Trader Strategy Battle in the Ethena Market: What Will Happen Next? (13/3/25)

Jakarta, Pintu News – In the world of cryptocurrency trading, the dynamic between derivatives and spot traders often dictates market direction. Recently, Ethena (ENA) experienced a 4.96% price spike driven by derivatives trader activity, while spot traders were seen selling heavily. This phenomenon raises a big question about what will happen next to ENA.

Derivatives Traders Take Charge of Momentum

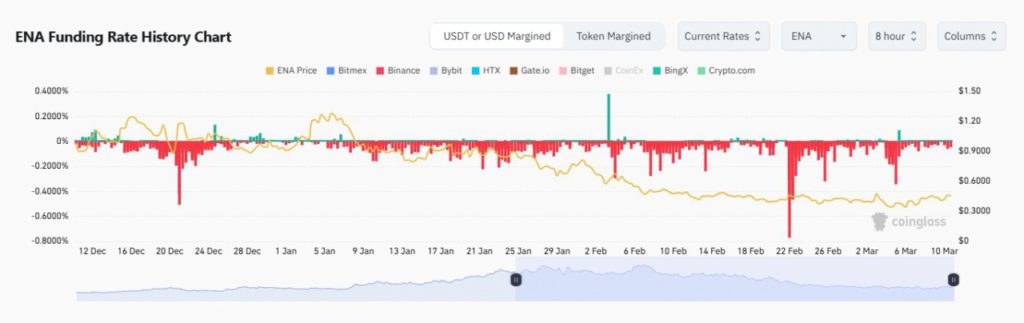

Derivatives traders, who use leverage to increase their potential profits, have been the main force behind Ethena’s (ENA) recent price rise. They continue to push the price up with aggressive strategies, capitalizing on market volatility to make quick profits.

This shows that there is strong optimism among these traders towards the future of ENA. Meanwhile, market indicators show that the trading volume of derivatives for ENA continues to increase. This signals that more and more market participants are interested in participating in this high-risk trade, in the hope that the upward price trend will continue.

Also Read: Bitcoin and Stock Market Plummet, Arthur Hayes Asks Investors to Be Patient: Why is Crypto Red?

Sales Increase in Spot Market

On the other hand, spot traders, who trade without leverage, started selling their ENA. Data from the Coinglass exchange shows that in the past 24 hours, $2.05 million worth of ENA has been sold. This shows a cautious tendency among these traders, who may feel unsure about the future stability of ENA prices.

This heavy selling could be a reaction to the price increase triggered by derivatives traders, or it could be for fundamental reasons that the market has yet to fully understand. Both of these factors add uncertainty to the market, which could have an impact on ENA’s future price volatility.

ENA’s Future Prospects

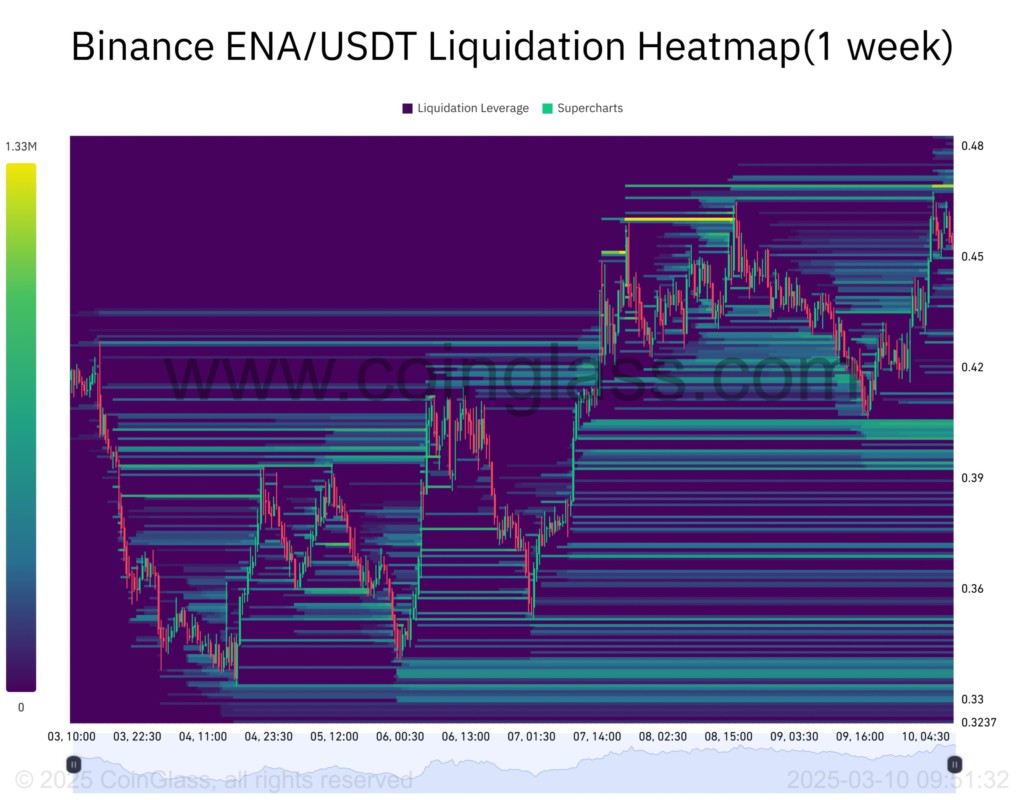

With significant differences in strategy between derivatives and spot traders, the future of ENA is becoming increasingly uncertain. If derivatives traders continue to push prices up, there could be more selling from the spot side, which could eventually push prices back down.

However, if ENA can demonstrate strong fundamentals and give spot traders a reason to maintain their holdings, it is possible that the currency will stabilize and grow gradually. Market watchers should continue to monitor both sides of this to get a clearer picture of the direction ENA will take.

Cover

The battle between derivatives and spot traders in the Ethena (ENA) market is creating an interesting and uncertain dynamic. How these two groups will affect ENA prices going forward remains to be seen, but certainly, volatility and trading strategies will continue to play an important role in determining the fate of ENA.

Also Read: Drastic 19% Drop in Solana Futures – Here’s Solana’s Technical Outlook in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethena: Spot and Derivative Traders Clash Over ENA’s Next Move – Here’s Why. Accessed on March 12, 2025

- Featured Image: CoinMarketCap

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.