Accessed March 6, 2025.

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.