Crypto Market Bounces Back, Driven by Macroeconomic Trends! What’s Happening?

Jakarta, Pintu News – After experiencing a rough start to the week with massive liquidations, the crypto market is finally showing signs of recovery. The uptick is being driven by favorable broader macroeconomic changes.

Crypto Market Recovery After Major Liquidation

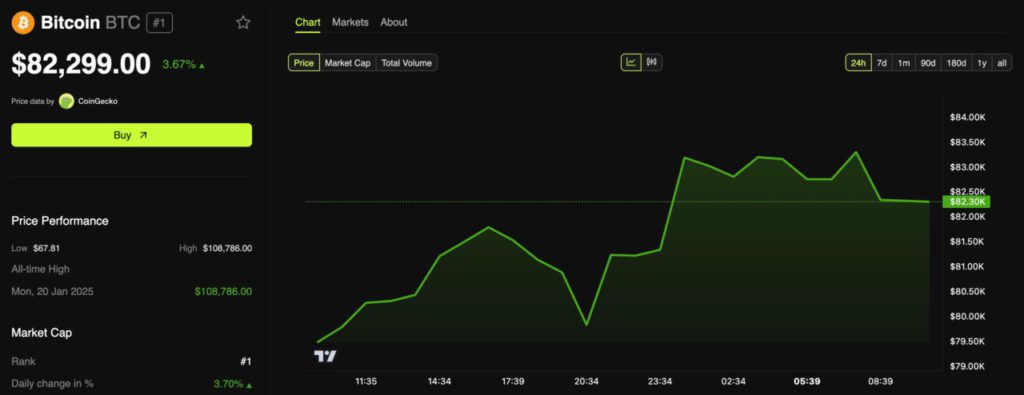

Crypto markets that were previously plagued by fears of a global recession, trade wars, and broader macroeconomic uncertainty are finally showing a recovery. Bitcoin (BTC) and Ethereum (ETH), which had plummeted to monthly and yearly lows, are now recovering. This sharp decline triggered massive liquidation in the market. Almost $1 billion in funds were liquidated from the market yesterday.

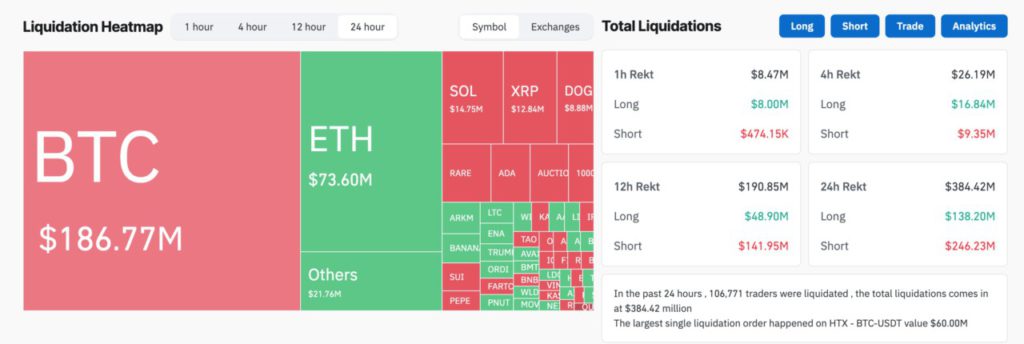

However, the latest data shows a more encouraging picture. According to data from Coinglass, liquidations in the last 24 hours amounted to $384.4 million, down significantly from the previous days. Of this amount, $138.2 million came from long positions, while $246.2 million from short positions. Notably, Bitcoin (BTC) saw liquidations of $186.7 million, with $146.0 million coming from short positions. Ethereum (ETH) saw liquidations of $73.6 million, with $40.3 million from long positions and $33.1 million from short positions.

Also Read: Bitcoin’s RSI Dominance Down? Crypto Analyst Seth Says Altcoin Market Opportunities Await!

Key Drivers of Market Recovery

One of the main factors driving the market recovery was the announcement of a temporary 30-day ceasefire in Ukraine in response to a proposal from the United States. This managed to reduce geopolitical tensions that were previously weighing on the market. In addition, Ontario suspended its 25% tariff on electricity exports to Michigan, New York, and Minnesota, another major step in easing trade tensions.

US political figures, including House Speaker Mike Johnson, also provided much-needed reassurance to the markets. Johnson suggested that President Trump’s economic policies, which initially contributed to market instability, would eventually stabilize the economy. “Give the president a chance to see the results of these policies,” he said.

Optimism from the White House

White House Press Secretary Karoline Leavitt emphasized that the market downturn is only a temporary state and not a definitive or permanent trend. “We are in a period of economic transition,” Leavitt said.

He also emphasized that market numbers, such as stock prices, trading volume, and liquidation, reflect a specific point in time and can evolve. These combined factors-political assurance, easing trade tensions, and reduced geopolitical risks-have contributed to the recent crypto market recovery.

Conclusion

With these positive developments, the crypto market is showing resilience and the ability to recover from external pressures. This rise not only restores investor confidence but also demonstrates the importance of external factors in crypto market dynamics.

Also Read: Will ETH Fall Below $1,500 Before the Market Recovers? Here’s the Price Pattern Analysis! (3/13/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Market Recovers After Liquidations. Accessed on March 13, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.