Bitcoin Trader Strategy: Optimism vs Market Uncertainty in Mid-March 2025

Jakarta, Pintu News – The Bitcoin (BTC) options market is showing bullish sentiment, with more call options contracts open than put options. The latest data shows that call open interest stands at 11,873.52 contracts, much higher than put open interest of only 8,594.58 contracts. This results in a put/call ratio of 0.72, signaling that more traders are betting on a rise in BTC prices in the near future.

However, despite the optimism, the large volume of put contracts in the Rp1,222,500,000 – Rp1,395,500,000 ($75,000-$85,000) price range suggests ahedging strategy. This indicates that despite the bullish bias, most investors are still cautious of potential volatility and possible price declines in the near term.

Open Interest and Market Volatility Analysis

Open Interest Positions and Their Impact on the Market

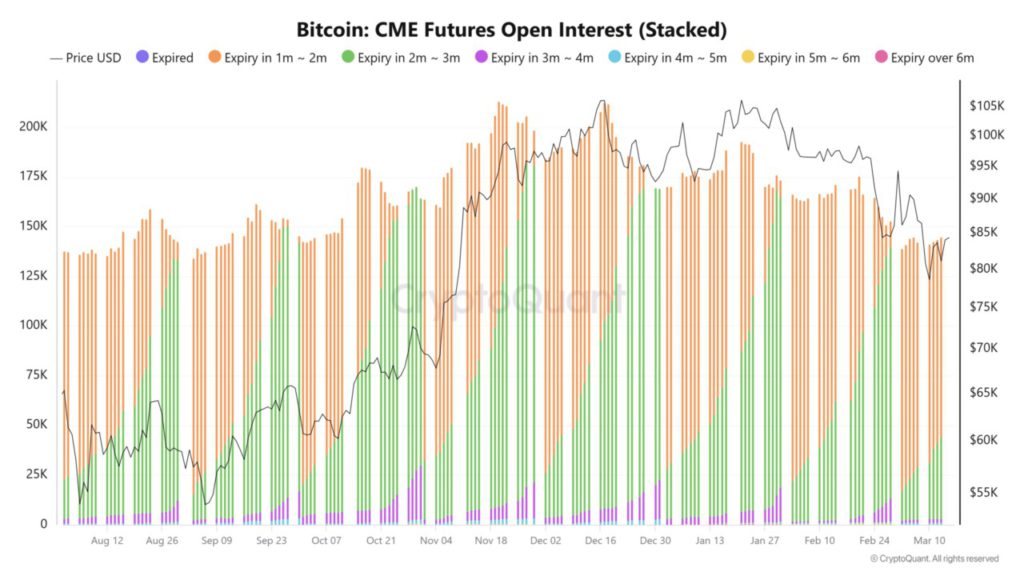

Open Interest on Bitcoin futures contracts on the Chicago Mercantile Exchange (CME) has shown a steady increase over the past few months. Its peak coincided with BTC’s record high of Rp1,711,500,000 ($105,000). However, after the price corrected to IDR1,304,000,000 ($80,000), the Open Interest also decreased, indicating less speculative activity.

Most Bitcoin contracts expire within the next one to three months. Historically, this period often triggers high volatility, especially if traders start toroll over or close their positions.

Also Read: Ethereum Prediction: Recovery or Bearish Signal? Here’s the Mid-March 2025 Technical Analysis!

Bitcoin Price Trends and Technical Indicators

Currently, Bitcoin is trading at around Rp1,373,600,000 ($84,210), having gained 0.27% in the past day. However, BTC is still below key resistance levels, namely the 50-day moving average at Rp1,441,200,000 ($88,467) and the 200-day moving average at Rp1,568,500,000 ($96,227). This indicates that despite optimism in the options market, Bitcoin is still in a corrective phase.

In addition, funding levels in the Perpetual Futures market showed mixed values, with some exchanges recording positive funding levels and others negative. This indicates that the market still has no clear direction, with demand yet to fully recover.

Bitcoin Movement Scenario in the Near Future

Bullish Scenario

If Bitcoin is able to return to the range of Rp1,432,700,000 – Rp1,467,000,000 ($88,000-$90,000), then activity in the options market could push the price higher, with a medium-term target of Rp1,630,000,000 ($100,000).

Bearish Scenario

If BTC remains below Rp1,395,500,000 ($85,000) and Open Interest continues to decline, it is likely that BTC will retest the support level at Rp1,270,000,000 – Rp1,304,000,000 ($78,000-$80,000). In this scenario, short-term downside risks will increase.

Conclusion: Beware of Volatility in the Near Term

The Bitcoin options market shows traders’ preference for a bullish scenario, but there are still indications of caution with hedging activity. With options contract expiration dates approaching and open interest decreasing, high volatility is likely in the next few weeks.

Investors should continue to monitor funding levels in the futures market, liquidity flows, and key price moving average levels to determine the next direction of Bitcoin’s movement.

Also Read: XRP Predictions and Impact on Crypto Market: 8% Drop After Positive Trend March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin Traders Bet on Upside, But Hedging Could Indicate Uncertainty – Explained. (Accessed March 17, 2025).

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.