$620 Million Liquidated in Crypto Bloodbath! Did Bitcoin Spark the Market Meltdown?

Jakarta, Pintu News – The crypto market started the week with a sharp decline, where a wave of liquidations in the last 24 hours has wiped out $620.5 million worth of funds (10/3/25).

This massive sell-off was triggered by the plummeting price of Bitcoin (BTC), which had dropped to $80,000 over the weekend. This sudden drop triggered widespread margin calls , forcing traders out of their leveraged positions and further increasing volatility across the market.

Crypto market hit by $620 million liquidation wave

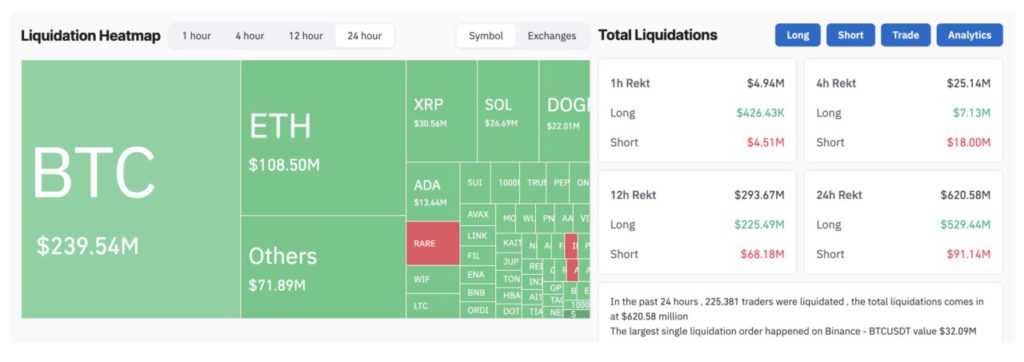

Based on data from Coinglass (10/3/25), in the last 24 hours there was a major shakeup in the crypto market, with 225,381 traders liquidated.

Read also: Pi Network at Risk? $480 Million Pi Coin Unlock Could Send Shockwaves Through the Market!

Long positions suffered the biggest losses, with liquidations totaling $529.4 million. Meanwhile, short positions saw liquidation of $91.1 million.

Bitcoin led the way in this wave of liquidation, with $239.5 million worth of positions wiped out. Of this, $205.6 million came from long traders who got caught up in the market decline, triggering a forced sell-off. The largest single liquidation occurred on Binance, where $32.0 million worth of BTC/USDT positions were erased.

Ash Crypto analysts highlighted the severity of the recent market turmoil in a post on X (formerly Twitter).

“The liquidation of long Bitcoin across all exchanges surpasses the collapse of 3AC, Celsius, and FTX,” he wrote.

Bitcoin Long Liquidation Surges, Market Pressured by Fresh Selling Pressure

Data from CryptoQuant shows that Bitcoin long liquidation surged to 14,714 BTC the previous day. In comparison, 13,453 BTC was liquidated during the Celsius crisis, 1,807 BTC during the FTX crash, and 1,311 BTC during the Three Arrows Capital (3AC) collapse.

This wave of liquidation comes amidst Bitcoin’s struggles as it faces renewed selling pressure in the market. Contrary to expectations, President Donald Trump’s Strategic Bitcoin Reserve executive order triggered a sharp decline in Bitcoin’s value.

Moreover, the growing fear of recession further exacerbates this downward trend, adding to the uncertainty in the market.

“Bad start to the week. Looks like BTC will retest the $78,000 level,” wrote former BitMEX CEO Arthur Hayes.

Hayes predicted that if Bitcoin fails to hold at $78,000, then the $75,000 level will be the next critical support. He also highlighted the large open interest (OI) in Bitcoin options in the range of $70,000 to $75,000.

If BTC enters this range, market volatility is expected to increase sharply.

Market Crash Triggers Liquidation Chaos for Crypto Whales

The massive impact of Bitcoin’s price drop was felt across the crypto sector. The total crypto market capitalization plummeted by $148 billion, with Ethereum (ETH) being the second most affected asset, recording $108.5 million in liquidations.

