Ethereum Price Dips Slightly Today (3/18/25) – But Analysts Predict a Comeback Is Near!

Jakarta, Pintu News – The crypto market continues to evolve with interesting dynamics, and Ethereum (ETH) seems to be on the verge of a major change.

With a significant increase in the adoption of real assets and changes in on-chain ownership, there are strong indications that Ethereum (ETH) may experience a strong price recovery in the near future.

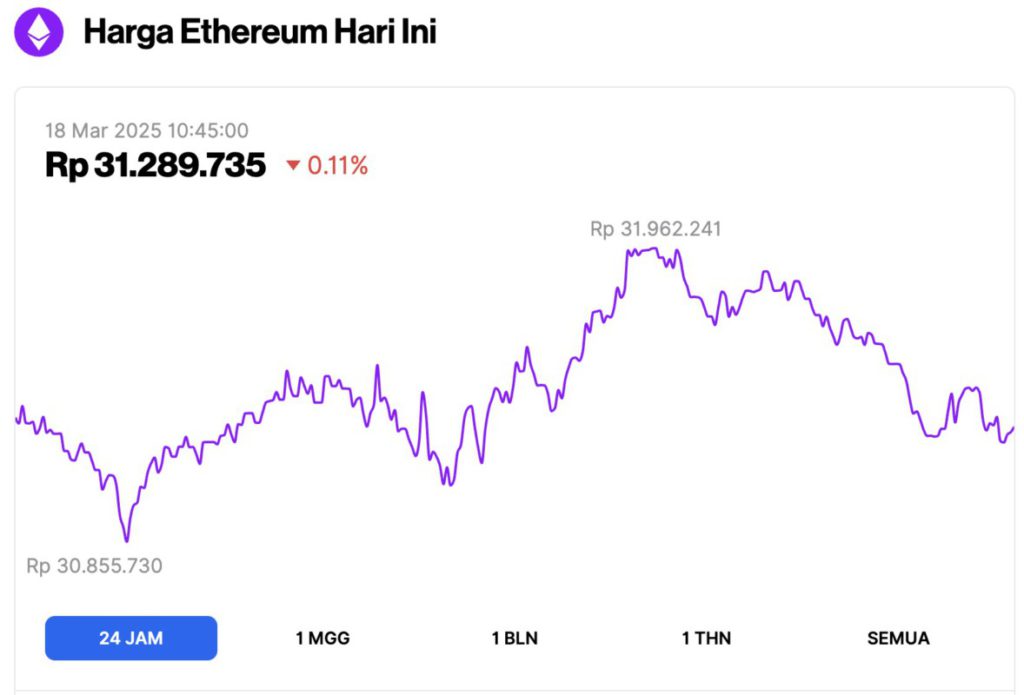

Ethereum Price Drops 0.11% in 24 Hours

As of March 18, 2025, Ethereum (ETH) is trading at approximately $1,905 (IDR 31,289,735), reflecting a slight 0.11% dip over the past 24 hours. Throughout this period, ETH reached a high of IDR 31,962,241 and a low of IDR 30,855,730.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $229.54 billion, with daily trading volume rising 5% to $10.38 billion in the last 24 hours.

Read also: Bitcoin Stalls at $83,200 Today (March 18, 2025) – Are Short-Term Holders Finally Surrendering?

What happened to the Ethereum price today?

ETH Price Attempts Trend Reversal as ETH Fundamentals Turn Bullish?

According to Coingape (3/17/25), ETH’s sluggish price performance throughout 2024 will still haunt investors in 2025.

However, this outlook could change due to two major fundamental factors, namely growth in the Real World Asset (RWA) sector as well as a sharp decline in the amount of ETH held on exchanges.

The Real World Asset (RWA) category has seen growth of 850% in the past year, according to Hitesh.eth, founder of Dyor. Currently, only two protocols-Ethereum and zkSync-capture more than 80% of the overall market share. Moreover, the RWA sector has increased by more than 50% in the last 30 days.

As the crypto market matures and institutional investors’ participation increases, the next phase of the bullish rally will most likely be driven by utility rather than mere popularity or hype. With this future outlook, Ethereum price has the potential to trigger a major rally.

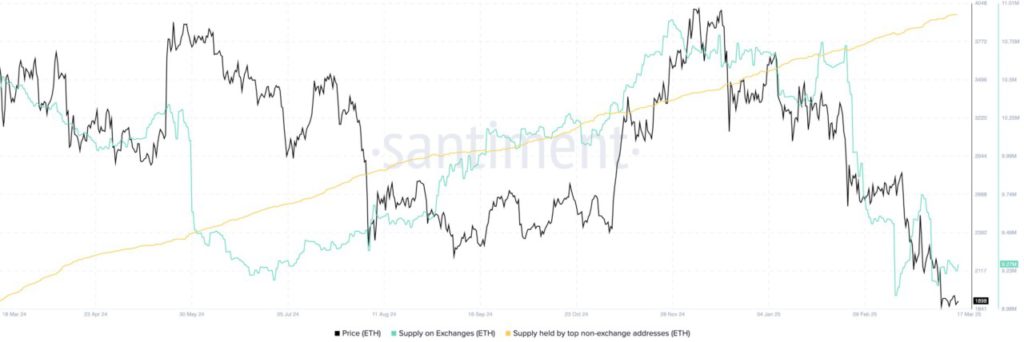

The second fundamental factor is the on-chain metrics that show a sharp decline in the amount of ETH held on exchanges, while the holdings of high-net-worth investors have increased.

This trend divergence indicates that selling pressure on the bourse is easing as supply shifts to long-term holders.

The amount of ETH on exchanges decreased from 10.9 million to 9.3 million in less than four months. Meanwhile, the supply held by top non-exchange addresses increased by more than 17 million, reaching 68.8 million as of March 17.

Read also: MUBARAK Meme Coin Skyrockets! BNB Chain Surpasses Solana—Is $720 Next for BNB?

Key Levels to Watch If ETH is Looking for a Bottom

Ethereum price has spent more than a week below the $2,000 psychological level, making its prospects look bleak. However, from a technical perspective, the next two major hurdles are $2,100 and $2,200.

In order to form or confirm a strong low, Ethereum price must be able to break this level.

The next two crucial resistance levels are at $2,602 and $2,768. These levels will be a test of bullish strength and buying pressure.

If the price fails to break it, then Ethereum could form a lower high pattern, indicating that the uptrend hasn’t really started yet.

The real confirmation of the bullish rally will happen if ETH price records a daily candlestick close above $3,014. If that happens, Ethereum price predictions target $4,000, $4,100, or even a new all-time high.

The rapid growth of the Real-World Assets (RWA) sector and the decline in the amount of ETH held on exchanges are two major fundamental factors that indicate a potential bullish trend reversal. This could lead to a major rally driven by the utility factor.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. 2 Fundamentals Hint Bullish Reversal For Ethereum Price Could Happen Soon. Accessed on March 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.