Binance Discontinues Altcoin/Bitcoin Pairing, What Impact for Investors? (6/3/25)

Jakarta, Pintu News – In early 2025, Binance announced the discontinuation of several Altcoin/Bitcoin (BTC) spot trading pairs on its platform. This decision reflects the changing preferences of traders who now favor Altcoin/Tether (USDT) pairs due to more manageable liquidity and risk factors.

Causes and Impact of Altcoin/Bitcoin Pair Deletion

Binance has delisted several Altcoin/Bitcoin (BTC) pairs such as Measurable Data Token (MDT)/BTC, Melon (MLN)/BTC, Viberate (VIB)/BTC, Vice Industry Token (VIC)/BTC, and Aavegotchi (XAI)/BTC. The main cause of these delistings is low trading volume and poor liquidity. Binance conducts periodic evaluations of all listed trading pairs and removes those that do not meet the standards.

This removal does not necessarily mean that the corresponding Altcoin/Tether (USDT) pair is also removed. For example, the Enjin Coin (ENJ)/USDT, Coin98 (C98)/USDT, and Reserve (REZ)/USDT pairs are still available. This shows that traders prefer to trade pairs involving stablecoins like Tether (USDT) as they are considered more stable and reduce risk.

Also Read: Arbitrum (ARB) Surges After Robinhood Entry: What Will Happen Next?

Changing Investor Preferences: From Bitcoin to Altcoins

Data from CryptoQuant shows that retail investors have been reducing their Bitcoin (BTC) holdings since the fourth quarter of 2024, while institutional investors continue to accumulate. This comes on the heels of the approval of a Bitcoin ETF and the start of Donald Trump’s new term in office, which makes Bitcoin even more dominant among large investors.

Retail investors tend to stay away from Bitcoin (BTC) due to its high price and prefer to allocate their capital to altcoins, especially meme coins. In addition, trading Altcoin/Bitcoin (BTC) pairs exposes traders to the volatility of both assets, which can increase the risk of loss.

Market Analysis and Recent Trading Trends

Market analysis is currently focusing more on the Altcoin/Tether (USDT) pair than the Altcoin/Bitcoin (BTC) pair. This is due to the daily trading volume of Tether (USDT) reaching over $115 billion out of the total market trading volume of $147 billion. This confirms that Tether (USDT) remains a key channel for traders looking for opportunities.

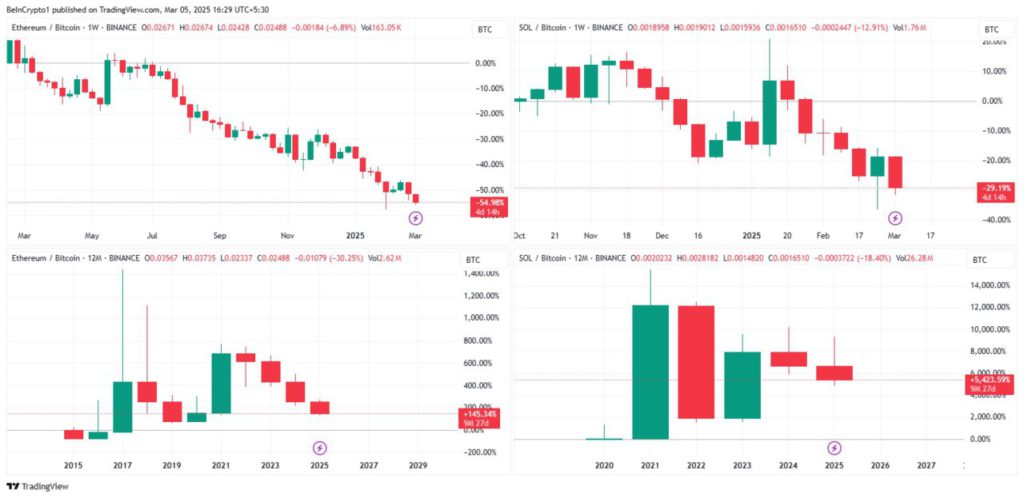

More liquid pairs such as Ethereum (ETH)/BTC and Solana (SOL)/BTC have also shown prolonged downward trends and high volatility. This further confirms traders’ preference to move to pairs involving stablecoins, which are considered safer in volatile market conditions.

Conclusion

Binance’s decision to discontinue some Altcoin/Bitcoin (BTC) pairs is indicative of a major shift in crypto market dynamics. Investors and traders need to pay attention to this trend and may need to adjust their trading strategies to optimize potential profits and minimize risks.

Also Read: Binance Attracts Investors After Bybit Hack, Funds Flow Increases Sharply!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoin-BTC Spot Market is Dying. Accessed on March 6, 2025

- Featured Image: Reuters

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.