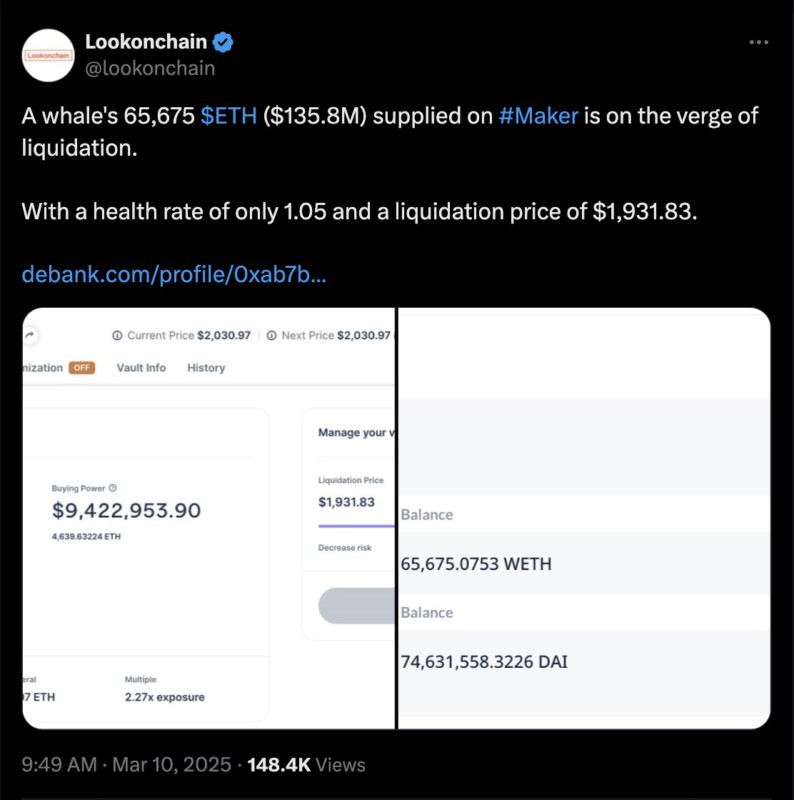

This decline has further pressured whales, with some of them facing the risk of massive liquidation. According to data from Lookonchain, a whale holding 65,675 ETH (worth $135.8 million) in Maker is now on the verge of liquidation.

The whale’s health rate dropped to 1.05, with the liquidation price set at $1,931. This has sparked fears of a potential forced sell-off if ETH prices continue to slide.

In addition, an on-chain analyst revealed that World Liberty Financial’s (WLFI) investment portfolio suffered heavy losses. The company initially invested $336 million in nine tokens, but its portfolio value has now plummeted to $226 million, registering a loss of $110 million.

Ethereum accounts for 65% of WLFI’s total portfolio, making it the most affected asset. The average purchase price of ETH is $3,240, but with ETH now trading at around $2,000, the DeFi project has suffered a 37% loss, equivalent to $80.8 million.

Amid market turmoil, Whale adds long positions despite heavy losses

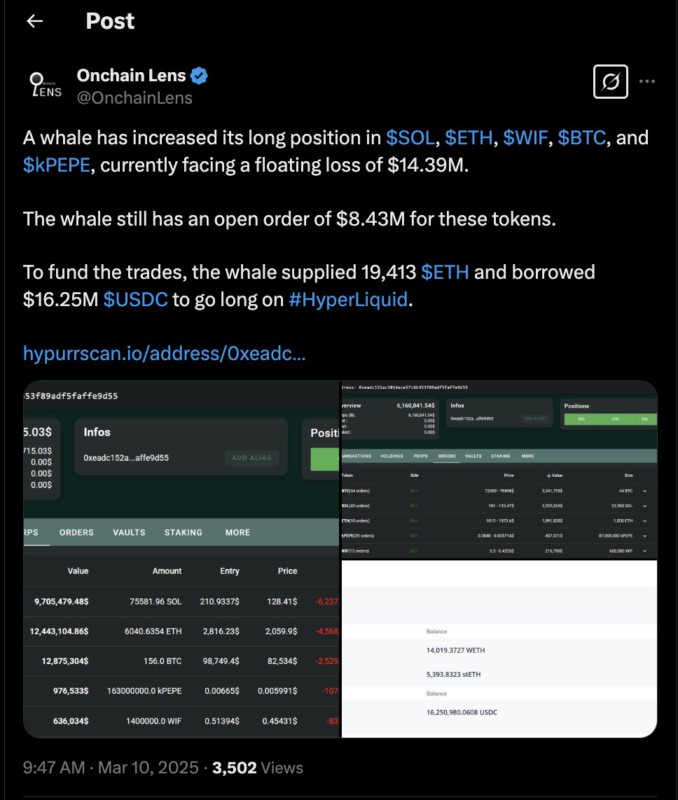

Amidst the market chaos, OnchainLens reported that a whale actually increased long positions on several assets, including Solana (SOL), Ethereum (ETH), dogwifhat (WIF), and Bitcoin (BTC).

Read also: Massive Gains! 3 Altcoin That Surged as the Crypto Market Recovers!

However, this strategy backfired on the trader, who now has an unrealized loss of $14.3 million. In addition, the whale still has $8.4 million worth of open orders for the tokens, further increasing the risk of exposure.

To fund this trade, the whale has deposited 19,413 ETH and borrowed $16.2 million USDC to go long on HyperLiquid.

Not all whales suffered losses due to this market shock. Lookonchain reported that another whale managed to short Bitcoin multiple times during the recent price drop, resulting in an unrealized profit of over $7.5 million.

“He has now established additional short positions in the range of $92,449 – $92,636 and placed limit orders to take profits between $70,475 – $74,192,” the report read.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Liquidations Soar to $620 Million as Bitcoin Leads Market Collapse. Accessed on March 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.