Litecoin (LTC) hits record high, will the price surge? (7/3/25)

Jakarta, Pintu News – Litecoin (LTC) is currently testing key demand zones, with on-chain indicators suggesting a potential price reversal. Although the profit-taking phase is putting pressure, on-chain data and increased mining activity are giving positive signals for the future of Litecoin (LTC).

The Effect of Profit Taking on Litecoin (LTC) Price

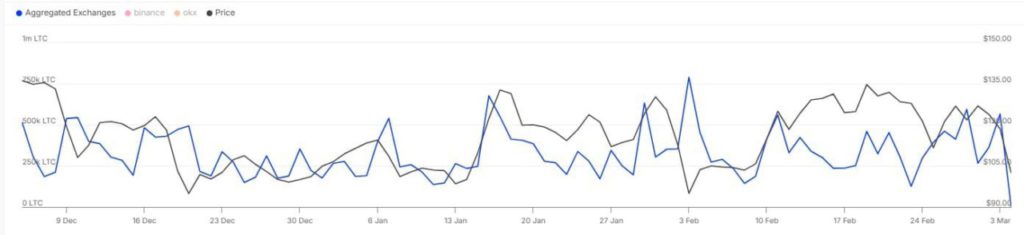

Recent analysis attributes the recent Litecoin (LTC) price drop to profit-taking activity by investors, after a long period of inactivity. This phenomenon often occurs after rapid price spikes, which investors capitalize on to secure profits.

As a result, the Litecoin (LTC) price dropped to reach the $94 support level. Nonetheless, this support zone may not last long if investors continue to take profits. This raises questions about Litecoin’s (LTC) ability to maintain value above this critical zone in the long term.

Also Read: Arbitrum (ARB) Surges After Robinhood Entry: What Will Happen Next?

Technical Indicators and On-Chain Data Show Positive Signals

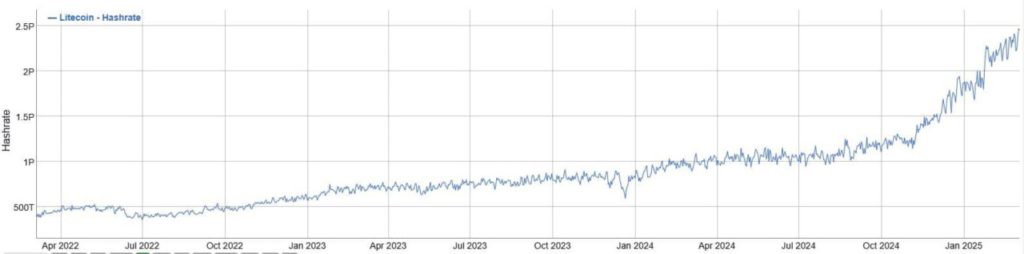

Litecoin (LTC) on-chain data shows some encouraging developments. The Litecoin (LTC) network hash rate recently hit a record high, signaling healthy miner activity and increased network security.

This high hash rate is an important indicator of trust and investment in Litecoin (LTC) infrastructure. In addition, Litecoin (LTC) reserves on exchanges have decreased significantly, meaning the number of coins available for sale is reduced. This decrease reduces selling pressure and potentially stabilizes the Litecoin (LTC) price in the market.

Litecoin (LTC) Price Outlook and Predictions

With the Stochastic RSI showing oversold conditions and the hash rate hitting record highs, the outlook for Litecoin (LTC) seems increasingly bullish. If Litecoin (LTC) manages to maintain support above the $94 demand zone, it is possible that the coin will rally and try to break through higher resistance levels in the near future.

Market watchers and investors will continue to monitor these indicators to make informed investment decisions. A potential Litecoin (LTC) price increase could be an opportunity for those looking for an asset with stable long-term prospects.

Conclusion

With various technical indicators and on-chain data in favor, the future of Litecoin (LTC) looks bright. Investors and market watchers would be wise to take note of these developments as signals for their investment strategies. Litecoin (LTC)’s stability and growth potential may soon be realized.

Also Read: Binance Attracts Investors After Bybit Hack, Funds Flow Increases Sharply!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Litecoin prices eyes recovery after sharp drop. Accessed on March 6, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.