Ethereum (ETH) Surges Almost 10%: A Sign of the Next Great Awakening? (7/3/25)

Jakarta, Pintu News – Ethereum (ETH) has recently experienced a significant price increase of nearly 10% in the past 24 hours, following in the footsteps of Bitcoin (BTC) which has also shown an increase. This rise comes after a period of market correction that left many investors worried. However, the latest on-chain data suggests that Ethereum (ETH) may be entering a new accumulation phase that could have a positive impact on its price in the coming weeks.

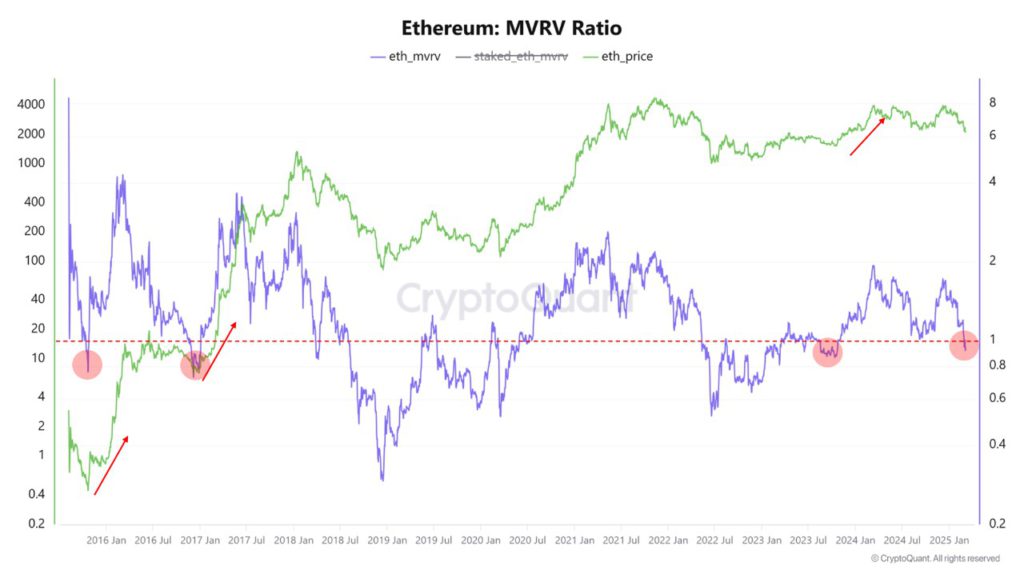

MVRV Ratio and Institutional Accumulation Trends

An analysis on the CryptoQuant QuickTake platform by a contributor known as Mac shows that Ethereum’s (ETH) Market Value to Realized Value (MVRV) ratio is currently below 1. This signifies that the asset is undervalued or priced below its true value. The MVRV ratio is an on-chain metric used to assess whether an asset is overvalued or undervalued.

According to Mac, when Ethereum’s (ETH) MVRV ratio drops below 1, this is often followed by a significant price recovery. In addition, there has been an increase in the number of ETH-wallet accumulation addresses that receive ETH but never make withdrawals. This suggests that large and institutional investors are increasing their holdings, especially in the current price range between $2,200 and $2,300.

Also Read: The Burning of 20 Million SHIBs: Will Shiba Inu Prices Skyrocket? (7/3/25)

Market Conditions and Price Support

The current price level, where realized prices for large investors are concentrated, is expected to act as a strong support zone. This reinforces the possibility of continued accumulation. Large investors seem to be capitalizing on these undervalued conditions to add to their holdings in Ethereum (ETH), which could trigger further price increases.

In addition, macroeconomic factors such as liquidity policies in the US, including trade and monetary policies of the Trump administration, continue to affect the performance of risk assets, including cryptocurrencies. These policies may provide more insight into how global market conditions might affect Ethereum (ETH) going forward.

Ethereum’s Long-Term Outlook

Ethereum (ETH) remains the second largest cryptocurrency by market capitalization and is a proven network with thousands of mature DeFi projects. With this position, Ethereum (ETH) is attracting more accumulation from institutional investors, especially in price zones that are considered undervalued.

From a long-term perspective, the outlook for Ethereum (ETH) remains positive. Along with increased interest and adoption in the financial and technology sectors, Ethereum (ETH) is expected to continue to show steady growth and may experience greater price increases in the future.

Conclusion

With strong indications from on-chain data and institutional accumulation trends, Ethereum (ETH) seems to be gearing up for its next phase of growth. Investors who understand these dynamics may find lucrative opportunities in capitalizing on current market conditions.

Also Read: Litecoin (LTC) Hit a Record High, Will the Price Surge? (7/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Surges Nearly 10% as MVRV Ratio Drops Below 1, Bigger Rally Incoming. Accessed on March 6, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.